Singapore Tackling High Cost of Living Seen as Top Budget Goal

(Bloomberg) — Singapore’s budget on Tuesday is expected to emphasize a return to pre-pandemic fiscal conservatism, without undermining support to the most vulnerable from rising costs of rent, transport and food.

As the city-state stares down persistent inflation and a bleak global growth outlook, the government will likely prioritize measures to blunt the impact of rising prices on low-income groups, while phasing out Covid-era stimulus just as it did mask-wearing rules. The annual spending plan is also expected to return focus to longer-term investments including digital and green-energy transitions.

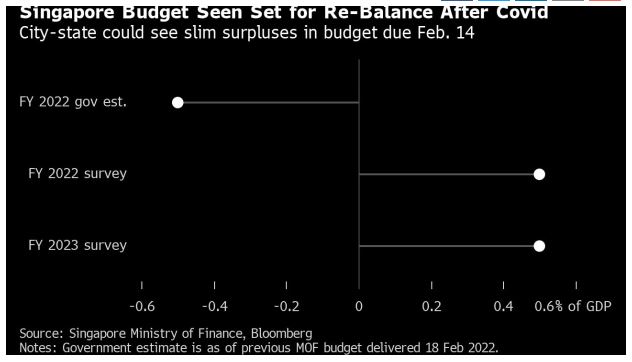

The need to strike that balance with enhanced spending in certain longer-term priority areas means economists are split on whether the government will plan a deficit for the fiscal year starting April. Seven analysts in a Bloomberg survey expect a surplus in the new fiscal period, five see a shortfall and one a balanced budget.

For the current fiscal year ending March, a greater majority projected a budget at better-than-even, with nine expecting a surplus, three estimating a deficit and one seeing it balanced.

Here’s a look at what might be in the budget speech to Parliament, to be delivered by Deputy Prime Minister and Finance Minister Lawrence Wong:

Inflation

A plurality of survey respondents identified “addressing the rising cost of living” as the single-most urgent economic need for the budget to address, alongside a list that included removing pandemic-era support and making the tax system more equitable. Low-income consumers were roundly perceived to be the biggest beneficiaries of the upcoming spending plan.

Although core inflation is hovering close to a 14-year high, two-thirds of those surveyed don’t see the need for an off-cycle move by Singapore’s central bank, which tightened policy five times since October 2021. The core gauge, which excludes private transport and accommodation, is closely watched by the Monetary Authority of Singapore that’s scheduled to announce its policy in April.

The survey showed Singapore is likely to see core price gains of about 4% this year — the midpoint of the 3.5%-4.5% range forecast by policymakers. Headline inflation is expected to come in at about 5% in the same period, a slight moderation from the 6.1% average for all of last year.

HSBC Holdings Plc. analysts led by economist Yun Liu see this budget including about S$1 billion-S$1.5 billion ($750 million-$1.13 billion) in support to households in the form of cash handouts, vouchers and rebates to help cushion against high price growth and the recent rise in the goods-and-services tax.

“This will mostly target the most vulnerable, with relatively limited broad-based support,” they said in a Feb. 7 report. “After all, Singapore does not want to stoke inflation.”

Taxes, Inequality

Singapore increased its goods-and-services tax at the start of this year, to 8% from 7%, while maintaining subsidies for those in the lower-income bracket. Survey respondents almost unanimously said that a further planned increase to 9% in 2024 is unlikely to be delayed, while one said it was likely to be pushed to the start of 2025.

Also in focus will be any changes to wealth and corporate taxes — especially if touted as a way to help pay for longer-term investments and trim the city-state’s inequality gap.

More taxes on the wealthy might be “hard to swallow” on top of higher property taxes, car duties and marginal personal income tax rates at the top brackets that are already being put in place, Selena Ling, head of Treasury research and strategy at Oversea-Chinese Banking Corp., said in a Feb. 6 report.

“Nevertheless, the question remains as to how policymakers can tap the rapid wealth growth more efficiently in Singapore due to its expanding financial and wealth hub status, without killing the golden goose, so to speak,” said Ling.

Digitization, Green

Singapore has in recent years — even, and particularly, during the pandemic — pushed businesses and consumers to go digital in their payments, records, and everyday life. The drive has often been paired with officials’ messaging on the green-economy transition.

Such dual goals, especially in a country that has long relied on the traditional energy sector for a crucial growth boost, are likely to manifest in more spending.

Among green-related incentives that could come up in the budget: allowing co-sharing of lending risk for loans made on green projects and offering more focused government consultation with small businesses struggling with sustainability goals, United Overseas Bank Ltd. analysts Suan Teck Kin and Alvin Liew said in a Jan. 31 report.

Source: https://www.bnnbloomberg.ca/singapore-tackling-high-cost-of-living-seen-as-top-budget-goal-1.1883337

English

English