Vietnamese currency predicted to continue weakening: Fitch

The Hanoitimes – Any currency weakness is likely to be mild so as to avoid possible sanctions from the US given Vietnam’s inclusion in the US Treasury’s currency manipulator watch list.

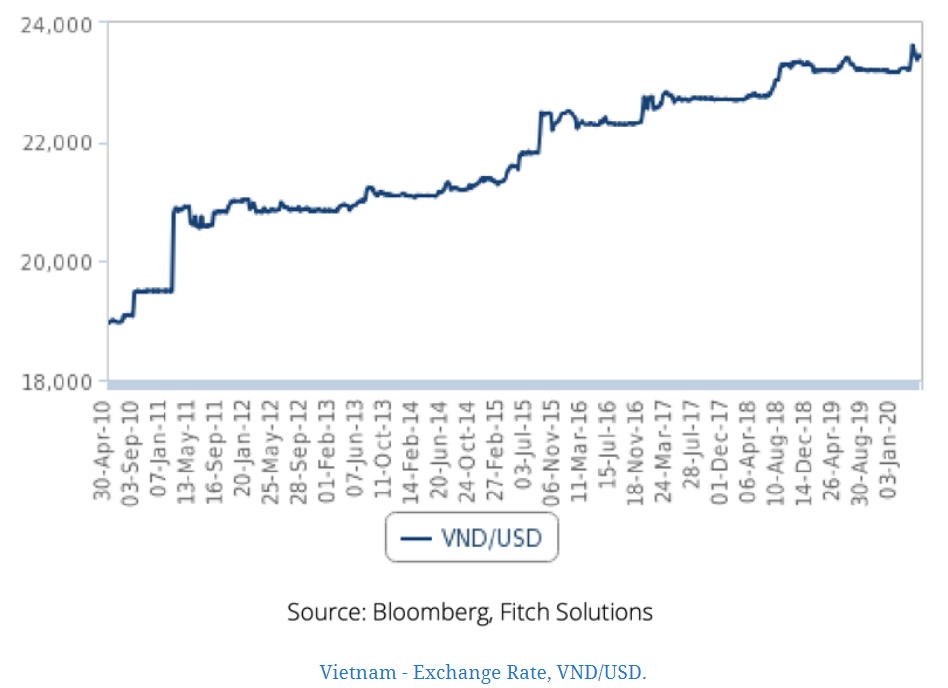

Fitch Solutions, a subsidiary of Fitch Group, expected the Vietnamese dong (VND) to weaken slightly over the coming quarters and to average VND23,475/USD in 2020 due mainly to weaker foreign direct investment (FDI) inflows and a likely preference by the central bank for a weaker dong to support the exports sector.

According to Fitch, the VND has depreciated by 1.2% against the US dollar since its January forecast and has averaged VND23,309/USD in the year-to-date.

Meanwhile, FDI inflow will slow drastically in 2020 due to the Covid-19 pandemic and this will provide less support to the dong. 2019 saw US$38 billion in total registered investment capital, up 7% from US$35.5 billion in 2018. FDI inflow in 2019 was supported by supply chain relocation from China by businesses seeking to diversify their manufacturing locations amid the height of the US-China trade war then.

With Vietnam having positioned itself as a low-cost regional manufacturing hub in the global supply chain, export demand and also FDI inflow will be heavily susceptible to swings in global economic demand. Given that the global economy is now in recession as a result of the Covid-19 pandemic, external demand will weaken significantly as compared to before.

Business investment will weaken as companies prioritize cash conservation amid an uncertain economic environment. Moreover, FDI decisions tend to be made only after site visits by stakeholders, especially in Vietnam’s case. Travel and movement restrictions will continue to prohibit these visits, thereby slowing the decision making process and FDI inflow.

|

| Vietnam – Foreign Exchange Reserves, USDmn. |

Fitch also expected the State Bank of Vietnam (SBV), the country’s central bank, to favor a weaker dong to support its external sector. Vietnam is dependent on exports as exports account for 95% of GDP, and as such a weaker currency would ideally position Vietnam for a stronger exports rebound with global demand likely to pick up after restrictive measures and lockdowns are gradually lifted.

From a production perspective, currency weakness will mainly support the country’s large manufacturing sector (17% of GDP), which is being buffeted by strong headwinds from supply chain disruptions and a weak demand outlook.

That said, Fitch believed that any currency weakness is likely to be mild so as to avoid possible sanctions from the US given that Vietnam has remained on the US Treasury’s currency manipulator watchlist in its January 2020 report. Being on the watchlist implies that Vietnam is still at risk of coming under punitive tariffs such as those levied on China, although these risks appear low, as the US will likely continue to reduce its dependence on Chinese exports by reorganizing its supply chain with other partners, such as Vietnam.

With a foreign exchange reserve position of US$80 billion in February, representing 3.8 months of imports, the central bank has sufficient firepower to ensure a measured pace of currency depreciation.

Long-term outlook

Fitch maintained its expectations for the VND to persist on a gradual depreciatory trend against the US dollar due to the dong’s persistent overvaluation and higher structural inflation in Vietnam versus the US. Therefore, Fitch forecast the unit to average VND23,650/USD in 2021.

|

| Vietnam – Real Effective Exchange Rate Index. |

The Vietnamese dong’s real effective exchange rate (REER) is trading 9.7% above its 10-year average, which suggests currency overvaluation. While it is likely that some of the strength in the REER could be attributed to productivity gains, an overvalued currency would in general still weigh on export competitiveness, dragging on export earnings and the strength of the dong.

|

| Vietnam And US – Average Inflation, %. |

Fitch forecast inflation in Vietnam to average 3.8% in 2020 and 4.2% in 2021, mainly on the back of food inflation as animal protein prices are rising due to supply shortages. African Swine Fever, which ravaged Vietnam in 2019, reduced the country’s hog herd by about a fifth and Fitch expected pork production to only recover somewhat closer to 2023.

A shortage of pork will spur consumers to turn to other substitutes, and this will raise prices of animal protein across the board. Moreover, with global supply lines being disrupted by the Covid-19 driven movement restrictions, obtaining imports to ease the supply crunch will also be challenging. This suggest that food inflation is likely to remain elevated. That said, transport price deflation owing to low global oil prices amid a supply glut and easing inflation in housing and construction materials due to a decline in construction activity amid movement restrictions put in place to contain the Covid-19 outbreak domestically.

A global oil supply glut combined with a shortage of oil storage space globally has seen Brent oil prices fall to around US$20 per barrel, from above US$60 in January, Fitch forecast Brent oil prices to average US$30 per barrel in 2020. Fitch’s inflation forecast for Vietnam is far above the 1.5% its forecast for the US for both years. High inflation would weigh on Vietnam’s export competitiveness in addition to incentivizing imports, which combined, would pressure the dong weaker over the long run.

Source: http://hanoitimes.vn/vietnamese-dong-predicted-to-continue-weakening-fitch-311944.html

English

English