Vietnam featured in world’s top 10 emerging markets logistics

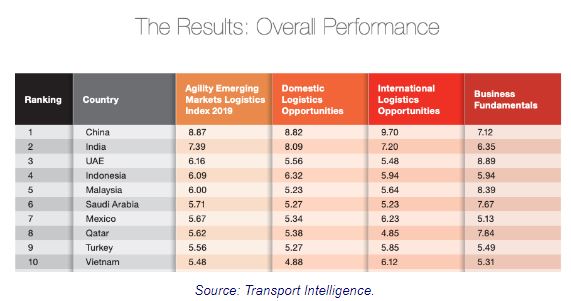

China claimed the top spot of the index, followed by India and UAE, Indonesia, Malaysia, Saudi Arabia, Mexico, Qatar, Turkey and Vietnam.

In Southeast Asia, Vietnam ranked third, behind Indonesia and Malaysia, and stood above Thailand at 11st and the Philippines 20th.

Vietnam’s international logistics market is the standout driver of its overall performance in the 2019 Index. Domestically, the country has solid but not remarkable logistics opportunities – both contract logistics and domestic express markets are around US$750 million in value per year with healthy growth rates, and GDP per capita is amongst the higher of the 50 emerging markets in the index, reinforcing likely positive development.

On the international side, Vietnam has developed real strength. It rates as the fifth largest market for logistics intensive goods trade by value – a measure where it is broadly in line with the significantly larger Indian economy and double the size of much larger Brazil.

This advantage is expected to strengthen further as strong growth in both imports and exports is expected over the next five years. The country’s sea freight market also plays a key role in strong international logistics performance.

A network of more than 160 ports throughout the country – with main gateways at Ho Chi Minh City, Hai Phong and Da Nang – have annual capacity of more than 11 million TEU, while the report estimated that Vietnam’s sea freight market will grow at a 15.3% CAGR over the five years to 2022.

Additionally, Vietnam remained 4th overall in the international logistics opportunities sub-Index – where average wages in the manufacturing sector are approximately four times lower than in China.

Its expertise and infrastructure have improved to such an extent that it is a major global exporter in a number of sectors, including textiles and apparel which have come to account for approximately 40% of air freight trade with the US. Such exports are helping fulfil the rapid delivery expectations of fast-fashion and online retail, according to Agility.

More widely, Vietnam’s ability to negotiate and sign new bilateral (such as with the EU) and multilateral (such as with ASEAN members) trade agreements has bolstered its ability to access new markets and should see it continue to grow over the longer term too. To date, it has signed 17 FTAs, although not all are implemented.

Meanwhile, a rank of 20th in the business fundamentals sub-index suggests room from improvement, with the need to address regulatory burden in particular.

Thailand

Thailand