Vietnam’s Transfer Pricing Regulations – Compliance Strategies

Vietnam’s transfer pricing regulations under Decree No. 20/2017/ND-CP (“Decree 20”) became effective in May 2017 and outline all relevant aspects of the transfer pricing compliance process. Foreign investors should consider the following when creating a compliance strategy for transfer pricing in the country.

What are the main transfer pricing compliances?

According to regulations, taxpayers subject to Decree 20, if not exempted, must comply with the following requirements:

- Disclose information about their related-party relationships and transactions by compiling the Form 01 of Decree 20, which should be transmitted together with corporate income tax (CIT) finalization return declaration;

- Prepare and store transfer pricing contemporaneous documentation, including a local file pertaining to the company’s operations in Vietnam, related party transactions, and a master file with information on the company’s inner workings.

What files do I need to prepare?

Investors must prepare a local file, a master file, and where necessary, a country-by-country report. We discuss the details below:

Local File

The purpose of the Local File is to help verify compliance with the arm’s length principle between a taxpayer and their related parties. The Local File contains the following:

- A list of related-party transactions in which the client was involved in the period;

- A determination of related parties involved in those transactions and their relationship; and

- A function and comparability analysis of client and related parties involved in respective related-party transactions.

Master File

The purpose of a Master File is to provide a global overview of a multinational group’s operations, particularly related to transfer pricing. The Master File contains the following:

- an overview of the company’s global operations;

- transfer pricing policies for the creation and ownership of intangibles and the company’s financial activities; and

- the global allocation of income and economic activities of the company to place the MNE group’s transfer pricing practices in their global context.

Given the amount of information required for the Master File, the parent company is usually responsible for the report. However, all businesses should check with local tax officials and review relevant government circulars to understand how Vietnam’s regulations are applied.

Country-by-country Report

The Country-by-Country Report (CbCR) contains aggregate information – without any intercompany adjustments or eliminations – for all entities and each tax jurisdiction. This aggregate information includes:

- Revenues;

- Profits before income tax;

- Income tax paid (including withholding taxes);

- Income tax accrued;

- Number of employees;

- Stated capital;

- Retained earnings; and

- Tangible assets (excluding cash and cash equivalents).

CbCR requirements apply in two scenarios:

- The client is part of an MNE with annual consolidated group revenue of at least US$790 million (VND 18,000 billion) in the last fiscal year; and

- The ultimate parent company must prepare the CbCR in its host country.

What are the deadlines for transfer pricing documentation?

Foreign investors should note two key transfer pricing deadlines for documentation. The annual compliance deadlines apply to all taxpayers, while there are also special deadlines during audits.

Annual compliance deadlines: Taxpayers must prepare their transfer pricing documentation before the submission of annual corporate income tax (CIT) returns, which are due within 90 days of the taxpayers’ year-end.

Ad hoc compliance: Companies must submit TP documentation to tax authorities within 15 business days of receiving a request during a tax or transfer pricing audit.

Who must comply with Vietnam’s transfer pricing regulations?

Under Decree 20, companies calculating tax liability according to the declaration method and performing transactions with related parties (related-party transactions, i.e. RPTs) are considered subjects of transfer pricing regulations.

Transfer pricing penalties

Investors’ greatest transfer pricing risk in Vietnam is to fall afoul with tax authorities. Tax authorities may impose a 20 percent penalty, following an audit, on the amount of tax that is determined to be underdeclared. Companies that fail to make this payment on time, are subject to an interest of 0.03 percent of the tax liability for every day that it is not paid.

When do transfer pricing regulations apply?

Under most circumstances, foreign companies operating in Vietnam will be subject to the country’s transfer pricing regulations at one point or another. However, not all companies will carry out transactions that need documentation in line with transfer pricing requirements.

