Thailand: 2% GDP growth an optimistic view

The economy will continue to struggle, owing to the downside shock from the coronavirus outbreak and potential delays to the disbursement of fiscal stimulus.

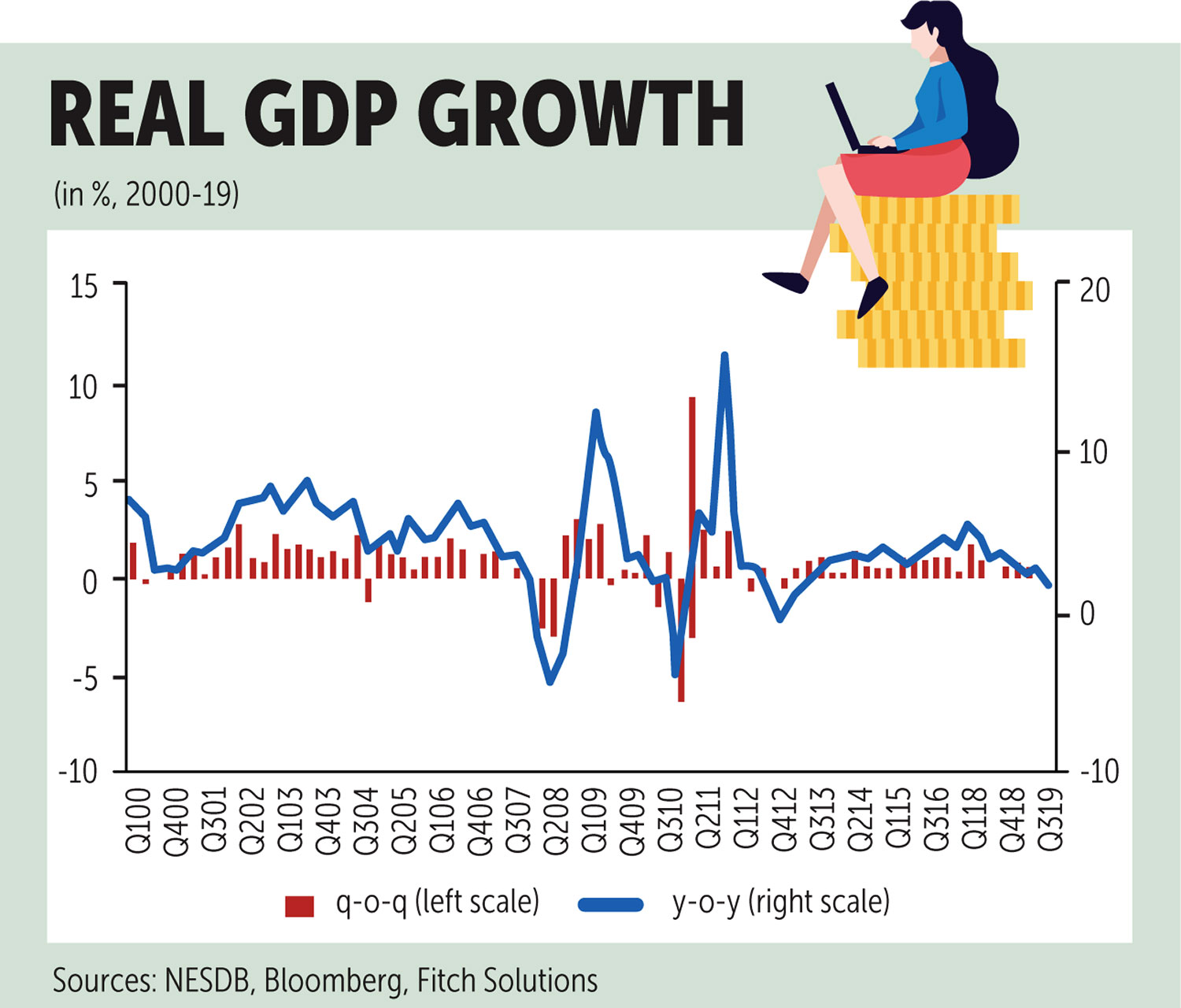

Growth of 2.4% in 2019 was already the slowest in five years, significantly lower than the 4.1% expansion in 2018. The National Economic and Social Development Council has lowered its 2020 forecast to a range of 1.5-2.5% from 2.7-3.7% earlier.

