Thailand: Dispute bypass cut holder complaints by some 30%

The number of insurance complaints declined by about 30% in the first nine months of this year, after the Office of the Insurance Commission (OIC) allowed voluntary insurance policyholders with coverage of less than 2 million baht to receive claims without a dispute.

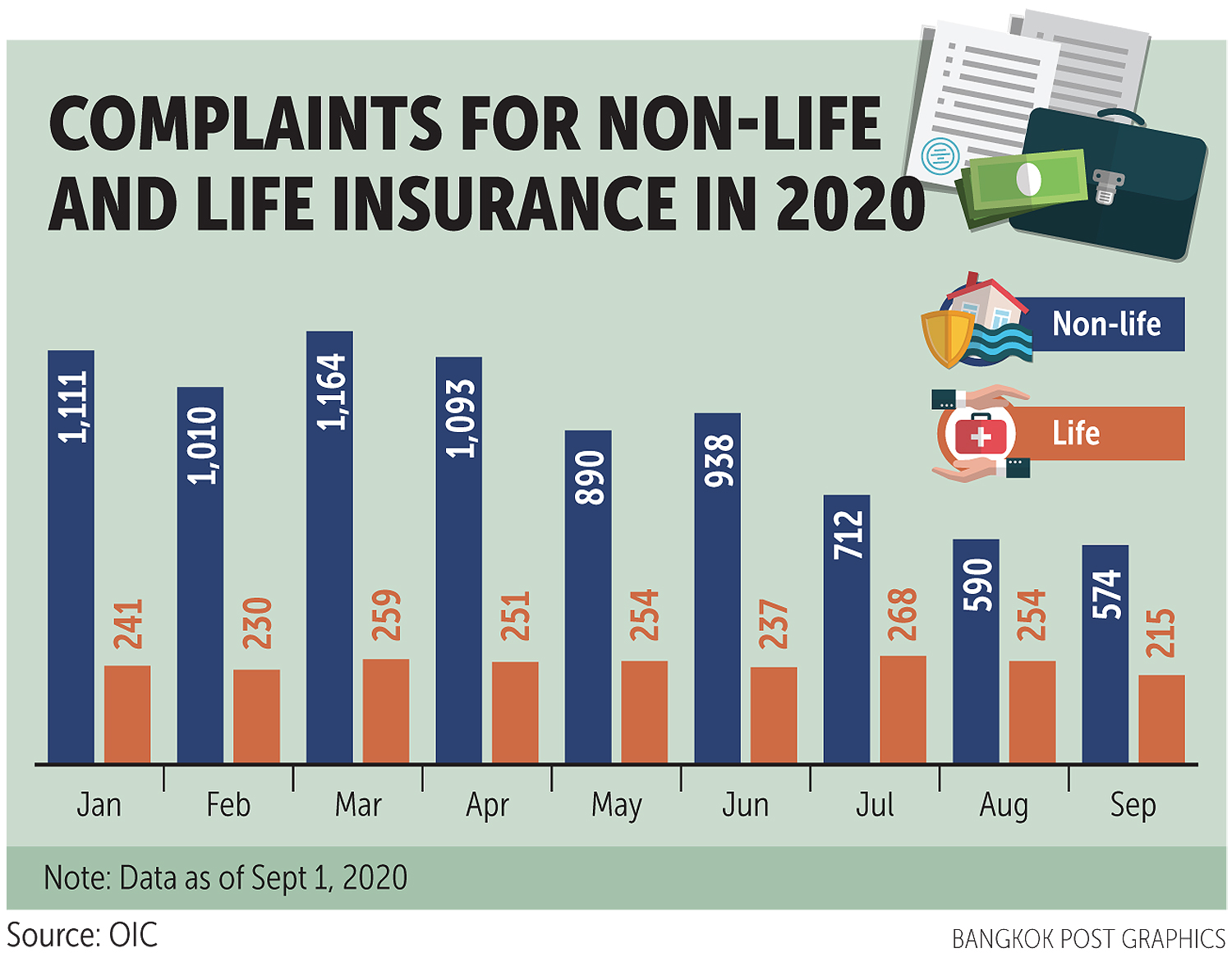

In the first nine months of 2020, there were 8,082 cases of non-life insurance complaints and 2,209 cases of life insurance complaints. Complaints occur when insurers and policyholders cannot find a solution over compensation for a claim.

“We found in most cases, the cause of complaints for non-life insurance policies is the cost to repair a vehicle after an accident, or the cost of a burial,” said Chaiyut Mungsri, assistant secretary-general for policyholder protection at the OIC.

The OIC issued guidelines this April for claim compensation that allow insurance holders of voluntary-based policies with coverage not exceeding 2 million baht to receive automatic compensation for a claim.

“Interestingly, non-life insurance customer complaints decreased by 30% with the majority of the decreases coming from auto insurance claims made since April,” he said.

However, the number of complaints from other insurance types remained about the same, as insurers do not deny payment as often within segments.

According to the OIC, the main causes of life insurance complaints are cases where the insurance company refuses to pay claims by cancelling the policy, or when insurers refuse to offer refunds to customers after they cancel their policies, and when insurers do not compensate customers by using a violation of the terms and conditions as an excuse.

He said these disputes can be avoided by training insurance agents to better explain policies to customers.

The OIC is in the process of linking these complaints to a nationwide database, and plans to develop a mobile application where insurance customers can monitor the progress of complaints.

OIC secretary-general Suthiphon Thaveechaiyagarn said the office is resolving a dispute over the price of auto repairs, an increasing source of complaints, by requiring repairs at garages that belong to the Central Garage Association and using pricing standards set by the OIC. The standard price will be set by the Thai General Insurance Association, the Central Insurance Garage Association and the Auto Repair Association of Thailand, under the approval of the registrar.

Source: https://www.bangkokpost.com/business/2001763/dispute-bypass-cut-holder-complaints-by-some-30-

English

English