5 factors laying foundation for Vietnam’s economic outlook: IMF

The Hanoitimes – Looking ahead to the longer term, Vietnam will face risks related to aging, climate change, and digitalization.

The International and Monetary Fund (IMF) has named five factors expecting to lay the foundation for Vietnam’s economic outlook.

Despite rising trade tensions and volatility in emerging economies throughout 2018, Vietnam’s economy saw broad-based growth and low inflation.

However, the IMF suggested Vietnam maintain growth and raise its quality, the country needs to modernize economic institutions, especially in terms of fiscal and monetary management, and continue with market-oriented and outward-looking reforms. In practice, continued tightening of credit policies, developing capital markets, and building a modern market infrastructure with adequate tools for financial system supervisors and regulators, would help enhance the financial sector’s ability to support sustainable growth.

In recent years, Vietnam has managed to halt the increase in public debt and create some fiscal space. The more favorable fiscal position provides the authorities with the means to step in should downside risks materialize.

Conversely, if growth surprises on the upside, existing debt could be paid down at a faster pace. Recapitalization of Vietnam’s state-owned commercial banks should also be a priority, and the country’s ongoing efforts to tackle corruption provide an opportunity to strengthen the rule of law.

All of these were summarized in five factors as below:

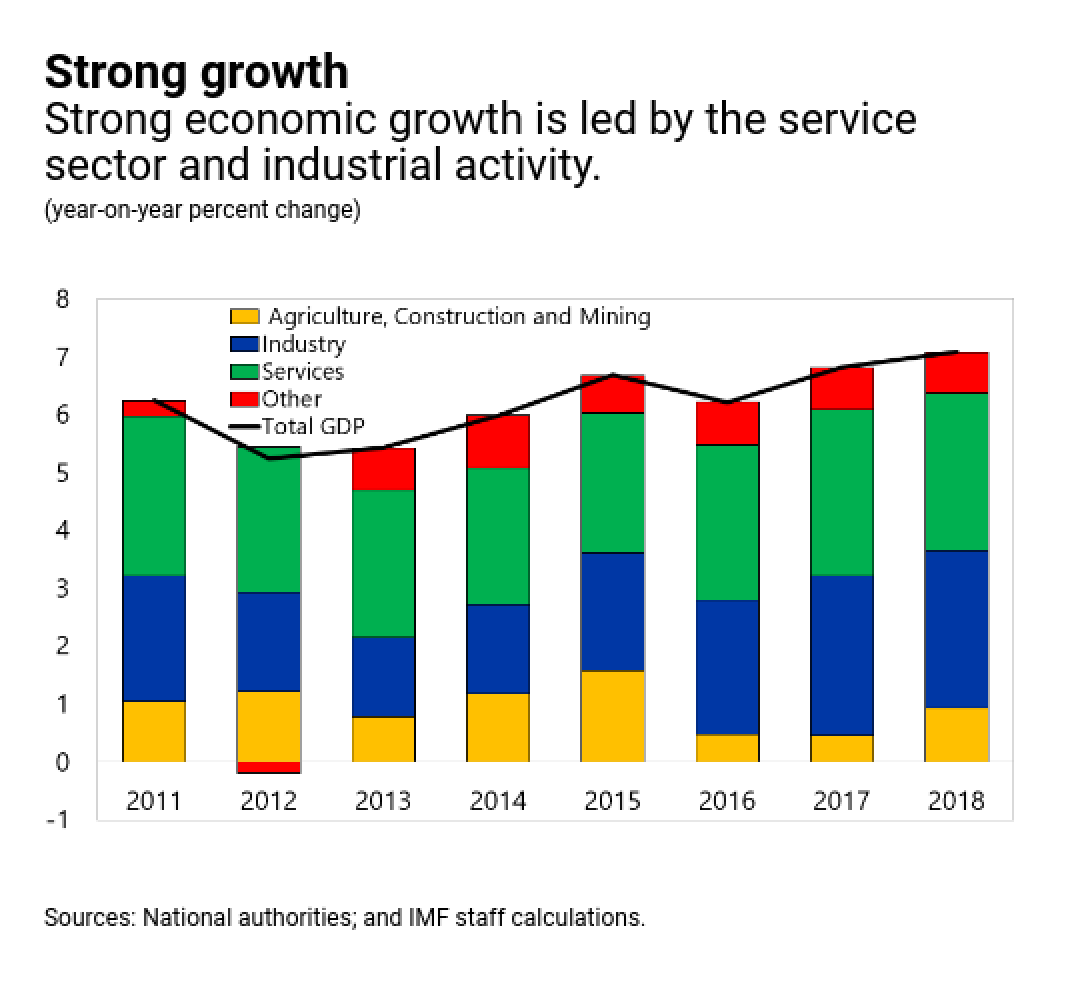

1. Extensive market reforms since the dawn of the “doi moi” era in 1986, and strict commitment to macroeconomic stability more recently, have laid the ground work for rapid, inclusive growth that averaged 6.6% per annum during 2014–18 and reached a 10-year high of 7.1% in 2018.

2. In recent years, Vietnam successfully reversed the rapid rise in public and publicly guaranteed debt, which declined to 55.6% of GDP at end-2018, down 4 points of GDP from its 2016 peak. The government strictly limited the issuance of government guarantees, which helped to stabilize the deficit of the state budget to about 4.6% of GDP in 2017–18, down from 5.5% in 2014–2016.

When the surplus of Vietnam Social Security – the pay-go pension system – and other extrabudgetary funds are included, the general government deficit averages 2.7% of GDP in 2017–18. The budget deficit is projected to decline to 4.2% in 2020 (2.6%, when extrabudgetary funds are included.

