Thailand: Retailers upbeat on oil sales

SET-listed oil retailers are very optimistic about the growth of oil sales volume this year amid tough competition in the local market.

Four listed companies forecast 2019 growth of oil sales volume at 3-16% from the year before, with each oil retailer competing via marketing campaigns with new fuel formulas, mileage memberships and non-oil services.

An example of a new fuel formula is the development of biodiesel B20, as most oil retailers are participating in the government’s programme to increase widespread consumption in the country, expanding from big trucks and buses.

Pitak Ratchakitprakarn, president and chief executive of PTG Energy Plc (PTG), expects oil sales volume to rise by 16% from 3.92 billion litres in 2018.

For PTG’s liquefied petroleum gas (LPG) business, it expects to increase its 2019 sales volume by 55-60% from 98 million litres in 2018.

“We also plan to increase the number of petrol stations to 2,000 in 2019 from 1,884 stations in 2018,” said Mr Pitak.

He said PTG allocated a budget this year of 3.5 billion baht for expansion of both oil and non-oil units.

Of the total budget, 2.5 billion baht has been set aside for oil and oil-related businesses, while 500 million goes to non-oil business, including renewable energy.

Another 500 million baht is for new merger and acquisition deals in the near future.

Chaiwat Kovavisarach, president and chief executive of Bangchak Corporation Plc (BCP), expects its oil sales volume to grow by 9% in 2019 from 4.02 billion litres in 2018.

BCP allocated a budget this year of 1.6 billion baht for its oil retail business to build 70 new petrol stations, up from 1,175 now, and expand its non-oil service stores.

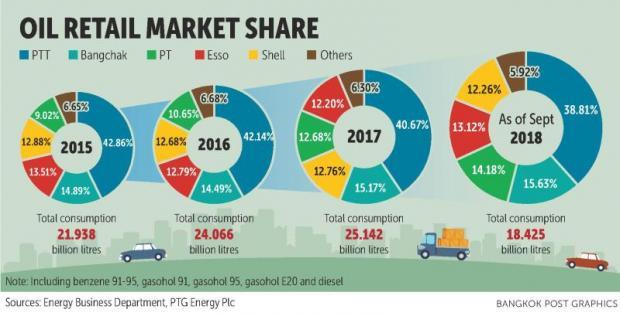

“We aim to maintain our No.2 spot in the oil retail market,” said Mr Chaiwat.

“In 2018, the average throughput sales volume of the whole market stood at 446,000 litres per month, while BCP did 496,000 litres.”

With fierce market competition, BCP plans to add another 200 branches of its Inthanin coffee shop, up from 732, and increase the number of Spar convenience stores from 65 to 85.

Jiraporn Khaosawas, chief executive and managing director of PTT Oil and Retail Business Plc (PTTOR), expects its 2019 oil sales volume to grow by 3% from 9.19 billion litres in 2018.

PTTOR plans to attract local motorists with its non-oil services such as new food and beverage chains at its petrol stations.

Ms Jiraporn said it plans additional petrol stations for big trucks along with several in the interconnected highway system nationwide to support B20 consumption.

“Moreover, PTTOR is committed to filing documents for listing on the stock market in 2019,” she said.

Chairit Simaroj, managing director of Susco Plc, aims for oil sales volume to grow by 8% in 2019, but the company will focus on exports to neighbouring countries instead of the hotly contested domestic market.

“Susco is upbeat about the sales of jet fuel this year,” said Mr Chairit.

Susco earmarked a budget of 350 million baht this year, of which 250 million goes to expansion of petrol stations by 20 from 250 as of 2018.

The remaining budget of 100 million baht is for its non-oil services.

In addition, he said Susco has spearheaded the commercial sale of B20 since mid-2018 at its petrol stations target to refill mainly big trucks and buses.

Mr Chairit expects B20 sales volume of 1.2 million litres in 2019 thanks to the government’s encouragement and subsidies.

Source: https://www.bangkokpost.com/business/news/1639318/retailers-upbeat-on-oil-sales

Thailand

Thailand