Thailand: Outer city calls to budget-conscious renters

As Bangkok condo supply is in a surplus and tenants are seeking units with lower rents, condos in outer-city locations along the extensions of mass transit lines are more attractive for a buy-to-let investment than those in inner-city areas.

Thana Torsahakul, chief executive of Primo Service Solution Co, a property consultant and subsidiary of SET-listed developer Origin Property Plc, said more condo tenants are relocating from the central business district (CBD) to outer-city areas.

“Tenants want to save costs amid an economic slowdown,” Mr Thana said. “Living in outer-city areas near a mass transit station may cost a higher fare for travelling to workplaces in the inner city, but it’s worth choosing.”

He said the higher fare that tenants pay to travel to work by mass transit will be minimal when compared with the difference in rent between units in the CBD and in outer locations.

In locations near Phra Khanong BTS station, for example, condo rent is 20,000 baht and above per month or 700-1,000 baht per square metre per month.

But units near On Nut station, one stop away, ask for 10,000 baht per month or 300-500 baht per sq m per month.

In inner-city areas, many facilities like petrol stations or food markets have vanished as landowners sold out amid rising land prices.

“This has driven many tenants to seek units in outer-city areas where they can find facilities or street food more conveniently,” Mr Thana said. “No one wants to dine at shopping malls every day.”

Other attractive locations for buy-to-let investment include BTS stations along Sukhumvit Road from On Nut to Samut Prakan and future BTS stations along Phahon Yothin Road near Kasetsart University, including locations near other universities.

Mr Thana said units with a rent of 10,000 baht per month are let faster than those with a higher rent, as many developers during the past few years launched new supply in the upper-end segment to escape from lower-end buyers who faced difficulty in getting a home loan.

“When supply in the upper-end segment is a surplus, tenants have many choices and they will make a bargain with unit owners,” he said.

As a result, rental yields for units in inner-city locations will be stagnant or lower while condo prices are on the rise.

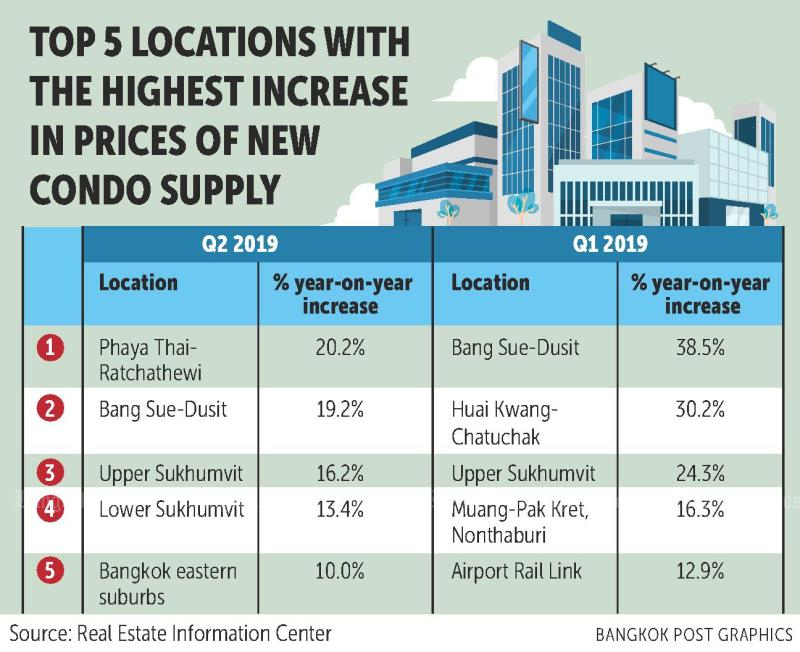

According to the Real Estate Information Center, the price index of condos in Greater Bangkok continued to grow with an increase of 8.2% in the second quarter of 2019 compared with the same period last year.

In Bangkok, the price index of condos rose 9.1%. In neighbouring provinces the increase was 4.7%.

Kantitat Moltha, vice-president of Deal Co Ltd, a property agency and subsidiary of residential developer Pruksa Real Estate, said locations on Charan Sanit Wong Road from Bang Or to Tha Phra are attractive for investing in condos for rent.

“An extension of the MRT Blue Line from Tao Poon to Tha Phra and city planning regulations are driving this location’s attractiveness,” Mr Kantitat said yesterday at a seminar on exploring property rentals held by Prop2morrow.com.

During 2011-19, land prices in the location rose by 46.6% from 60,000-180,000 baht per sq wah to 150,000-400,000 baht, according to Pruksa Real Estate’s market research.

The amount of new condo supply grew from 2,680 to 7,825 units and price per sq m of new condos increased 39% from 62,000 to 102,000 baht, Mr Kantitat said.

Pruksa surveyed the condo rental market in locations near nine future MRT stations: Bang Or, Bang Phlat, Sirindhorn, Bang Yee Khan, Bang Khunnon, Yaek Fai Chai, Charan 13, Tha Phra and Issaraphab.

It found that rents averaged 14,030 baht. A one-bedroom was most popular with an average rent of 18,000 baht per month.

Charan 13 experienced the highest yield with 6.08% a year, followed by Sirindhorn (5.78%), Bang Or (5.33%), Bang Khunnon (5.2%) and Yaek Fai Chai (5%).

“More than 70% of rental demand in this location was students, followed by those working for hospitals and hypermarkets,” Mr Kantitat said. “The rental condo market in this location is now very good but may be in a recession in the next three years due to too much supply coming in the future.”

Source: https://www.bangkokpost.com/business/1709079/outer-city-calls-to-budget-conscious-renters

English

English