Thailand: Making a market for private assets

Alternative investment firm Ally Global Management is establishing and accelerating a new private asset industry in Thailand and Southeast Asia, with strategies focused on direct investments alongside co-founders of the world’s largest institutions.

Kris Eiamsakulrat, managing partner of Ally Global Management, said the team’s proprietary networks and relationships built organically over decades with leading partners, operators and co-founders of global leading investment firms provide an evident advantage.

“I’ve seen many investment opportunities over the past 10 years in New York,” he said. “Trying to time the market is rarely a good strategy.”

Mr Kris said by speaking daily with its global team, with co-founders, local operators, and experts in each industry, the firm strategically shaped its investment thesis and acted on its high-conviction strategies well before the market got crowded. This is deemed an information advantage, he said.

Mr Kris said private assets have always been attractive investments. Their returns arehigher as they are more difficult to access. Their risks are also lower, as they are lessvolatile than public assets.

Mr Kris said private assets have always been attractive investments. Their returns arehigher as they are more difficult to access. Their risks are also lower, as they are lessvolatile than public assets.

PRIVATE ASSETS A NEW HAVEN

Mr Kris said private assets have always been attractive investments. Their returns are higher as they are more difficult to access. Their risks are also lower, as they are less volatile than public assets, he said.

“Investor mindset and approach has changed over the past two years and Covid-19 and the Russia-Ukraine conflict are catalysts,” said Mr Kris.

“Rising interest rates, inflation and uncertainty have driven many public market investors to divest into less volatile and better performing private assets or alternative investments.”

During the first wave of Covid-19 in March 2020, Thai and overseas stock markets declined by 35-40%. US stock markets shrank by 20% and those in China plummeted by 40% during the recent Russia-Ukraine conflict.

According to privately held London-based investment data company Preqin’s survey of more than 300 investors conducted in November 2021, most institutional investors remain committed to investing in alternative assets.

Across alternatives, an average of 86% of investors said performance had met or exceeded expectations in 2021.

While competition for assets, valuations and rising interest rates top the list of investor concerns, more than half expected to invest the same amount in alternatives over the next 12 months. Almost a third planned to invest more.

Mr Kris said access for Thai and Southeast Asian high net worth individuals and institutions to overseas investment products is quite limited when compared with global investors. Though they can invest through an overseas fund, fees are typically very high.

“We want to build a direct investment firm with superior products than what is currently offered in developed markets. Our goal is to educate and allow Southeast Asia-based investors to grow and diversify globally with conviction, trust and excitement,” he said.

“Simultaneously, we aim to leverage our significant presence in the region to deliver high-growth opportunities in our local markets.”

A GLOBAL INVESTMENT FIRM

“Ally Global Management was set up in December 2019 to help Thai investors directly access attractive investments with no brokers involved,” said Mr Kris.

The first investment was Ally Leasehold Real Estate Investment Trust, Thailand’s largest diversified REIT investing in core commercial real estate.

Ally REIT invested in 13 prime lifestyle retail malls with a total lettable area of 155,921 square metres and an average occupancy of 93.6%. Total asset value was 13 billion baht.

The firm expanded with investments in Europe, the US and South America, with offices in New York, Los Angeles, Singapore and Bangkok.

Ally Global Management has a total of US$1 billion (roughly 34 billion baht) in assets under management (AUM) and aims to reach $5-10 billion in five years.

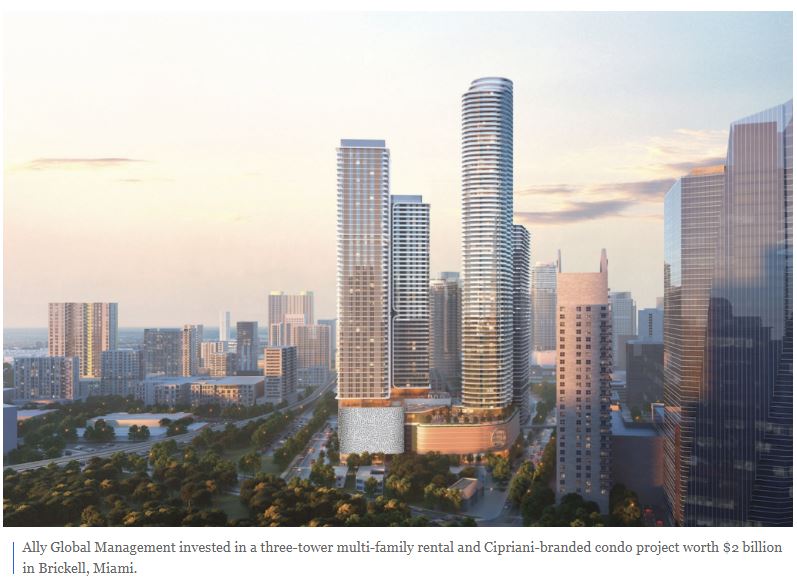

Ally Global Management invested in a three-tower multi-family rental and Cipriani-branded condo project worth $2 billion in Brickell, Miami.

