Steel sector keeping tabs on Myanmar

Thai steel manufacturers have fresh concerns over the impact of the suspension of foreign loan payments in Myanmar on steel exports to Myanmar.

Myanmar’s central bank instructed companies and individual borrowers to suspend paying principal and interest to foreign lenders in a move to slow the country’s decreasing foreign exchange reserves.

Authorities ordered companies with up to 35% foreign ownership to convert foreign exchange into the kyat — Myanmar’s national currency — state media reported earlier last week, extending a rule aimed at relieving pressure on the unit by including more businesses.

Exports of steel and other products from Thailand to Myanmar are paid for in US dollars while payments for border trade are usually made in baht, said Pravit Horungruang, a committee member of the EAF Long Product Steel Producers Association.

Thailand is Myanmar’s second-largest trading partner after China.

Other than steel, Myanmar also imports building materials, food as well as consumer products from Thailand.

The kyat has continued to weaken against the US dollar. This has sparked concerns that it may affect Thai companies trading with Myanmar, according to the Federation of Thai Industries.

“We are closely monitoring the impact. Many Thai steel companies are also finding ways to deal with foreign currency exchange problems,” said Mr Pravit.

The association expects the suspension order to be in place temporarily as it believes Myanmar is also aware of the impact on its economy.

SET-listed Millcon Steel, a Thai steel manufacturer which is running steel manufacturing operations in Myanmar has yet to see impact of the order on its business, said Mr Pravit, who is also chief executive of Millcon.

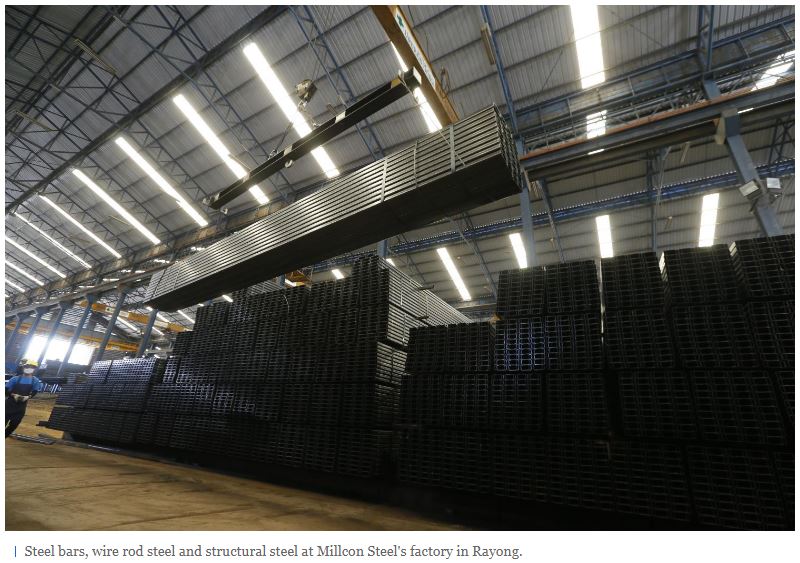

The company formed a joint venture “Millcon Thiha Co” under an investment worth US$12 million to produce structural steel to serve rising demand in Myanmar since 2016.

Millcon owns a 45% stake in the joint venture, while General Engineering Co holds 45% and 10% is held by the Thiha Group.

Most steel products from Millcon Thiha are sold domestically, with some exported to Cambodia, Laos and Vietnam.

Meanwhile, Scan Inter Plc (SCN), a Thai clean energy developer and trader, said its investment in a solar power project in Myanmar’s Minbu township will not be affected by the recent order issued by the government of Myanmar.

SCN is co-developing a solar power plant valued at 10 billion baht. It divided the development into four phases, with the aim of making its on-ground solar farm, with installed electricity generation capacity of 220 megawatts, the largest solar power facility in Southeast Asia.

The plant started operations, with a capacity of 50MW, under the first phase in September 2019.

“Our project does not depend on overseas loans,” said Littee Kitpipit, managing director of SCN.

“Electricity in Myanmar is also crucial to serve demand in the nation, so our company is facing no impact.”

Source: https://www.bangkokpost.com/business/2353321/steel-sector-keeping-tabs-on-myanmar

English

English