Singapore: 70% of all e-commerce scams last year happened on Carousell – and it’s now rolling out even more measures to lower the fraud rate

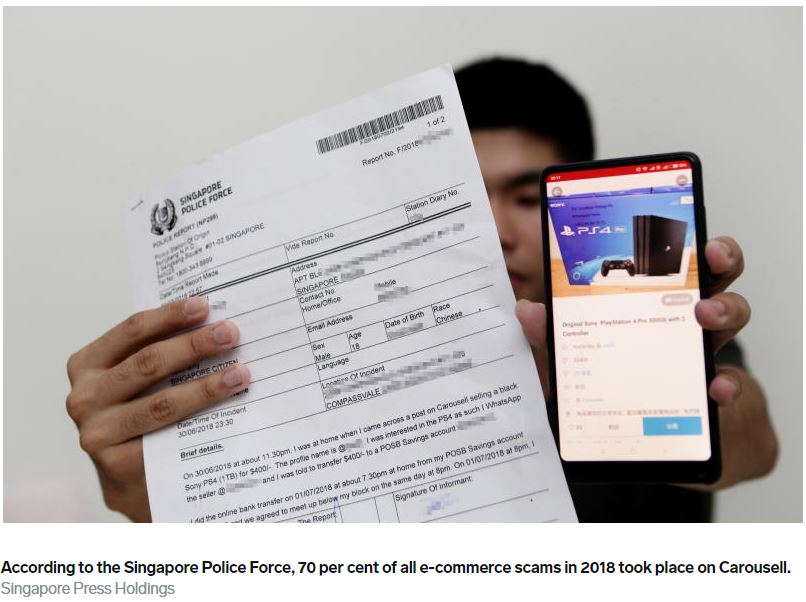

A large majority of scams committed in 2018 were e-commerce scams, and a whopping 70 per cent of those took place on Carousell, the Singapore Police Force said in its 2018 Annual Crime Brief on Wednesday (Feb 20).

SPF said that 2,125 cases of e-commerce scams were reported last year – an increase of 218 cases from 2017. This number is notably higher than that of other types of scams – second on the list is loan scams at 994, followed by internet love scams at 660.

SPF said that the common scams on Carousell involved electronic products and tickets to events and attractions – such as tickets for Universal Studios Singapore.

The high proportion of e-commerce scams was attributed to Carousell though it already has existing technology implemented on its platform to combat fraud – such as escrow service CarouPay, where the company temporarily holds funds and only releases them after an item is successfully delivered.

Carousell announced on Monday that “in the next few days”, two anti-fraud features will be launched – a digital fingerprint technology and a star rating system.

The new fingerprint technology will be implemented to tighten the account creation process, thereby warding off “bad actors” from returning, while the rating system will be used for customers to rate various aspects of the deal based on personal experiences, giving others a better idea of vendor behaviour.

Fraud rate declined over the past 12 months, says Carousell

Carousell also said in its statement that over the past 12 months, there was a 44 per cent decline in fraud rate on its platform.

According to Carousell, by the fourth quarter of 2018, only around three in every 10,000 transactions on Carousell were fraudulent.

It wrote: “This significant drop was achieved through improvements made to product and engineering, investment in human resources and a collaboration with the authorities to increase consumer education.”

In the last quarter of 2018, CarouPay Protection – a feature enhancement of CarouPay – was launched, allowing customers to freeze funds until a dispute is settled.

To combat fraud, the company has also employed artificial intelligence, partnered Sift – which uses artificial intelligence to detect fraud – and increased its investment in machine-learning by five-fold since last year.

Carousell also said that it has collaborated with SPF on seasonal scam advisories “to create greater awareness during peak periods of fraudulent behaviour”.

Source: https://www.businessinsider.sg/70-of-all-e-commerce-scams-last-year-happened-on-carousell-and-its-now-rolling-out-even-more-measures-to-lower-the-fraud-rate/

English

English