Vietnam’s local currency bond market returns to upward trend in Q1

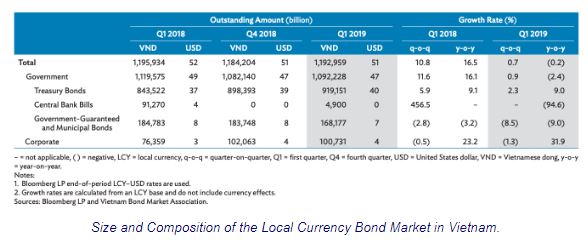

On a year-on-year basis, however, a 0.2% contraction was recorded, stated the report.

During the January – March period, total LCY government bonds outstanding stood at VND1,092.2 trillion (US$46.77 billion), with growth rebounding to 0.9% quarter-on-quarter after contracting 6.1% in the preceding quarter. On a year-on-year basis, the government bond market contracted 2.4% after expanding 7.9% in the fourth quarter of 2018. According to the report, the stock of Treasury instruments was the sole driver of growth as the stocks of central bank bills and government guaranteed and municipal bonds contracted during the review period. “The region’s bond markets are holding firm but the risks are still to the downside,” said ADB Chief Economist Yasuyuki Sawada. “That said, we see potential in the development of housing bonds to finance growing demand for homes as countries urbanize and for green bonds to fund clean energy and other climate-friendly projects.”

At the end of March, there were US$15 trillion in local currency bonds outstanding in emerging East Asia, 2.9% more than at the end of 2018 and 14% more than at the end of March 2018. Bond issuance in the region, meanwhile, amounted to US$1.4 trillion in the first quarter, 10% higher than in the last quarter of 2018 on the back of stronger issuance of government debt.

Emerging East Asia comprises China, Hong Kong (China), Indonesia, South Korea, Malaysia, the Philippines, Singapore, Thailand, and Vietnam.

LCY government bond yields going strong

Between March 1 and May 8, LCY government bond yields in Vietnam climbed for all tenors. Bond yields rose faster at the short-end than the long-end, resulting in a flattening of the yield curve. Yields gained an average of 30 basis points (bps) for the 1-year through 3-year maturities, but only rose an average of 6 bps for the 10-year through 15-year tenors. As a result, the spread between the 2-year and 10-year yields narrowed to 125 bps on May 8 from 150 bps on March 1.

The overall upward trend in bond yields was influenced by the uptick in deposit rates. Some banks raised deposit interest rates at the beginning of the year, to enable them to attract funds for mobilization. A regulation by the State Bank of Vietnam (SBV), which came into effect in 2019, reduced the ratio of short-term capital that can be used for long-term lending. Only 40% of a bank’s short term capital can now be used for long-term lending, down from the previous allowable amount of 45%. As a result, borrowing costs edged higher.

The uptick in bond yields at the short-end of the curve can also be attributed to rising inflation expectations. Upward adjustments in the prices of electricity and gasoline in March and April were expected to have a domino effect on the cost of goods and services. While inflation in the first four months of the year was the lowest for this period in three years, core inflation crept up to 1.8% year-on-year in January–April, hitting the upper-end of the target range of 1.6%–1.8% set by the National Assembly for full-year 2019.

On the external front, uncertainties in global financial markets, particularly those arising from the unresolved trade issues between the US and China, also impacted on bond yields. These two markets are among Vietnam’s largest trading partners. The SBV has kept its refinancing rate steady since July 2017 at 6.25% and continues to utilize other monetary tools in guiding interest rates.

The SBV has engaged in open market operations and intervened in the foreign exchange market to stabilize the USD/VND exchange rate. Between March 1 and May 8, the Vietnamese dong weakened by 0.7% versus the US dollar.

GDP growth in Vietnam eased to 6.8% year-on-year in the first quarter of 2019 from 7.5% year-on-year in the same period of last year as growth moderated in all major industry types.

The largest contributor to overall GDP growth was the industry and construction sector, which grew 8.6% year-on-year in the first quarter. The services sector expanded 6.5% year-on-year during the period, and the agriculture sector grew 2.7%.

English

English