Thailand: Ensuring a comfortable nest egg

Most retirees rely on savings accumulated over their working life, but longer life expectancy and higher costs of living could fan fears that the nest egg will come up short.

Working out how much money is sufficient for retirement depends on the spending behaviour, lifestyle and financial burden of each individual, but a good method to draw up a financial plan for retirement is the 4% rule, said Weerapon Bordeerat, first vice-president for customer advisory development at Kasikornbank (KBank).

The 4% rule is a rule of thumb for how much a retiree can safely spend. This states that a retiree can withdraw 4% of his or her nest egg each year throughout retirement.

Based on this guideline, a retiree will run out of money after 25 years, assuming he or she does not earn additional income, a duration considered long enough for most, Mr Weerapon said.

For example, if the nest egg amounts to 10 million baht, the retiree, based on the 4% rule, can spend 400,000 baht a year or around 33,000 a month, allowing the retiree to live comfortably.

A KBank survey found the cost of living for a Bangkok retiree averaged 10,000-16,000 baht a month.

According to the latest World Health Organisation data published in 2018, Thais have a life expectancy of 75.5 (71.8 for men and 79.3 for women).

Even though retirees no longer earn money from working, they can boost their retirement savings from investments to supplement the Social Security Fund and other sources of guaranteed income.

Mr Weerapon recommends that everyone plan a retirement investment income source while they are still working but focus on investment sources that create a regular stream of income when retirement is approaching and reduce those investments with risk exposure.

“Retirees should have assets with lower risk,” he said. “People who are closer to retirement should take lower risks and enlarge the portion of assets which yield a steady income stream. However, choosing which type of risk asset class goes in your portfolio depends on each individual’s risk tolerance.”

Preparing a retirement financial plan is crucial. Check out all potential income sources to ensure a retirement free from financial anxiety.

Common income sources

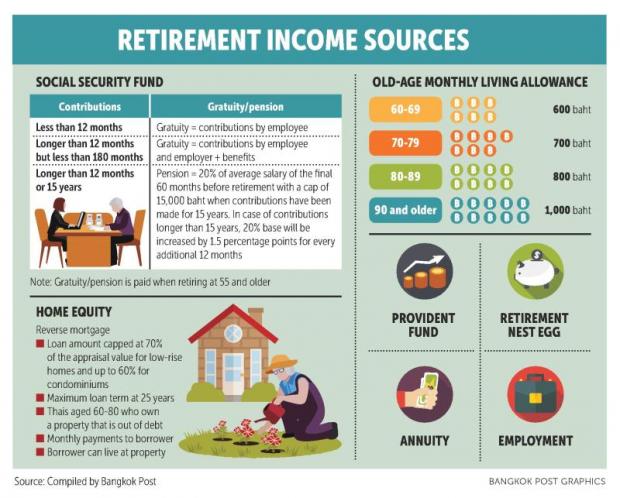

Social Security Fund

Workers who contribute to the Social Security Fund can claim either a gratuity or pension benefits when they turn 55 and retire. Keep in mind that medical care benefits provided by the Social Security Fund are immediately terminated when the gratuity or pension benefits are claimed.

Social Security Fund members can claim a gratuity in cases where they contribute to the fund for less than 180 months or 15 years, or an old age pension if they contribute for 180 months or longer.

Members receive a gratuity equal to the amount they contributed to the Social Security Fund if they pay into the fund less than 12 months, and they get the contribution paid by themselves and their employees plus benefits as stipulated by the Social Security Fund if they contributed to the fund for at least 12 months but not exceeding 180 months.

Retirees are entitled to an old age pension if they make contributions for at least 180 months. The pension benefit is equal to 20% of the average salary of the final 60 months before retirement with a cap of 15,000 baht if they consistently contributed to the fund for 180 months.

Based on the 20% base, they are eligible to receive 3,000 baht a month over the course of their post-retirement years if their salary over the last 60 months averages 15,000 baht a month or higher, and 2,400 baht if the average salary stands at 12,000 baht.

