Thailand: Foreign fund flows likely to continue

Foreign fund flows into Thai stock markets are expected to continue through next year, supported by positive global sentiment towards Joe Biden’s election victory in the US and successful trials of Covid-19 vaccines, says an executive of Stock Exchange of Thailand (SET).

However, investors should monitor the performance of large listed companies, Thailand’s GDP performance and global trends, such as spikes in Covid infection rates and the speed of vaccine dispersal.

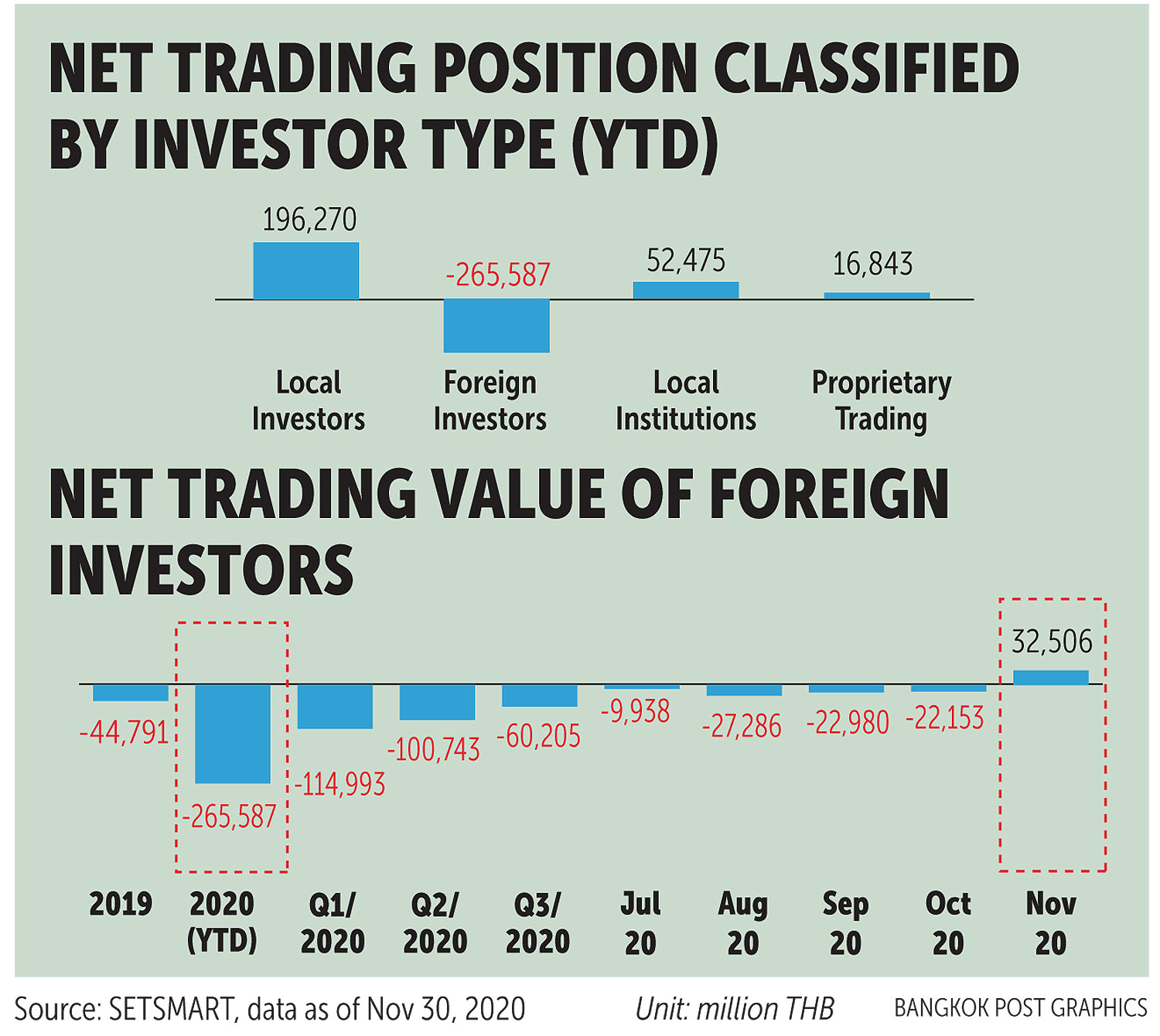

Soraphol Tulayasathien, senior executive vice-president and head of SET’s corporate strategy division, said fund inflows to the Thai stock market in November reached 32.5 billion baht, but year-to-date net outflows stood at 266 billion baht. Local investors were net buyers of 196 billion baht.

Foreign investors were net buyers on the SET in November for the first time in 16 months, resulting in their net sell position dropping to 265 billion baht from 285 billion earlier this year.

Mr Soraphol said Mr Biden’s presidential election victory along with news regarding vaccine developments had caused inflows into Asia including Thailand securing a piece of the positive investor sentiment, with easing trade tension between the US and China.

The SET index continued its rebound, reaching -8% year-to-date, from -37% early this year. The index rose 20.09 points yesterday, an increase of 2.01%, to close at 1478.92 points, hitting strong resistance at 1,450 points, with total trading worth 123 billion baht.

The sectors that performed better than the SET average year-to-date were agriculture and food (+3.3%), technology (+2%), and consumption (+1.7%), while the sectors affected by the pandemic were finance (-20%), property (-15.2%) and services (-13%).

Stocks that performed better than the SET average in November were large-cap stocks in the energy, petrochemical and banking sectors.

Trading valuation in November recorded a monthly high of 90.1 billion baht per day, compared with a 65.9 billion per day average for the first 11 months of the year, an increase of 22.8% from the same period in 2019. The SET index at the end of November closed at 1,408.31 points, up 17.8% from the previous month, the largest rebound among Asian bourses.

Thailand retained its position as the top initial public offering market in Asean in November, with four companies listing on Thai bourses (two on the SET and two on the Market for Alternative Investment). These IPOs boosted the SET’s and MAI’s price-to-earning ratios to 26.3 times and 24 times, respectively, higher than the Asian stock market averages of 18.5 times and 22.2 times, respectively.

The SET also had a dividend yield return as of November of 3%, higher than the Asian average of 2.5%.

The derivatives market had average trading volume of 621,620 contracts per day, the highest in seven months and a rise of 66.7% from the previous month. The main products were on the SET50 Index Futures and Single Stock Futures. Average trading volume for the first 11 months was 472,363 contracts per day, up 12.9% from the same period last year.

Mr Soraphol said foreign funds will continue to move into Thai markets if listed firms’ earning growth performance gains in line with Thai and global GDP, buoyed by the support of the vaccine roll-out.

Source: https://www.bangkokpost.com/business/2032175/foreign-fund-flows-likely-to-continue

English

English