Thailand: Internet stock trading accounts increase by 22.7%

Internet securities trading accounts increased by 553,000 or 22.7% during the first three quarters to 3.02 million accounts, driving total securities trading accounts to 3.32 million at the end of September.

According to the SET Note provided by the research department, the increase doubled the average annual figure of 230,000-330,000 accounts.

More than 77,000 accounts were created from March to June, the peak period, when social distancing was enforced. The number of investors also rose by 13.7% from 1.27 million to 1.45 million at the end of September.

Nuttachart Mekmasin, an analyst from Trinity Securities, said most of the new stock traders use daily and short-term trading strategies.

The portion of local retail investors in July rose to 48% of the average daily trading value, a pickup from 41.9% in March and from 33.7% in 2019, according to SET data.

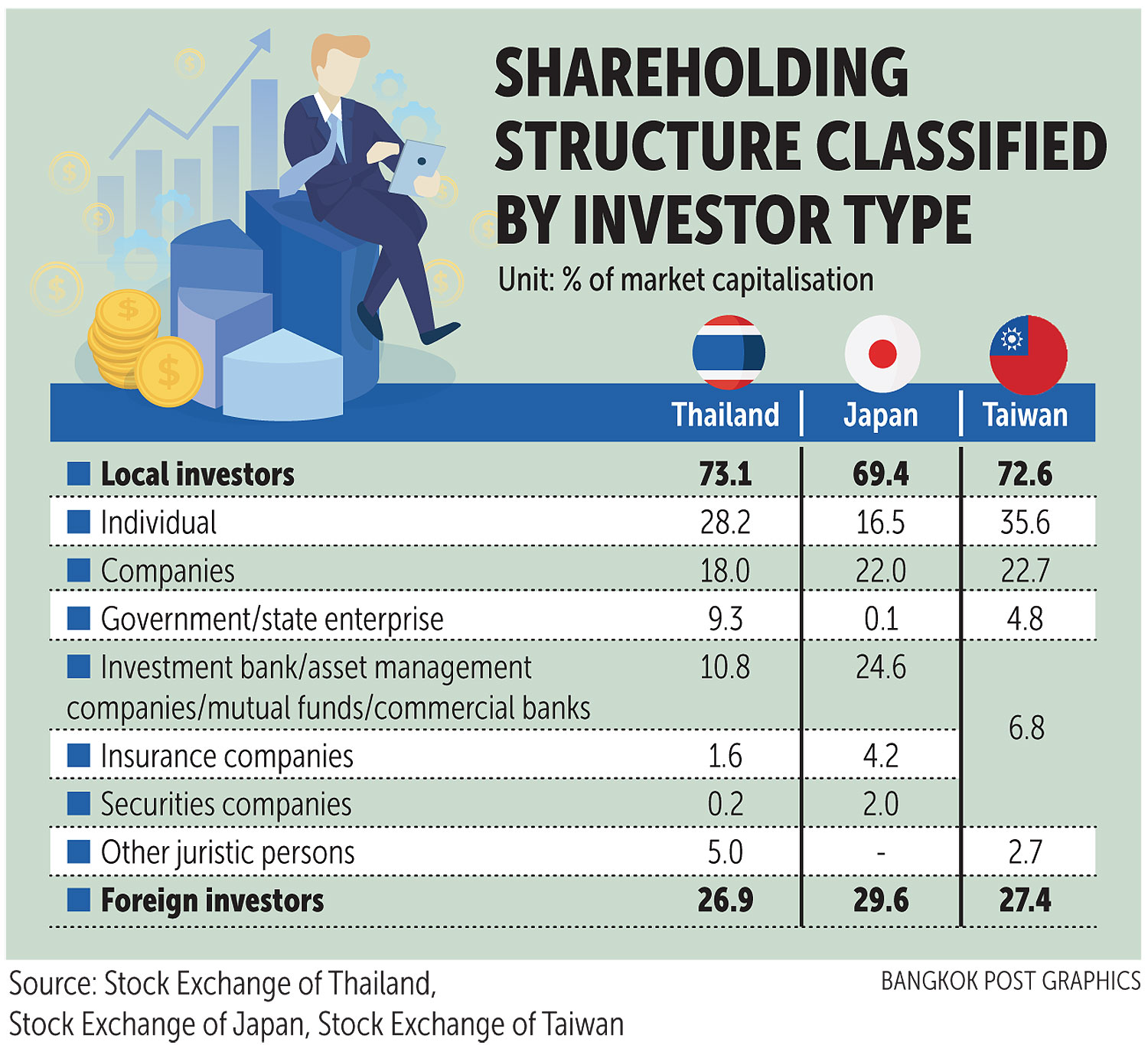

The shareholding structure of Thai bourses is similar to Taiwan, where local investors account for 73% of total market cap, while foreigners make up the rest, according to the estimated shareholding value based on registration book closing and corporate action data of 695 listed companies on the SET and MAI at the end of August.

The structure also resembles Japan’s bourse, in which local investors contribute 69% and foreign investors make up 31%.

“A balanced mix between individual investors, institutional investors and foreign investors will enhance the market’s depth and breadth, granting it protection from any disruptions,” said Soraphol Tulayasathien, the SET’s senior executive vice-president.

Strategic shareholders, as defined by the SET, are managing directors or top four executives, shareholders with more than 5% of paid-up capital, or controlling persons, which refers to a person having a significant influence over policymaking, management or the operation of the company.

Strategic shareholders reflect long-term investment, while retail reflects trading liquidity.

Mr Soraphol said retail investors and strategic investors are balanced in Thai bourses in terms of the shareholding value classified by participation in business management. At the end of August, strategic shareholders contributed 54.7% of the total market cap while retail investors shared 45.3%.

Win Phromphaet, chief investment officer at Principal Asset Management, said having various types of investors helps balance the market when some investors sell, which can trigger a decline.

He said in China, the government has made repeated efforts to allow foreign investors to buy China A-shares, those of mainland companies that trade on the Shanghai Stock Exchange and the Shenzhen Stock Exchange.

Chinese equities occupy more than 30% of the MSCI’s weight, while Thailand has a 1.7% share in MSCI Emerging Markets, the highest in Asean, excluding Singapore.

Mr Nuttachart said mutual fund investments in the Thai market should be increased because they are relatively low in proportion, reflecting Thai people’s low financial literacy.

Source: https://www.bangkokpost.com/business/2032387/internet-stock-trading-accounts-increase-by-22-7-

English

English