For those who make longer than 180 months’ contribution to the fund, their 20% base will be increased by 1.5 percentage points for every additional 12 months of contribution above the consecutive 180-month obligation.

Based on an average salary of 15,000 baht and higher over the last 60 months before retirement, fund members get 3,225 baht if they consistently contributed for 16 years, 3,450 baht for a 17-year contribution, 3,675 baht for a 18-year contribution, 3,900 baht for a 19-year contribution, 4,125 baht for a 20-year contribution and 6,375 baht for a 30-year contribution.

If a fund member dies within 60 months after the old-age pension starts being paid, the spouse receives a lump-sum pension payment.

Old-age living allowance

All elderly Thai citizens are entitled to a progressive living allowance, with 600 baht paid monthly to those aged 60-69, 700 baht to those aged 70-79, 800 baht to those aged 80-89 and 1,000 baht to those aged 90 and older.

Provident fund

The volunteer fund matches contributions between employees and employers.

Provident fund members are required by law to contribute at least 2% but not exceeding 15% of their salary, while the employer’s contribution must be equal to the minimum level that employees are required to contribute or higher but not exceeding 15%.

The whole sum of benefit payouts is tax-exempt on the condition that the member retires at an age not less than 55 and continues being a member for not less than five years.

In cases where retirees wish to keep this part of their nest egg under professional management, they can switch the money to retirement mutual funds (RMFs).

Retirement nest egg

Mr Weerapon said a diversification strategy should also be applied to the retirement portfolio.

The portfolio should consist of three asset classes: equities, bonds and alternative investment.

Assets should be mixed not only across categories but also within each class to let retirees live comfortably regardless of the state of the economy and in the event that one revenue stream dries up.

For instance, not only government bonds but also corporate debentures should be included in the portfolio and their maturities should vary.

Home equity

Property accounts for the largest share of wealth for most people. Selling a property or renting a smaller house makes sense for retirees if property prices are high enough to generate investment income from a sale or in situations where other income sources are not sufficient.

Buying or renting a smaller home could appeal, as this can help cut maintenance costs and sometimes better matches the elderly lifestyle.

Apart from liquidating homes, taking out a reverse mortgage is an income-generating option. A reverse mortgage is a substantial source of income for retirees, enabling elderly homeowners to convert their home equity into cash with no loan repayments until the borrower dies and helping the elderly cover monthly living expenses and healthcare costs.

This type of mortgage sees lenders make monthly payments to the borrowers, who live in their homes until they die. Upon the borrower’s death, the heirs have the option to either pay off the loan and reclaim ownership of the home or let lenders put the home on the market.

Reverse mortgages are now available from two state-run banks, the Government Savings Bank (GSB) and GH Bank. Those who are eligible to apply for GSB’s reverse mortgages are Thais aged 60 to 80 who own a property that is out of debt.

According to the GSB, the loan amount, which includes principal, interest and other expenses such as fire insurance premiums and mortgage fees, must not exceed 10 million baht or 70% of the appraisal value for low-rise homes and no more than 60% for a condo unit.

The loan term for a reverse mortgage is capped at 25 years or the length of time until the borrower reaches 85. If there is also a co-borrower, the terms will be calculated based on the younger borrower’s age.

Annuity

An annuity provides a regular guaranteed income for a certain period after having retired.

As with any investment, taking out an annuity involves risks, such as if the insured party dies shortly after retirement and ends up having received a lot less in total payments than the premiums paid.

Employment

If a retiree lacks sufficient funds to cover living costs, he or she should consider working to generate income, Mr Weerapon said.

A full- or part-time job supplements retirement income, but retirees should not count on work as their main income source, he said, as their health can deteriorate at a faster pace in their later years.

Source: https://www.bangkokpost.com/business/finance/1642504/ensuring-a-comfortable-nest-egg

English

English