Thailand: Inflation forecast slowest in 2 years

The government on Monday lowered the annual inflation forecast to a range of 0.8-0.9% this year, the slowest growth in two years, from 0.7-1.3% in July, due to lower oil prices.

Pimchanok Vonkorpon, director-general of the Trade Policy and Strategy Office, said the latest forecast was based on oil prices averaging US$64 per barrel, the exchange rate reaching 32-32 baht per dollar and GDP growth stagnating at 3.3-3.8%.

“Consumer prices grew at a slower pace in August because of declining energy prices and low demand, notably for construction materials and steel in the property sector,” she said. “The ongoing trade war resulted in lower condominium purchases by Chinese investors.”

Ms Pimchanok said the government’s recent stimulus package and farm price guarantee schemes are expected to help boost spending in the remainder of the year.

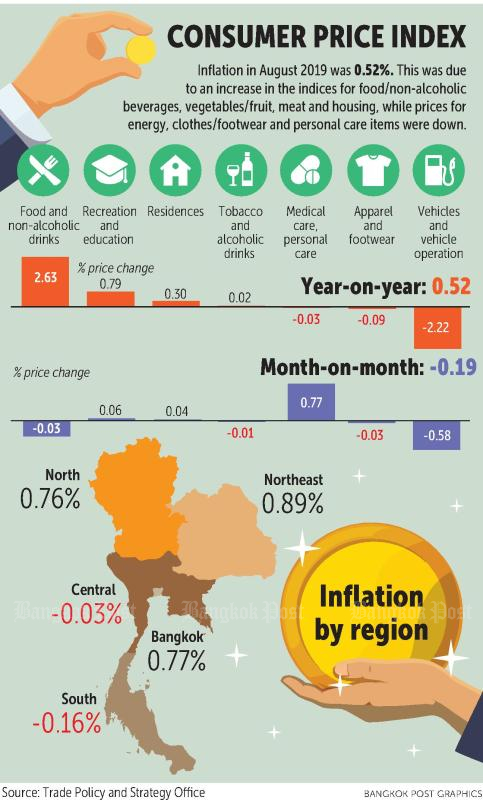

The Commerce Ministry reported overall consumer prices, which gauges headline inflation, rose by 0.52% in August year-on-year, but was lower than 0.98% in July. The rate was 0.87% in June, 1.15% in May, 1.23% in April and 1.24% in March.

The rise in August’s prices was boosted largely by a rise in food prices, particularly for milled rice and glutinous rice, vegetables and pork.

On a month-to-month basis, overall prices decreased 0.19% in August from a month earlier because of lower oil and construction materials prices.

Core CPI, which excludes volatile food and energy prices, rose 0.49% year-on-year in August and increased 0.09% from July.

For the first eight months, headline inflation averaged 0.87%, with core inflation standing at 0.55%.

Thanavath Phonvichai, vice-president of research for the University of the Thai Chamber of Commerce, said decelerating inflation growth in August was driven largely by lower oil prices, which was also reflected in low economic growth.

“We have to wait and observe the inflation rate for September-October, which will be the indicator for the whole year. During that period we will get a clear picture of the impact of higher import tariffs from the trade war and Brexit, as well as the stimulus package,” he said.

Noelan Arbis, an economist at HSBC, said August was the lowest inflation since January 2019, but there are also risks that inflation could fall even lower in the months ahead. Unfavourable base effects and subdued oil prices could take headline CPI as low as 0.3% year-on-year by September and inflation may fall below the central bank’s 1-4% target for the rest of the year.

Source: https://www.bangkokpost.com/business/1741574/inflation-forecast-slowest-in-2-years

Thailand

Thailand