Singapore private home prices up 0.9% in Q3: URA flash data

DESPITE Singapore’s economic slowdown and downside risks ahead, private home prices rose for the second consecutive quarter, with at least one analyst saying this might prompt the government to respond with more cooling measures.

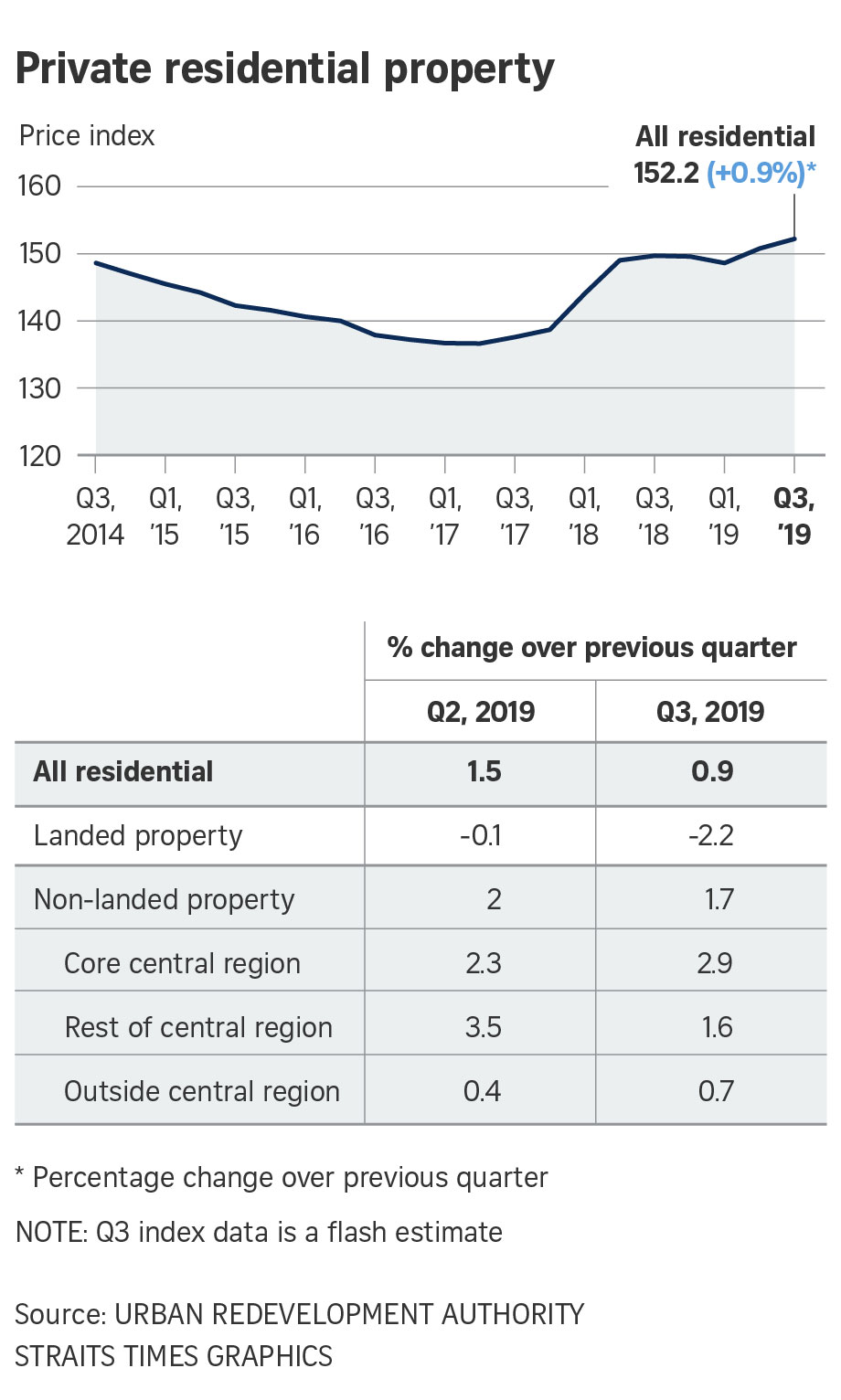

The Urban Redevelopment Authority’s (URA) flash estimate for the third quarter of 2019 shows that its overall price index for private homes rose 0.9 per cent over the preceding quarter. This follows the 1.5 per cent quarter-on-quarter increase in the second quarter of this year.

