Thailand: Tough times continue

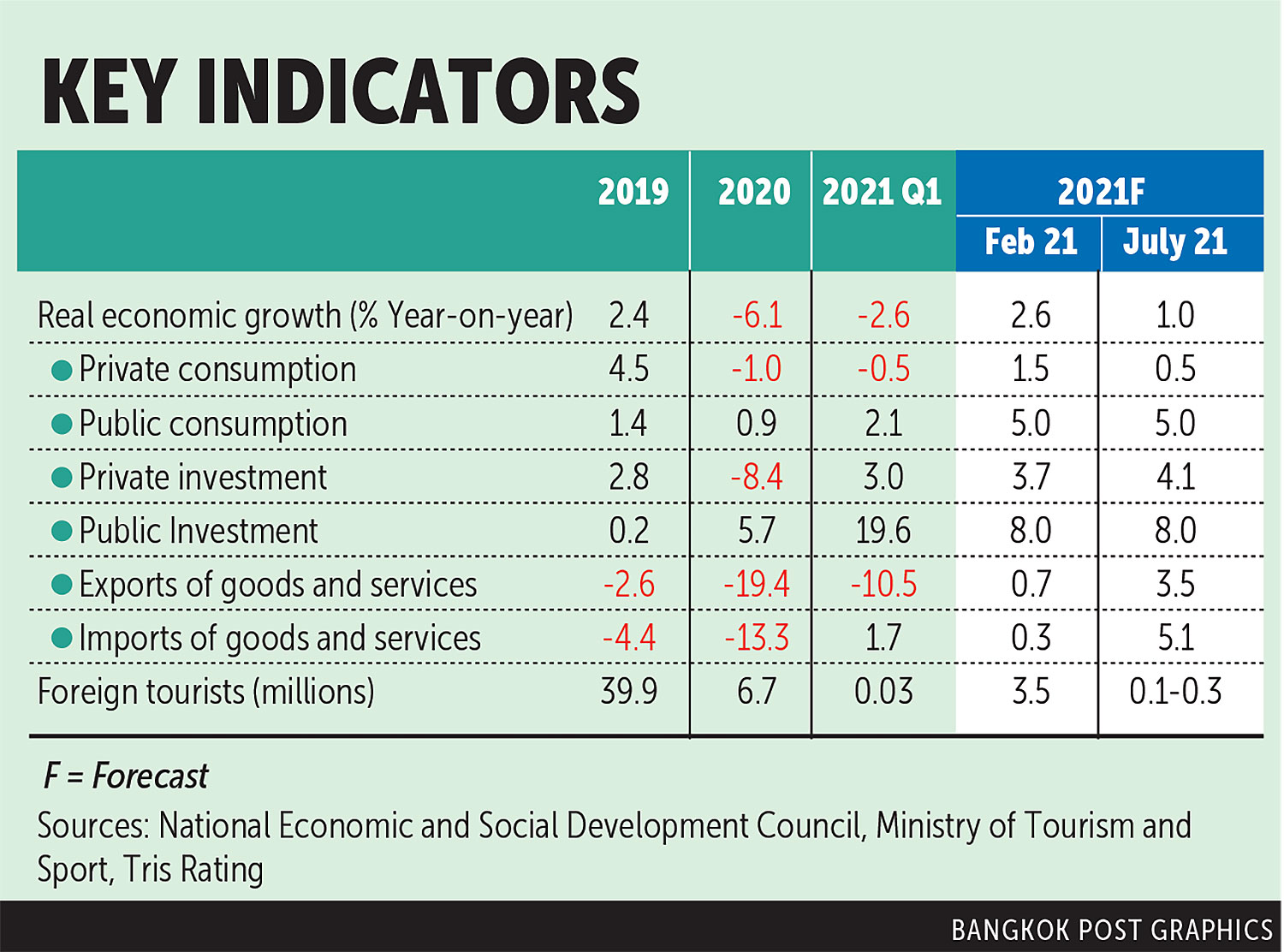

Tris Rating has revised its forecast of Thailand’s 2021 real gross domestic product (GDP) growth downward to 1.0%, from a February forecast of 2.6%, mainly due to the severity of economic fallout from the third wave of the Covid-19 outbreak.

