Thailand: Somkid rustles up larger SME loans

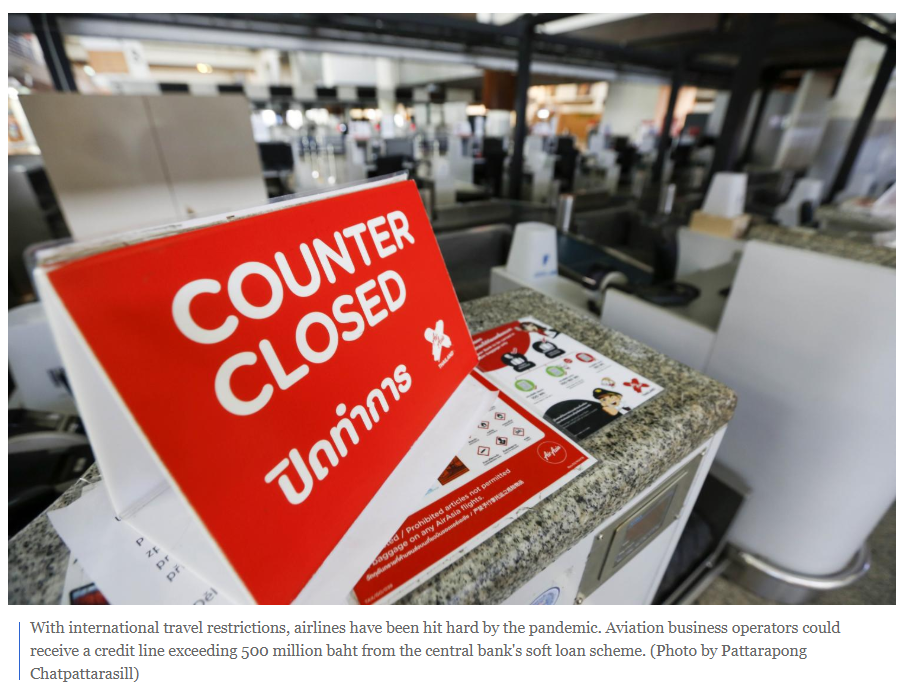

Deputy Prime Minister Somkid Jatusripitak has instructed related parties to set up a new mechanism to enable medium-scale business operators, particularly those in aviation and tourism, to seek a credit line exceeding 500 million baht from the central bank’s soft loan scheme to help them maintain employment.

The new instrument is expected to take shape by the middle of this month, Mr Somkid said.

The new mechanism will encourage aviation, tourism and hotel operators to keep employees on payroll, as well as some businesses that the government supports, he said.

The Bank of Thailand’s 500-billion-baht soft loan scheme is targeted at business operators with a credit line of up to 500 million baht, but some of these business operators want loans exceeding 500 million baht, Mr Somkid said.

Thai Bankers’ Association chairman Predee Daochai earlier this week said that the association was in talks with the central bank to seek ways to fine-tune the 500-billion-baht soft loan criteria, probably by allowing banks to extend loans with a specific purpose such as keeping small and medium-sized enterprise (SME) employees on payroll.

The central bank is offering 500 billion baht in soft loans at 0.01% interest to financial institutions for two years, which are to be extended to SMEs with a maximum credit line of 500 million baht at 2% interest. The government will absorb interest charges for six months for SMEs that receive soft loans.

The soft loan scheme had extended just 90.5 billion baht to 567,312 SMEs as of June 22. Of the total SMEs, 43,030 or 76.4% were small SMEs with credit lines below 20 million baht, 9,825 were mid-sized SMEs with credit lines of 20-100 million baht and the rest were large SMEs with credit lines of 100-500 million baht.

Mr Somkid said employment is the government’s main focus, to which end he asked the central bank and related agencies to consider extending the debt relief scheme as a pre-emptive approach to support virus-hit business operators and individuals.

The rising unemployment stems from the pandemic and business closures, he said.

The Revenue Department and the Fiscal Policy Office have been delegated with creating a consumption-boosting policy to encourage high-income earners to spend, he said, adding that they must come up with the measures by the middle of this month.

Finance Minister Uttama Savanayana said the Thai Credit Guarantee Corporation (TCG) is offering portfolio guarantee scheme (PGS) 9 to help provide credit guarantees to SMEs and make access to soft loans easier.

The potential stimulus measures could be integrated into the Taste-Shop-Spend scheme and could include tax breaks, he said.

As to whether the debt relief scheme, which will lapse at the end of September, will be extended, Mr Uttama said it’s too early to say but the government is mulling the issue as the impact from the pandemic persists.

Source: https://www.bangkokpost.com/business/1945032/somkid-rustles-up-larger-sme-loans

English

English