Year on year, the index is up 1.7 per cent, according to the URA flash data released on Tuesday morning.

It also showed the third quarter price rise was driven by those of non-landed private homes, whose prices rose 1.7 per cent quarter on quarter, after increasing 2.0 per cent in the previous quarter.

Prices of landed homes, in contrast, fell 2.2 per cent in the third quarter, after dipping 0.1 per cent in the previous quarter.

Christine Sun, head of research and consultancy at OrangeTee & Tie, said: “While the housing market may continue to be influenced by global forces in the wider economy, our population growth, rising household income, and positive employment numbers will remain key drivers for both home prices and demand over the long term. In view of the current economic uncertainties, Singapore will remain an attractive safe haven for foreign investors to park their funds here.

“We expect prices to remain relatively stable for the rest of the year as the underlying demand for private homes is still healthy despite the current macro-economic uncertainties. We expect the number of private homes (excluding executive condominiums) to be sold in Q3 to surpass that of Q2 2019, but lower than the number sold year on year.”

Brian Tan, regional economist at Barclays, said: “We believe the risk of more macroprudential measures to cool the housing market has risen to a relatively high level following this print. The continued rise in the private residential property price index suggests that its surprising jump in Q2 was not due to a distortion or measurement error.

“Instead, it may reflect an ongoing improvement in property market sentiment. We believe the government would view this as out of sync with the darkening economic outlook; the Ministry of Trade and Industry has downgraded the official GDP growth forecast range for the second time this year to 0-1 per cent from 1.5-2.5 per cent, with its base case for around 0.5 per cent.

“The government could act quickly. Last year, the government announced higher additional buyer’s stamp duty (ABSD) rates and lower loan-to-value (LTV) limits on residential property purchases on July 5, 2018, just days after the URA’s flash estimates showed a continued pick-up in private residential property prices. Similar measures are possible this time. Alternatively, the government could tighten its total debt servicing ratio (TDSR) framework introduced in 2013 by lowering the 60 per cent threshold for property loan approvals, possibly to as low as 40 per cent.

“While a cooling of the housing market could add to economic headwinds, we doubt this will deter the government from announcing more measures in order to prevent a build-up of financial stability risks. Instead, we expect fiscal policy – in the form of the budget early next year – and foreign exchange policy to bear the burden of supporting the economy.”

Giving a breakdown by region, URA said that prices of non-landed private homes in the prime areas or core central region (CCR) rose 2.9 per cent quarter on quarter, compared with the 2.3 per cent hike in the previous quarter.

Prices in the fringe areas or rest of central region (RCR) climbed 1.6 per cent, after posting an increase of 3.5 per cent in the previous quarter. In the suburbs or outside central region (OCR), prices rose 0.7 per cent, following the 0.4 per cent increase in the previous quarter.

URA’s flash estimates are compiled based on transaction prices given in contracts submitted for stamp duty payment and data on units sold by developers up till mid-September. The statistics will be updated on Oct 25 when URA releases its full set of real estate statistics for the third quarter of 2019.

“Past data have shown that the difference between the quarterly price changes indicated by the flash estimate and the actual price changes could be significant when the change is small. The public is advised to interpret the flash estimates with caution,” said URA.

Source: https://www.businesstimes.com.sg/real-estate/singapore-private-home-prices-up-09-in-q3-ura-flash-data

Thailand

Thailand