Thailand: Cabinet approves 23-day shopping tax break

The cabinet has approved a personal income tax break for spending between Nov 11 and Dec 3 to stimulate the economy.

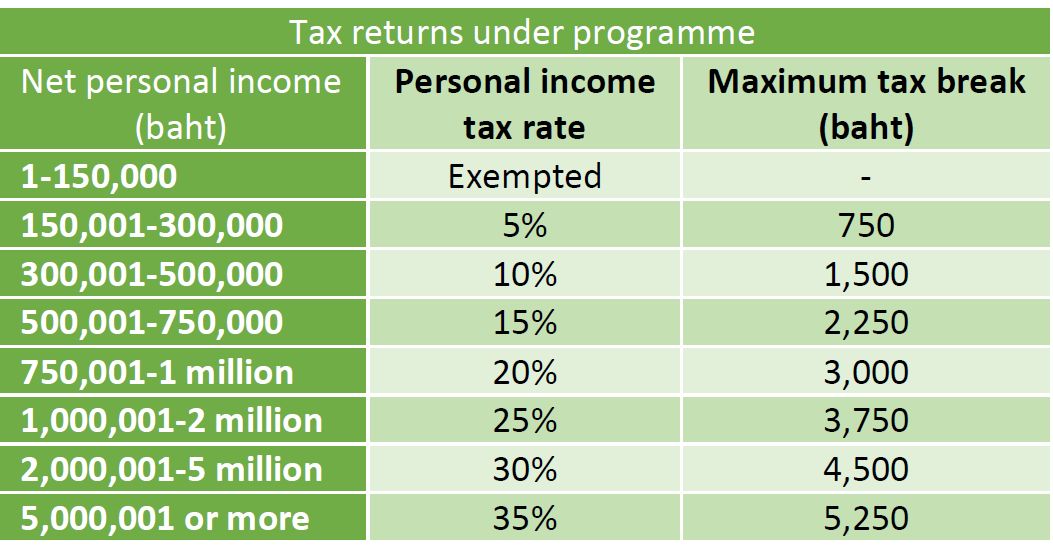

Shoppers can deduct expenses on goods and services during the 23-day period from taxable incomes but not more than 15,000 baht.

Eligible expenses do not include alcoholic beverages, wine, tobacco, automobiles, motorcycles, boats, fuels and gas for vehicles. Tourist guide fees and hotel room fees will also not be qualified, as they might come under another tax break campaign to promote tourism.

The expenses must come with full receipts — those with the names, addresses and ID numbers of the buyers.

Taxpayers who benefit from the campaign are those earning 150,001 baht or more a year — the minimum required to be taxed. They can apply the deductions to their 2017 personal income tax calculation to be filed in the first quarter of next year.

This is the third year of the campaign, which began in 2015 for seven days. In the following year, it lasted 18 days.

The government cited the need to stimulate the economy and maintain growth momentum. It also said the campaign would reduce people’s tax burden and bring more operators to register for value-added tax, which would help expand the tax base and bring in more revenue in the long term.

But some academics warned the economic benefits would be temporary and people would cut back spending later.

English

English