Philippines to settle on weaker growth trajectory post-pandemic — ING

MANILA, Philippines — “Shell-shocked” consumers and stalled investments will disappoint the Duterte administration’s expectations of a quick economic bounce-back from the pandemic, forcing it to settle to a lower growth trajectory by the time it caps its six-year term in 2022, an investment bank said.

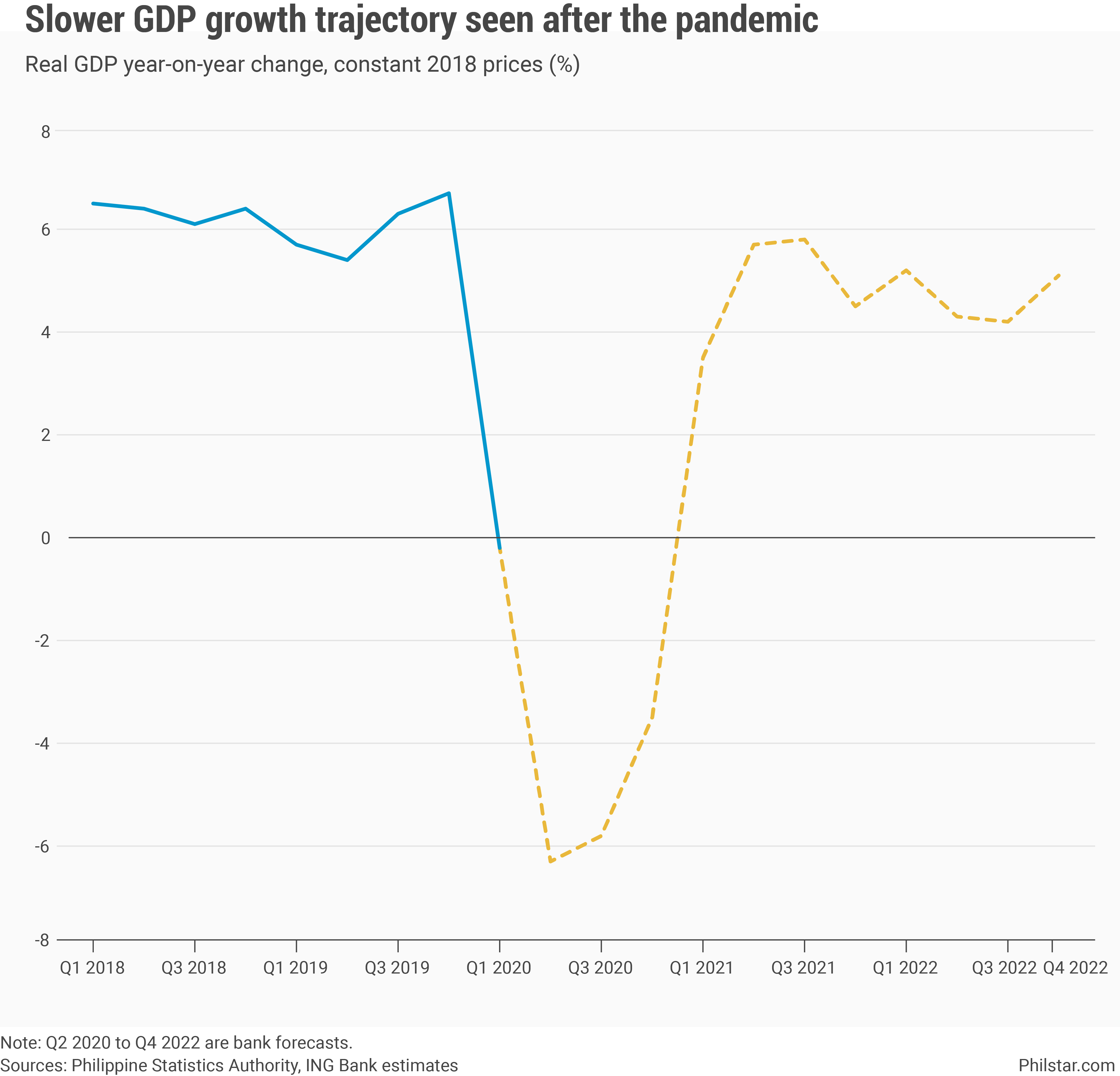

From an average of 6% economic growth before the pandemic struck, ING Bank N.V. sees the Philippine economy decelerating to 3.7% over the next two years, said Nicholas Antonio Mapa, the bank’s senior economist, in a note to clients.

The economy likely entered a recession as of end-June, following a 0.2% contraction in the first quarter.

“Previously, we had penciled in a gradual ‘U-shaped’ recovery with the economy returning to robust growth by the end of 2020, but with the continued rise in cases and a less than-substantial fiscal response, we now expect a protracted downturn with the economy not returning to pre-COVID-19 momentum in the near-term,” Mapa said.

If realized, an average of 3.7% gross domestic product (GDP) expansion would pale in comparison with an assumption of up to 9% growth next year, and 8% for the entire 2022. President Rodrigo Duterte caps his single, six-year term by June 30, 2022, which means his successor will take over the reins of a weaker economy.

By quarter, Mapa expects the economy to have contracted 6.3% in the second quarter, and to continue shrinking 5.8% this quarter and 3.5% in the final three months. By 2021, growth will speed up to 5.7% in the second quarter, before slowing down to 4.5% in fourth quarter. In 2022, GDP is not seen to grow beyond 5.1%.

A large part of the dismal projection, Mapa said, rests on a weaker household consumption “crippled” by a bleak job market where 7.4 million Filipinos were unemployed as of April and the unemployment rate at a staggering record of 17.7%.

While the number of jobless people are expected to taper off this month with the lockdowns lifted, Mapa said job losses will continue to mount, forcing consumers to cut back on spending and save more. The problem gets compounded if one considers the need for borrowers to pay up loans whose payments were merely delayed while the lockdowns were in effect.

Household consumption typically accounts for as much as 70% of GDP.

“Apart from the base-effect induced bounce expected in 2021, we don’t expect the economy to return to pre-pandemic growth anytime soon as household consumption remains weighed down by social distancing measures and anxiousness about a second wave,” Mapa said.

“In the absence of a vaccine and with COVID-19 daily infections still elevated, we can expect consumption of non-essential items and services to remain subdued, especially where social distancing is difficult to implement,” Mapa added.

Investments are also unlikely to gain traction and support growth. As the private sector is depended to take on added costs to facilitate recovery, corporations will be constrained to spend “given the economic environment.”

Proof of this is the “severely contracting” imports, suggesting lack of demand for capital and consumer products necessary for growth. Weak imports, in turn, strengthened the peso, which is more of a “symptom” of underlying economic weakness than strength.

“We don’t expect investment momentum to return anytime soon and a return to pre-pandemic investment expansion will only happen once the job market heals and consumption reverts to pre-COVID-19 levels,” Mapa said.

“The pandemic has severely impact household consumption. Shopping malls are empty, restaurants limited to partial capacity and vacations are on hold. More than 4.8 million Filipinos have lost their jobs since January and the job market will take some time to heal, clouding the economic recovery,” he said.

Source: https://www.philstar.com/business/2020/07/21/2029590/philippines-settle-weaker-growth-trajectory-post-pandemic-ing

English

English