We view the Thai economy as one of the most vulnerable in Asia to the impact of the coronavirus, and our GDP growth forecast of 2% comes with risks to the downside.

In 2019, a weak external backdrop was compounded by a loss of export competitiveness due to the strength of the baht, while the delayed passage of the budget while the new government was formed proved a major drag on the economy.

The economy was also affected by drought conditions that hit the agricultural sector, which accounts for about 8% of output. This exposed the already weak fundamentals of highly indebted households and domestic firms choosing to invest abroad rather than domestically.

Thailand’s tourism industry is set to face significant challenges as a result of the coronavirus outbreak. Tourism receipts account for 13-14% of the economy, and the sector provides about one in six jobs. The Chinese government’s suspension of international group tours and restrictions on movement will severely affect tourist arrivals to Thailand, with other international tourists also potentially avoiding trips to or within the region.

Chinese tourists make up 27.6% of international tourists to Thailand and have been a key source of growth in recent years, as the baht’s strength and reduced interest from Europe have posed challenges.

We also expect softer export and household consumption growth, with downside risks to gross fixed capital formation (GFCF). Leading indicators were already pointing to a weak start to 2020; the manufacturing purchasing managers’ index fell into contraction in January, at 49.9, down from 50.1 previously. Business confidence fell to its lowest since June 2018, and businesses therefore used up existing inventory.

In addition, manufacturers continued to reduce employment, boding poorly for the household demand outlook. Weaker employment dynamics in the tourism sector will add to the deteriorating job market and compound the already steep decline in consumer confidence.

Moreover, the economy is being affected by a drought that is expected to continue in 2020 and hit rice production, which risks adding to higher food price inflation, weaker exports and household incomes.

Ultimately, the combination of contracting tourism receipts, reduced rice production and a slump in household confidence has prompted us to revise down our forecasts. We predict the contribution of exports (61.1% of GDP) to headline growth at 1.6 percentage points, down from 2 previously. Risks to our GFCF contribution forecast of 0.8 percentage points are tilted to the downside, given potential delays to tourism-related investment and China-backed projects.

Another headwind is the delayed passage of the 2020 budget, which finally cleared the House and Senate last week. The resulting delays in disbursement of key stimulus will ultimately mean even weaker activity in the first quarter, and we will watch closely to see whether disbursement is ramped up to compensate. It also highlights the potential for domestic political instability to add to economic woes.

We have stopped short of reducing our growth forecast any further, given that we still expect some fiscal stimulus, alongside continued monetary easing by the Bank of Thailand. We forecast another 25-basis-point rate cut in 2020, following the 25-basis-point cut this month.

The government has announced plans to introduce tax cuts and subsidies for the tourism sector and other areas of the economy affected by the coronavirus outbreak. It has already announced plans to extend the Taste-Shop-Spend programme, aimed at supporting domestic consumption and travel.

The effects of the Thailand Plus investment package introduced in September 2019 may also begin to feed through, with corporate income tax breaks on research, training/skills and capital investment, as well as grace periods for foreign direct investment.

In particular, a focus on kick-starting work on the delayed high-speed rail link, as part of the Eastern Economic Corridor initiative, could spur some construction and investment activity in the region.

Both the Bank of Thailand and government have taken a proactive approach to supporting growth, with combined efforts to ease the baht’s appreciation and help struggling households.

Moreover, we still expect global growth to stabilise in 2020 and forecast a rebound in the Chinese economy in the second half of 2020, which should prove supportive for Thailand’s industrial sector.

While financial markets have yet to display significant risk aversion despite the coronavirus outbreak, a more aggressive flight to safety could add to challenges in Asia and affect investment decisions and financing access, posing risks to the Thai economy.

Source: https://www.bangkokpost.com/business/1862414/2-gdp-growth-an-optimistic-view

English

English