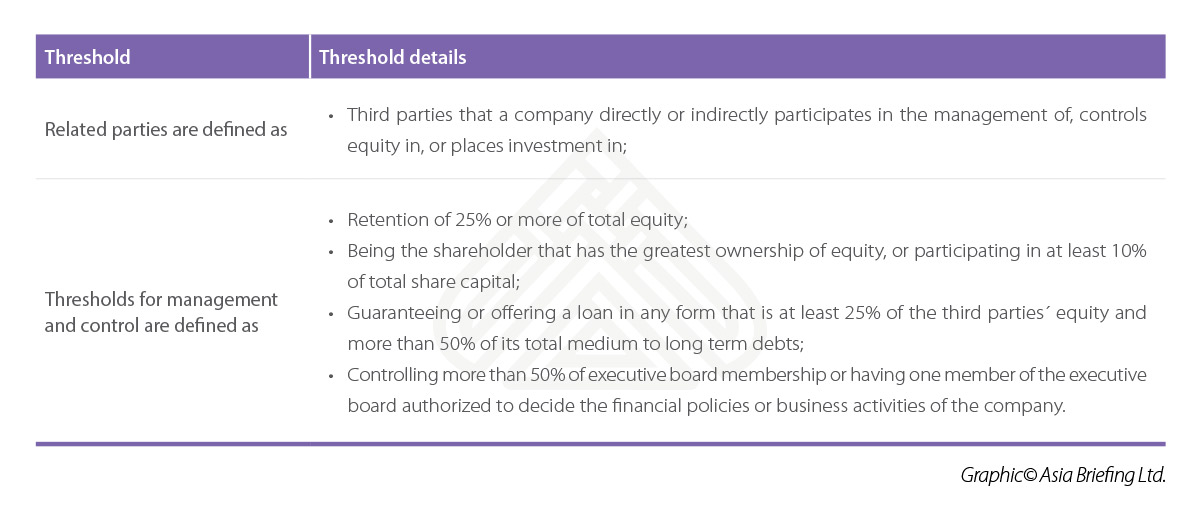

Thresholds for related entities

Investors in Vietnam should consider the below definitions for related parties and transactional thresholds when considering their exposure to transfer pricing regulations.

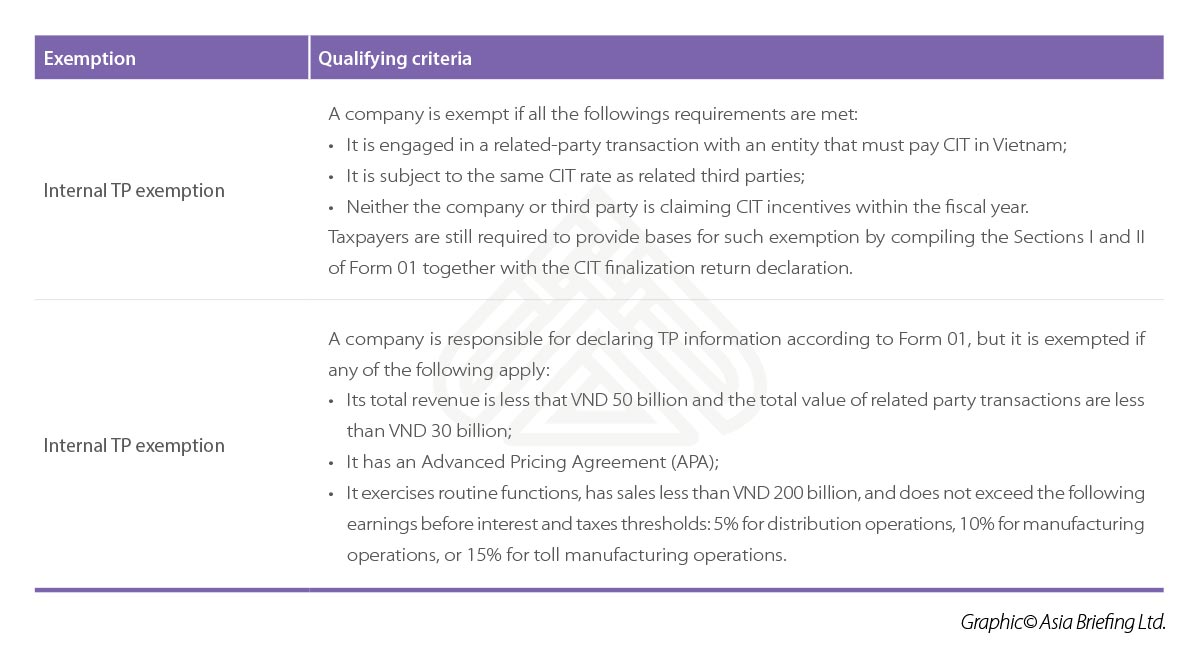

Exemptions from transfer pricing regulations

Foreign investors may be exempt from some or all transfer pricing compliance in the following cases.

Source: https://www.vietnam-briefing.com/news/vietnams-transfer-pricing-regulations-compliance-strategies.html/

English

English