Ally Global Management invested in a three-tower multi-family rental and Cipriani-branded condo project worth $2 billion in Brickell, Miami.

FOCUS ON 4 INTEGRATED VERTICALS

Ally Global Management invests in four vertical segments: real estate; media and entertainment; hospitality; and growth, sustainability and green energy.

The real estate investments are mainly in the US, comprising a three-tower multi-family rental and Cipriani-branded condo project worth $2 billion in Brickell, Miami.

The firm co-invested in a 20-storey office tower near Bryant Park in New York City with a family office owned by David Rubenstein, a co-founder of the Carlyle Group, which is one of the largest investment companies in the US with AUM of $301 billion.

“We invested in the tower in 2020 amid the pandemic at a greatly discounted basis. With an occupancy rate of 95%, it achieved rents higher than expected with an expected internal rate of return of 17% as a lender,” he said.

Ally Global Management also invested in 18 mixed-use buildings on Western Avenue near Paramount Studios and Netflix headquarters in Hollywood. This is a co-investment with the family office of Marc Lasry, co-founder of Avenue Capital Group, a global investment firm with $9.5 billion of AUM.

Today David Zwirner Art Gallery, Moran Moran and curated F&B and retail offerings are anchor tenants in the neighbourhood.

In Thailand, Ally Global Management invested in preferred stocks worth 600 million baht for Hua Hin Alpha 71 Co, the owner of luxury resort home InterContinental Residences Hua Hin.

In the hospitality vertical, the firm bought into Six Senses Ibiza, a luxury resort in Spain. It achieved a room rate of €1,430 per night last year, more than doubling the projection of €700.

Ally Global Management also acquired the Crescent Hotel near Rodeo Drive, Beverly Hills, one of the most prime locations in the US.

Hotels have rarely been offered for sale in this location during the past 10 years, said Mr Kris.

Changed to short-term rental operator Sonder, the firm has already been offered 30% more than it paid since it was purchased in February 2022.

“Our hotel investments will focus on destinations with robust demand growth and high-quality assets in locations where it is notoriously difficult to build, naturally limiting future supply,” he said.

In media and entertainment, the firm plans to build a complete ecosystem by introducing Thai and Southeast Asian creative works to the globe through a joint venture with renowned media and entertainment firms in the country, the region and Hollywood.

“The long-term structure of our investment funds will allow strategic cross-pollination and value enhancement across our vertical investments,” said Mr Kris.

For example, the firm may have an artist in its media and entertainment business performing in an event space owned by its real estate fund. Sponsors of the event may be a growth portfolio company, he said.

Alternatively, a film produced for the entertainment company may be housed in one of the firm’s real estate properties. The opportunities are endless, said Mr Kris.

For growth, sustainability and green energy, the firm has invested in more than 50 startups including Hungryroot, an artificial intelligence-powered grocery service valued at $750 million, and waste-to-energy firm Braven Environmental valued at $1 billion.

PLATFORM ALONG MARKET LEADERS

“We invest with co-founders of large global investment firms and family offices as their access to high-return investments is superior to the market,” he said.

Ally Global Management also works with leading alternative investment firms such as Blackstone and Rockpoint Group as well as experienced local operators to learn changing global trends and to directly access attractive assets for the maximum benefit of investors.

“Our team used to run real estate groups at large financial institutions like Goldman Sachs and Bank of America. We know the best operators in each market, allowing us to achieve a minimum internal rate of return of 18-40% on each investment,” said Mr Kris.

He said Ally Global’s platform distinguishes it from other firms. It directly invests in private assets using high-conviction strategies and generates higher risk-adjusted returns.

Using strong relationships with leading local operators, Ally Global Management also receives a generous and constant stream of attractive deals, maximising access to the best market-specific investment opportunities, said Mr Kris.

“We are building a new investment platform that links Thai and Southeast Asian investors with leading global business operators with an aim to drive the region quickly to the next level,” he said.

Source: https://www.bangkokpost.com/business/2284206/making-a-market-for-private-assets

English

English