3. The government’s commitment to private-sector–led growth has helped improve the business climate. Vietnam’s regulatory quality and ease of doing business generally improved over the years, reflecting a leveling of the playing field between the private sector and the state. However, structural problems in the land and credit markets and the still-large state-owned-enterprise sector remain obstacles to the private sector.

4. In recent years, Vietnam took steps to strengthen governance and fight corruption. The revamped 2018 anti-corruption law clarifies and strengthens laws for combating corruption, but further enhancements are needed. Greater transparency and data availability will also help. The linking (by end-2019) of databases on taxation, anti-money laundering, customs, and land transactions should facilitate asset verification.

Since 2016 when the government began tackling corruption, significant sentences have been handed down in several high-level cases, which boosted credibility and public trust of anti-corruption investigations. However, additional measures are needed to ensure the independence of the Government Inspectorate of Vietnam—the agency empowered to inspect and fight corruption—against undue political influence. Judiciary reform is also needed to improve the enforcement of contracts, strengthen legal interpretation, and facilitate resolution, restructuring, and bankruptcy proceedings.

5. Vietnam’s population will be aging rapidly in coming decades, making deeper reforms in the pension system now a priority. In Vietnam, the old age dependency ratio, which compares the number of people 60 and older to 15–59 year-olds, is expected to double in the next 25 years, and replacement rates are around 70 percent, significantly above the 54 percent average for counties in the Organization for Economic Cooperation and Development (OECD).

At the same time, retirement ages are low, with 55 years for women and 60 years for men, far below the OECD average of 67 years, but also below that of other Asian countries (between 63 and 65 years on average). Among the policy changes now under discussion in the National Assembly are raising the retirement ages to 62 for men and 60 for women. While pension reforms are difficult as they take decades to complete, they should start as soon as possible to ensure long-term sustainability. Continued monitoring and reforms will be needed to ensure that vulnerable groups are adequately protected from aging and other risks.

Source: http://www.hanoitimes.vn/economy/2019/07/81E0D9A4/5-factors-laying-foundation-for-vietnam-s-economic-outlook-imf/

Thailand

Thailand