Vietnam sees slowest rise in industrial output in 21 months

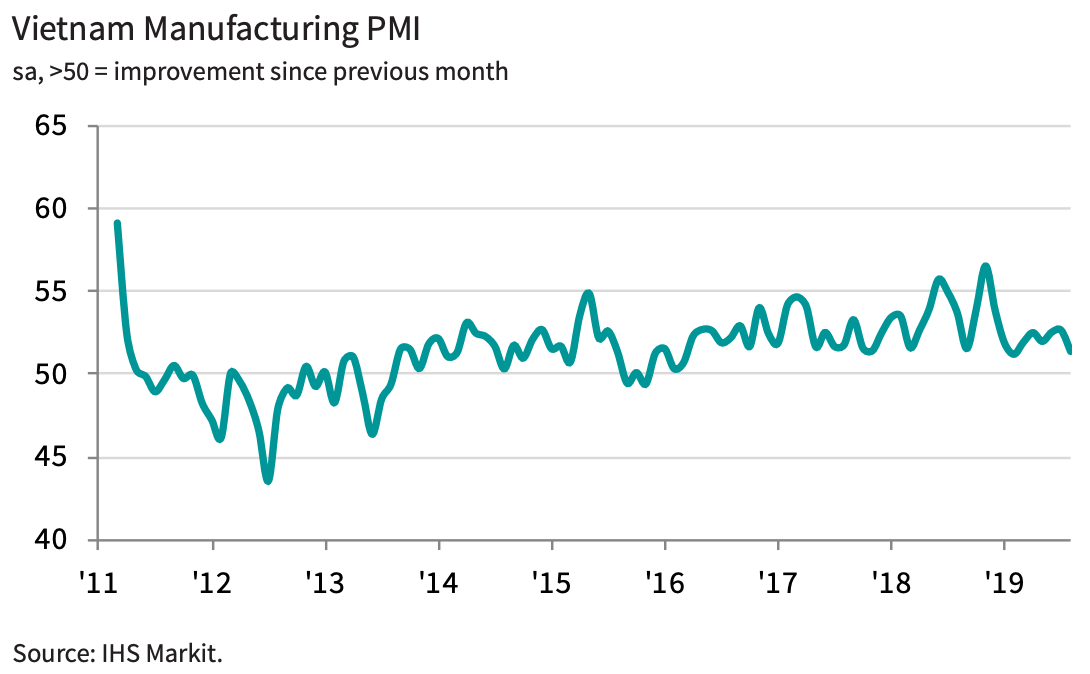

A reading below the 50 neutral mark indicates no change from the previous month, while a reading below 50 indicates contractions and above 50 points to an expansion.Weakness in August was centered on investment goods producers, where operating conditions worsened. This contrasted with further improvements in the consumer and intermediate goods sectors. This pattern was repeated with regards to output, new orders and employment.While rising new orders supported increased production at some firms, others reported softer client demand and reductions caused by US-China trade tensions.These factors were also linked to a slowdown in new order growth. New business increased at a solid pace, but one that was the weakest since January. Meanwhile, new export orders rose modestly for the second month running.Manufacturers supported ongoing increases in production by raising their purchasing activity and employment levels. Job creation was recorded for the fourth time in the past five months.

As well as supporting current output requirements, some respondents indicated that input buying had been raised to help build inventories. Consequently, stocks of purchases were also up.

Improved operating capacity and slower new order growth enabled firms to work through outstanding business in August. Backlogs decreased for the first time in three months.

The rate of input cost inflation eased for the fourth consecutive month, with input prices up only marginally midway through the third quarter. Firms were therefore able to lower their selling prices without greatly impacting profit margins. Charges decreased for the ninth successive month, albeit fractionally.

Suppliers’ delivery times lengthened for the first time in four months, with panelists generally attributing delivery delays to material shortages at vendors.

Finally, business confidence dropped to a six-month low and was below the series average. Companies were still confident that output will rise over the coming year, however, with optimism reflecting expectations of improving customer demand.

“The slowdown in growth in August, and panelist reports of the US-China trade tensions harming demand, show that the Vietnamese manufacturing sector is not immune to the impacts of global trade issues. While Vietnam is one of the countries seen as able to gain from trade diversion and companies setting up new operations there, the reduction in trade flows resulting from the current tensions can still make work harder to come by,” said Andrew Harker, associate director at IHS Markit, which compiles the survey.

“That said, the resilience of the Vietnamese manufacturing sector should not be underestimated. We have seen slowdowns such as that recorded in August before during the current sequence of growth, and rates of expansion have always then rebounded in the following months. This could therefore be the case again as 2019 draws to a close,” he added.

Thailand

Thailand