Malaysia: Overhang value exceeded 600% over five years

OF late, there have been calls from different quarters appealing to the government to reduce the pricing threshold of properties that foreigners are allowed to buy.

The call is a result of a growing number of completed but unsold units in the country.

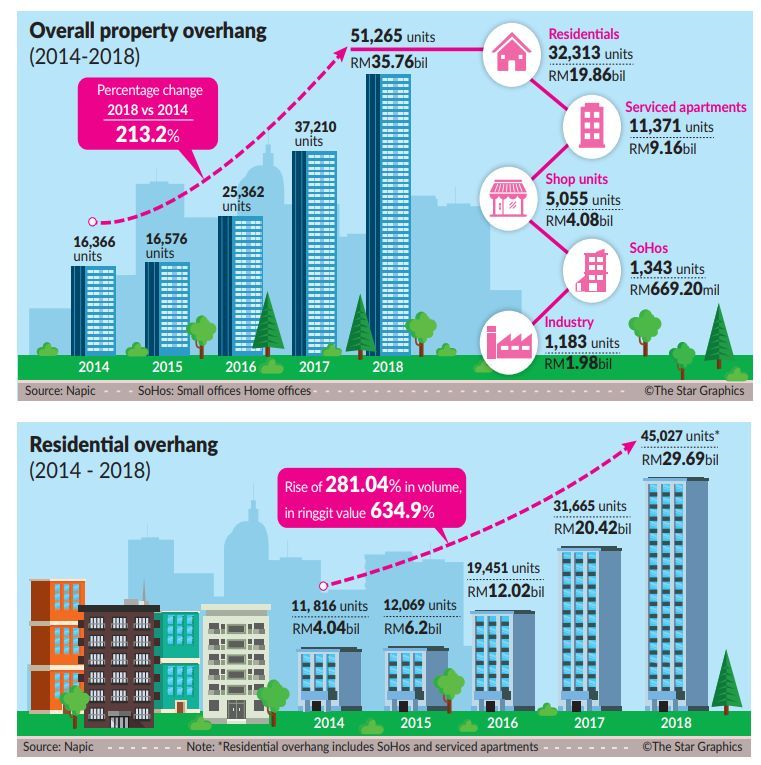

Over a five-year period between 2014 and the end of 2018, the number of unsold completed residentials grew from 11,816 units to more than 45,000 units by the end of 2018, including serviced apartments and small offices home offices (SoHos).

This translates to a rise of 281% over the period.

In ringgit value, the rise is even greater. The value of residential overhang snowballed by a massive 635%, according to the National Property Information Centre (Napic) records.

The residential overhang was valued at RM4bil at the end of 2014. It grew to RM29.7bil by the end of 2018, Napic records showed.

This double increase coincided with the escalation of property prices over a 10-year period starting from 2009/2010. Property prices remain high today.

This rise in volume and even greater rise in ringgit value underscores the need for concrete action.

On June 25, TA Global Bhd  ’s non-independent and non-executive director Datin Alicia Tiah repeated the call to tweak threshold prices of properties for foreign buyers.

’s non-independent and non-executive director Datin Alicia Tiah repeated the call to tweak threshold prices of properties for foreign buyers.

While the country wants to promote Malaysia My Second Home (MM2H) programme, the government is at the same time stringent on China residents, Tiah said.

“I understand that we are more stringent on MM2H applications from mainland Chinese,” Tiah told a post-AGM press conference.

Tiah and her husband Tony were involved in the stockbroking and property business. A year after the 2008 Global Financial Crisis, Tiah listed TA Global and parked the property business there, to be looked after by their son, Joo Kim.

The last 10 years saw the emergence of strong and aggressive contenders in the sector, quite a few of them parked under government-linked companies. The sector is largely unregulated.

The local authorities approved development orders left and right. The result: overbuilding.

The overhang of properties of different segments is not lost on the Valuation and Property Services Division which comes under the Housing and Local Government Ministry.

At a May 2 Big Data Analytics conference organised by Rehda Institute, Napic property marketing division deputy director Norhisham Shafie said Malaysia has a property overhang worth RM35.76bil.

Numbering 51,265 units, Norhisham said these include residential, serviced apartments and SoHos, shopunits and industrial properties. The overhang volume has grown by a massive 213.2% over five years between 2014 and the end of 2018, he says.

Norhisham says the overhang needs to be thoroughly handled and holistic measures put in place.

“Both the government and property players, especially developers, need to join hands to ensure that the overhang issue will not be aggravated further,” Norhisham says.

This, however, may be a tall order. A developer who declined to be named says while the current overhang should be a concern, and it is getting a bit of attention, there is “a bigger issue” brewing.

“The attention so far has been on the completed unsold units of more than 45,000 units, residentials and commercial SoHos and serviced apartments.

“But there is a further 123,234 residential and commercial unsold units under construction as at the end of 2018,” he says.

“The under construction unsold (figure) is really very big. It is not called overhang yet, because they are still being constructed. It will swell up the overhang figure in a couple of years,” he says.

Napic defines an overhang as completed properties that have been certified for occupation but remain unsold nine months after their launch.

So work-in-progress, or those under construction, will amplify the issue further in a few years, he says.

Source: https://www.thestar.com.my/business/business-news/2019/06/29/overhang-value-exceeded-600-over-five-years/#R7vSRCt3bPmfgQl8.99

English

English