Some Malaysian companies to take a hit from currency drop

A SHARP decline in the British pound following the results of the UK election yesterday will impact a number of Malaysian companies that are in the property development, utility and casino operation sectors.

Yesterday, the UK election results delivered a hung parliament, where no party gained a clear majority. This would essentially mean that the markets will face another round of uncertainty, especially a delay in the Brexit negotiations.

The outcome saw the British pound tanking against major currencies. The currency fell 2.2% to 1.27 against the US dollar and weakened by some 1.86% against the ringgit yesterday.

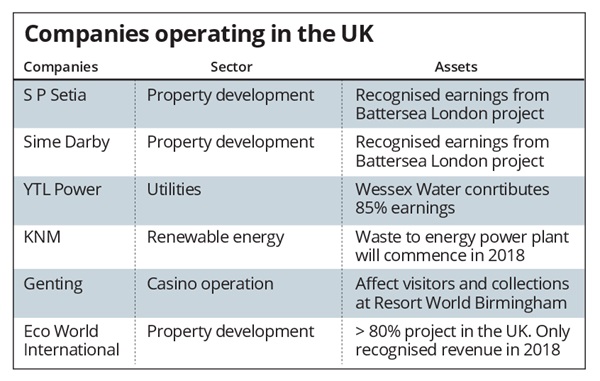

Companies such as Eco World International Bhd (EWI) and KNM Group Bhd are expected to see minimal impact on their earnings following another round of sharp declines in the British pound.

An analyst says that companies will only recognise their earnings in the UK operations next year.

More than 80% of EWI’s property development projects are in the UK with an estimated gross development value of RM13.6bil.

Meanwhile, KNM’s waste-to-energy plant in Peterborough in the UK is expected to commence operations next year.

In July 2016, following the UK referendum to leave the European Union (Brexit), KNM chief executive officer Lee Swee Eng said there was a positive outlook on the renewable energy sector in the country.

“The UK government is at the forefront of promoting renewable energy … we don’t think Brexit will cause the country to reverse its commitment and policy stance to promote green energy,” Lee said.

Shares in EWI closed unchanged yesterday at RM1.04, while KNM fell 1.8% to 27 sen.

In the meantime, a weak pound could hit companies such as S P Setia Bhd and Sime Darby Bhd, which are involved in a property development project in Battersea, London, as well as YTL Power International Bhd and Genting Malaysia Bhd.

Maybank Investment Bank Research (Maybank IB) analyst Wong Wei Sum says that both S P Setia and Sime Darby are expected to recognise earnings from their Battersea project this year.

She says that a 10% weakness in the British pound against the ringgit would impact the financial year 2017 net profit estimates for S P Setia and Sime Darby by -3.5% and -1.1% respectively.

In Maybank IB’s report in 2016 following Brexit, it said that Battersea’s combined take-up rate averaged 85%, with unbilled sales of £1.6bil (RM8.7bil) as at end-December 2015.

The total development cost incurred as at end-December 2015 was RM7.9bil, according to S P Setia’s annual report.

Meanwhile, on YTL Power and Genting Malaysia, Wong says that a 10% weakness in the pound/ringgit exchange rate would impact lower net profit estimates by 7% and 0.8%, respectively.

YTL Power bought the Wessex Water Services Ltd asset back in 2002. Wessex is a significant investment of YTL Power, contributing 85% to group earnings.

Meanwhile, Genting Malaysia’s UK operations contribute 16% to group turnover annually.

In the first quarter of 2017, the group’s UK business saw revenue declining 11.7% year-on-year due to the weaker pound/ringgit exchange rate, as well as a lower hold percentage in spite of a higher volume of business in its high-end markets.

Schroders Research expects sectors that are economically-sensitive such as general retailers to be vulnerable to a weakening pound.

“This is because foreign-exchange moves impact their profit margins and the real disposable income of their customers.

“Other domestic financial stocks such as banks, housing and real estate may also be weak,” says its European economist and strategist Azad Zangana in a note.

On the economy, he says households and corporates will be concerned by the increased political uncertainty.

“However, at the same time, the paralysis in Westminster will mean fewer changes to the fiscal and economic policy.

“Despite this, we expect a pullback in household spending and business investment, which will exacerbate the slowdown currently being experienced,” Zangana says.

Source: http://www.thestar.com.my/business/business-news/2017/06/10/some-msian-companies-to-take-a-hit-from-currency-drop/#zSlW08jb0RPPyehr.99

English

English