Thailand: Investors told to seek high dividends to beat inflation

SET Investnow, an investment educational unit of the Stock Exchange of Thailand (SET), suggests investing in stocks with high dividend payouts of above 5% with low beta values to hedge against volatility and inflation.

The principle is to buy stocks with higher dividends than the February inflation rate of 5.28%, because they will generate better returns and expose investors to lower risks from volatility.

They are often classified as safe stocks or defensive stocks, although dividend stocks may not produce lower capital gains but offer stability, as the dividends will be paid regularly.

According to SET Investnow, a stock with a good dividend yield, with a low beta value, can reduce risks for investors. Beta value is another factor investors use to compare stock price movements against the movement of the overall stock index.

By definition, a stock market index has a beta value of 1.0, and each stock’s beta is ranked based on the stock’s price movement that deviates more or less relative to the stock market index.

Therefore, stocks with a beta greater than 1.0 will be more volatile than the overall market. Conversely, stocks with a beta below 1.0 are less volatile.

Stocks with lower betas can offer investors a buffer against market volatility, and offer higher dividend yields than the market average.

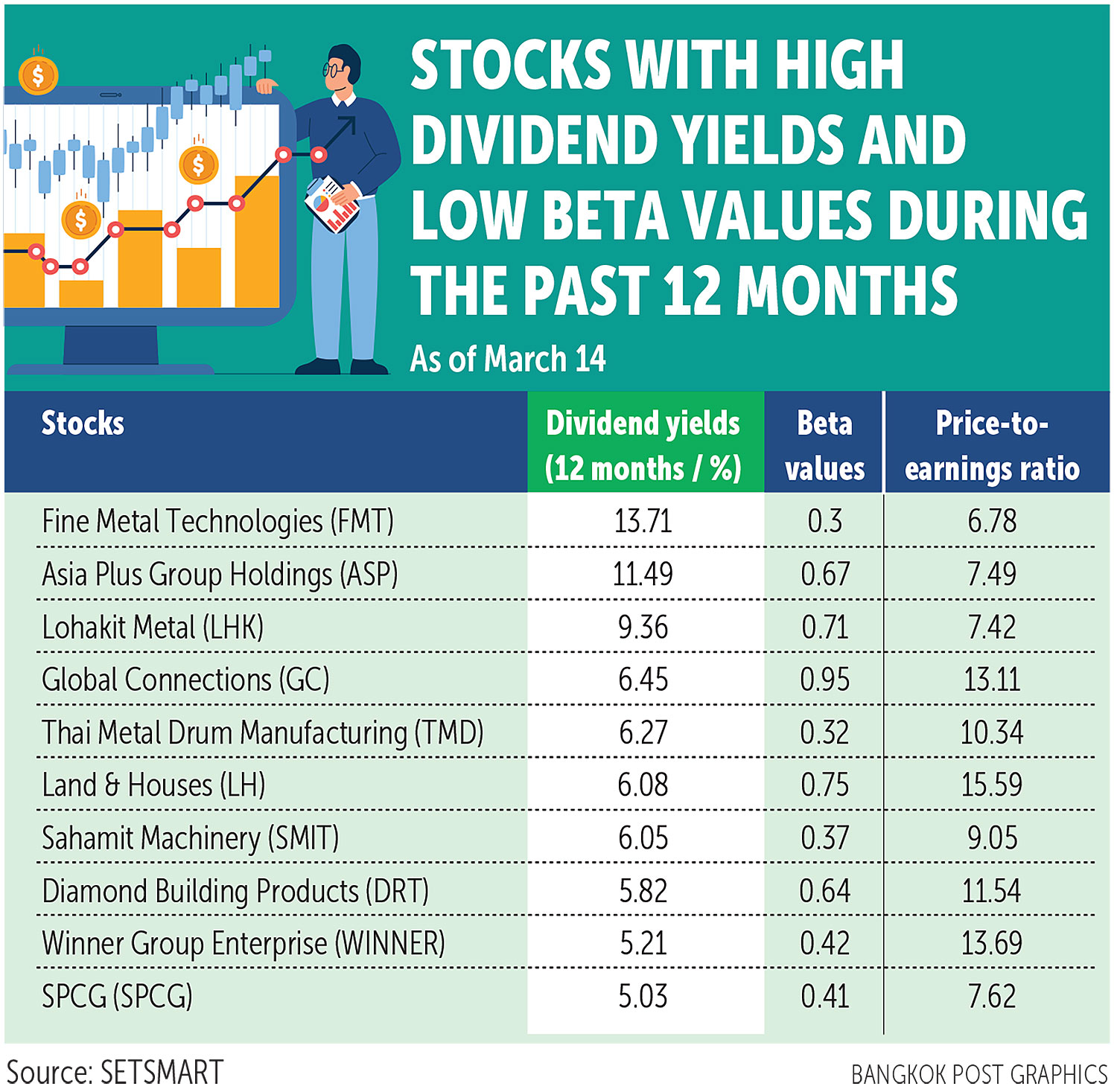

SET Investnow’s top picks include stocks with dividend yields of over 5% over five years (2017-2021) and over the past 12 months as of March 14, and with betas of less than 1.0, such as Fine Metal Technologies (FMT), Asia Plus Group Holdings (ASP), and Lohakit Metal (LHK).

According to Krungsri Securities, the top stocks with the highest dividend yields for 2021 were Sri Trang Gloves Thailand (17.9%), Thai Vegetable Oil (7.9%), Banpu (7%), and Bangchak Corporation (7%).

Source: https://www.bangkokpost.com/business/2296750/investors-told-to-seek-high-dividends-to-beat-inflation

English

English