The country’s overstretched public health system and slow progress of vaccine rollout will likely cause further delays in the revival of the country’s tourism industry and the overall economy. We project real GDP growth in 2022 will be in the range of 3.0% to 3.5%, with any return to pre-Covid levels unlikely before the third quarter of 2023.

The new wave of the Covid outbreak has exacerbated already weak domestic private consumption. While government financial relief measures should alleviate falling consumption to some extent, the surge of new infections and a drawn-out timeline for containing the spread of the virus continue to aggravate the unhealed economic wounds from last year, especially in the small and medium enterprise (SME) sector.

A faster-than-expected recovery of trade, supported by robust recoveries in China and the US, should serve as a key recovery driver for the Thai economy. However, growth in trade volumes is facing headwinds in the form of relentlessly rising international logistics costs, which are contributing to a deterioration in the current account balance and the depreciation of the Thai baht from last year.

We have revised our 2021 second-quarter real GDP growth estimate upward to 6.7%, from 6.1% in February, due to the higher-than-expected growth in external trade. However, the surge of new infection caseloads with increasingly stringent social distancing measures and the slow progress of vaccine rollout continues to depress consumer confidence and private consumption.

TOURISM MARGINAL

We expect that new daily infections should decline and stabilise by the end of September and the government will subsequently be able to ease its containment measures in the last quarter of 2021. We have adjusted our economic growth forecast for the fourth quarter downward to 1.0%, based on foreign tourist arrivals of between 100,000 and 300,000 this year, down from 3.5 million in the previous forecast.

We have cut our forecast for 2021 annual growth of private consumption to 0.5%, from 1.5% in the previous forecast. We expect state economic relief measures will only partially mitigate the impacts from the economic fallout; these measures are likely to become less effective without a resumption of social activities.

The drawn-out timeline for containing the spread of the virus means business closures and unemployment continue to rise. This is particularly evident in the SME sector, which makes up one third of national GDP and employs 70% of the formal labour force.

A sign of financial distress is the rising proportion of non-performing loans (NPLs) in the SME sector, which surged to a historical high of 7.3% of total loans at the end of the first quarter, from 4.8% at the end of the first quarter of 2020. We see this becoming worse as the ratio of special-mention loans among SMEs has also soared to 13.1%.

Meanwhile, the number of applicants for unemployment benefits (under Section 33 of the Social Security Act) remains persistently high, reaching 307,883 people at the end of June. We expect these figures to remain high until this third wave is brought under control.

The improving global trade outlook has led us to revise our forecast for the growth of goods and services exports to 3.5% from 0.7% in February, and imports to 5.1% from 0.3% in our previous forecast. The export revision also incorporates the above-mentioned cut in the projected number of foreign tourist arrivals.

CHINA TRADE BRISK

We expect a V-shaped recovery in external trade, bolstered by growing demand from China and the US. Exports to the US made up 15% of Thailand’s total export value in 2020 (US$34.1 billion), followed by China with 13% ($29.6 billion) and Japan at 10% ($22.7 billion). The recent uptick in export demand has been led by China and the US, with the monthly value of exports to China exceeding those to the US since April 2021.

However, rising international logistics costs may remain a significant issue until the end of the year. Skyrocketing costs for container and dry bulk shipping since mid-2020 are rooted in an imbalance in demand between the Western and Eastern hemispheres, resulting in a large differential in shipping rates between the westward and eastward routes.

With an absence of foreign tourist receipts, rising freight costs have resulted in a widening services deficit since the second quarter of 2020 and a current account deficit since the fourth quarter of 2020.

We expect the current account balance for 2021 to register a deficit for the first time since 2012, pressuring the value of the baht which has depreciated significantly from last year.

Source: https://www.bangkokpost.com/business/2152879/tough-times-continue

English

English