Thailand – CBRE: Office rents shot up 3.1% in Q1

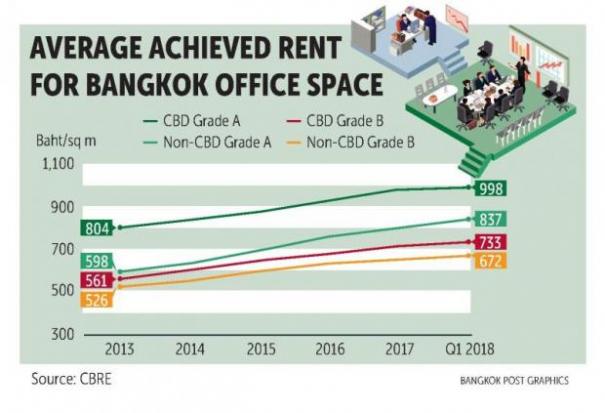

Grade A central business district (CBD) office rents rose by 3.1% year-on-year in the first quarter of 2018, a trend that is set to continue for the rest of the year, says property advisory CBRE Research.

The average rent for Grade A CBD buildings was just under 1,000 baht per square metre per month. A record high of 1,500 baht per sq m was achieved at Gaysorn Tower, according to CBRE’s latest Bangkok office report.

The total take-up was 65,000 sq m in the first quarter of 2018, up 15.1% year-on-year, led by the completion and owner occupation of the new Bank of Ayudhya Building (Krungsri Ploenchit Tower) on Phloenchit Road and Thai Rath’s new building on Vibhavadi Road.

The overall vacancy rate fell to 7.3% and is expected to remain at a low level for the next three to four years.

About 750,000 sq m of office space is under construction, including the first phases of One Bangkok and The Parq, both on Rama IV Road, with completion dates between now and the end of 2022.

CBRE Research forecasts that growth in demand will match new supply for the next three years.

The direction of the market from 2022 onward is harder to predict, according to CBRE.

Roughly 2 million sq m of new office space is being planned for sites that have been acquired by developers but where construction has yet to start. The question is how much space will be completed in each year after 2022.

Four co-working spaces will open at various Grade A CBD buildings in Bangkok this year.

“Globally, there is a trend for some companies choosing to acquire office space as a service from co-working space operators rather than commit to a lease and incur a capital expense in fitting out,” CBRE said.

“Co-working space is not just aimed at startups, and co-working space operators will be competing with landlords offering offices on traditional lease terms,” said Roongrat Veeraparkkaroon, director of advisory and transaction services at CBRE Thailand.

Despite this disruptive change in the office leasing market, CBRE Research forecasts that the net take-up in 2018 will be similar to that of 2017.

Some of the key office developments to be completed in 2018 are the 60,000-sq-m Singha Complex at Asok/Phetchaburi intersection; the 40,000-sq-m MS Siam at the Rama III/Industrial Ring Road intersection; the 22,000-sq-m T1 Building at Thong Lor skytrain station; the 6,000-sq-m Ladprao Hill at Lat Phrao MRT station; and the 5,000- sq-m Summer Hub at Phra Khanong skytrain station.

Source: https://www.bangkokpost.com/business/news/1476097/cbre-office-rents-shot-up-3-1-in-q1

English

English