Thailand: ‘Reflation theme’ on the up

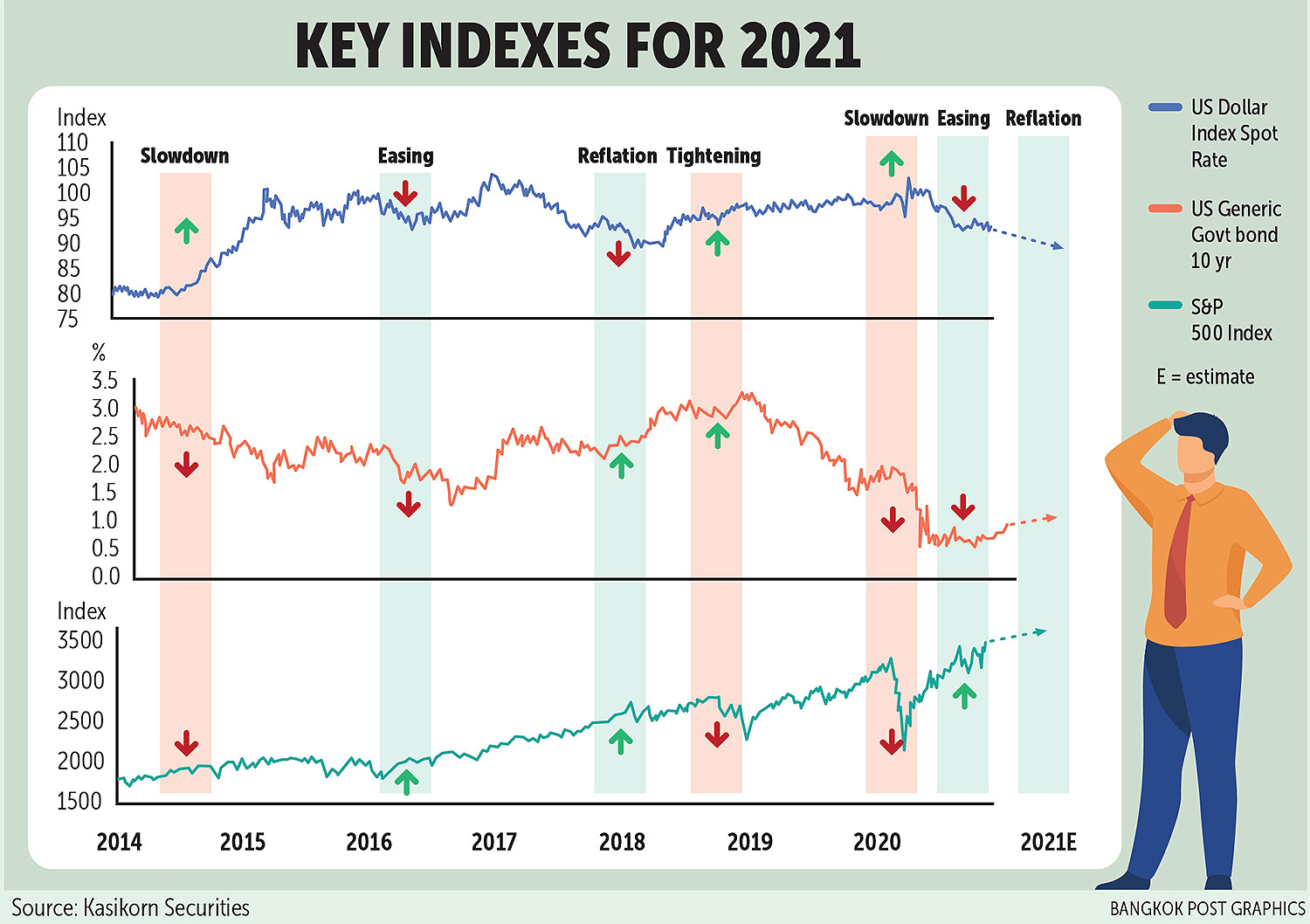

Investors are riding the reflation investment trend with commodities and consumption-related stocks outperforming again, as the global economy recovers and brings with it another wave of inflation.

Conversely, investors are selling off gold and secured assets that once performed well during the uncertainty of the pandemic, but are now dropping in profit return.

As there are several factors strongly suggesting the global inflation rate is on the rise, investors are now adjusting their strategy and turning to high-risk assets to hedge against inflation and reap high returns from assets that are usually boosted by US dollar depreciation.

This strategy is called “reflation theme” investment which will likely begin to pick up steam within the first half of this year, says Sorrabhol Virameteekul, senior vice-president of Kasikorn Securities.

As the global economy begins to recover, oil prices are on the rise while the US dollar and gold weaken as ongoing mass vaccine rollouts are giving investors confidence that the economy is recovering faster than expected.

Brent crude oil surged more than 20% from around US$51 per barrel earlier this year to $64 per barrel as of Feb 15.

The S&P 500 Index rose by 0.29% while the UK’s FTSE 100 increased by 1.39%. Japan’s Nikkei 225 jumped 1.9% while the Chinese markets were closed for the Lunar New Year.

The US bond market also now sees a “bear steepener” or the widening of the yield curve caused by long-term interest rates increasing at a faster pace than short-term rates.

The US 10-year government bond yield increased from 1.25% earlier this year to 1.75% while short-term bonds were sold.

The number of Covid-19 infections in the US has dropped significantly from 250,000 to 70,000-80,000 per day after mass vaccination efforts proved effective.

The US government is predicted to continue maintaining low interest levels for the first half and may be able to raise rates in the second half. But quantitative easing measures will likely continue for some time.

These conditions support investments in the stock market, especially stocks related to banks and consumption including other risk assets to cope with the coming inflation, Mr Sorrabhol said.

“This year will be a golden year for investing in local and global stocks. Prices of oil and bank stocks surged in the past 1-2 weeks. It is believed that the two sectors are in the reflation theme that will grow and overcome inflation,” said Merchant Partners Asset Management’s senior vice-president Prakit Siriwattanaket.

Mr Prakit said emerging markets and those that were rendered laggards during the pandemic will gain investors’ attention.

Several hedge funds are also found holding their net long positions in the Nasdaq stock market, suggesting investors’ confidence in the economic recovery.

“The current phenomenon of reflation theme investment is as clear as the increase in investment in technology stocks during mid-2020 when progress in vaccine development was still uncertain,” said Mr Prakit.

According to the Fiscal Policy Office, Thailand’s inflation rates were 1.1% in 2018, 0.7% in 2019, and forecast at -0.8% in 2020 and 1.3% this year.

YLG Bullion chief executive Pawan Nawawattanasub said gold price was under pressure from the vaccine rollout and prospective recovery, driving traders to invest in other risky assets.

Source: https://www.bangkokpost.com/business/2069471/reflation-theme-on-the-up

English

English