Thailand: BOT to consider suggestions from developers, banks for home loan policy

The Bank of Thailand (BOT) revealed that real estate developers and commercial banks had submitted ideas to help develop new criteria for home loans.

Participants emphasised the need to adjust the regulatory framework if they benefit the general image of the banks without significantly affecting the system. They hoped that customers will gain the most benefit from these proposals, the BOT’s executives said.

The BOT received suggestions and insights until October 22 from related parties with regard to measures to regulate home loans.

The BOT plans to consider the suggestions and announce measures by November, which will be effective from January 1, 2019 onwards, Sakkapop Panyanukul, director of financial stability unit at the BOT, said.

“We will consider it as soon as possible. We all know that this is a matter of urgency, as all involved parties need to be prepared for any changes in the measures which the BOT will introduce. I think that this will be beneficial to the overall system and will not significantly affect the lenders. After the recent hearing, we now have a better understanding of all the parties,” he said.

This is the first time the BOT was so open to receiving suggestions. “This is because we understand that this is a significant and delicate issue. We are not sure whether it will be finished by the end of this month,” he said.

Wajeetip Pongpech, assistant governor of the BOT’s Financial Institutions Policy Group, added that there were many questions and issues that may have been misunderstood, especially if the current situation were as serious as the 1997 Asian financial crisis.

She said the BOT would like to emphasise that the current situation was different and there were measures in place to prevent a crisis like 1997 from happening again.

The BOT has said the aim of this measure was to raise the credit standards of financial institutions that had fallen to some extent. The measure will also focus on establishing discipline among customers to have savings before going for a housing loan.

Wajeetip said the BOT would like to clarify some of the issues people may have misconceptions about.

First, the measure will only apply to cases where two house loan instalments are being repaid at the same time and will not affect cases where one house loan instalment has already been repaid and the second house loan is being taken out. In the latter case, it will be accounted as a first contract.

Second, the revision of this rule will not affect low-income buyers who are purchasing a home for the first time. The regulations apply only to residences that cost more than Bt10 million.

Finally, the measure will not affect those who have taken out a home loan before the new criteria come into effect. There will be no retroactive effect for the borrower.

According to the BOT announcement early this month, there are three main areas of home loan regulations that the central bank has disclosed previously. In cases where the home loan is taken out to purchase the first home, the down payment is at 5 to 10 per cent of total value, or no more than 90 to 95 per cent of the loan-to-value (LTV) ratio, but top-up loans must not exceed 100 per cent of the house price.

The remaining two areas are loans for a second home or second contract and houses costing Bt10 million or more. A down payment of 20 per cent and LTV ratio of less than 80 per cent is required.

Kobsak Duangdee, secretary of the Thai Bankers’ Association, said recently that the association is not the central organisation collecting all the information from private banks regarding the recommendation guidelines sent to the BOT. However, the association will consult the BOT to find out how to draft measures or discuss standardised home loan procedures for private banks. This will ensure that private banks comply with the BOT policy and achieve standardised home loans at the same time.

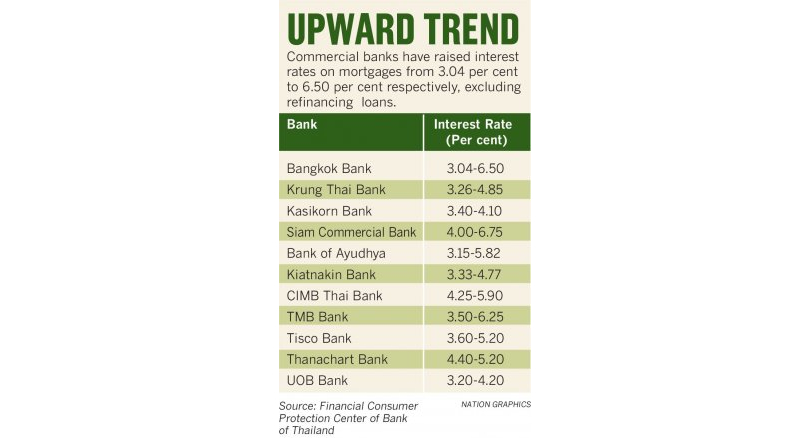

While commercial banks have gradually raised interest rates since the third quarter of this year, home-loan packages have also been revised, focusing more on floating interest rates as opposed to fixed interest rates to cope with increasing costs as a result of interest rates rising up to 6.5 per cent, according to the report by Financial Customer Protection Centre of the BOT. (see graphic)

Bank of Ayudhya’s executive vice president and head of mortgage loan division, Nathapol Luepromchai, said the bank had increased interest rates for mortgages by about 0.10 per cent due to the rising cost.

“We increased our interest rate for mortgage not because of the new BOT measure but because our cost was rising,” he said.

Source: http://www.nationmultimedia.com/detail/Economy/30357028

English

English