Philippines: Rate adjustments needed to tame inflation, says BSP

MANILA, Philippines — Monetary authorities are ready to adjust policy stance as necessary after inflation blew past expectations to hit a fresh 14-year high of 8.7 percent in January, according to Bangko Sentral ng Pilipinas Governor Felipe Medalla.

“The BSP will continue to adjust our policy stance as necessary to keep further second-round effects at bay and prevent inflation expectations from becoming disanchored,” he said.

Medalla joined other economic managers at the Philippine Business Opportunities Forum in Tokyo as part of the state visit of President Marcos Jr. in Japan.

To drum up investors’ interest, the economic managers talked about further strengthening of strategic partnerships with the Japanese investing community.

“I’m thankful to have been given the chance to add to the interesting discussions, to express optimism on addressing inflation through the combined efforts of the BSP and the national government to mitigate the impact of supply-side constraints,” Medalla said.

The BSP chief earlier said he was not ruling out another supply shock as he said that the fresh 14-year high last month was most likely the peak for the consumer price index (CPI).

Medalla and Finance Secretary Benjamin Diokno earlier said inflation already peaked last December at 8.1 percent.

Inflation last month was above the BSP’s forecast range of 7.5 to 8.3 percent and the government’s average inflation target range of two to four percent for the year.

Similarly, core inflation, which excludes selected volatile food and energy items to depict underlying demand-side price pressures, increased to 7.4 percent in January from 6.9 percent in December.

On a month-on-month seasonally adjusted basis, inflation went up to one percent in January 2023 from 0.3 percent in the previous month.

According to the BSP, the higher inflation was traced to non-food items, particularly the increase in housing and utilities inflation with higher electricity generation charges and the implementation of the approved water rate rebasing during the month.

At the same time, the central bank said food inflation also increased particularly for vegetables and fruits due to agricultural damages from heavy rains during the month, while inflation for dairy products and eggs rose to double-digit rates.

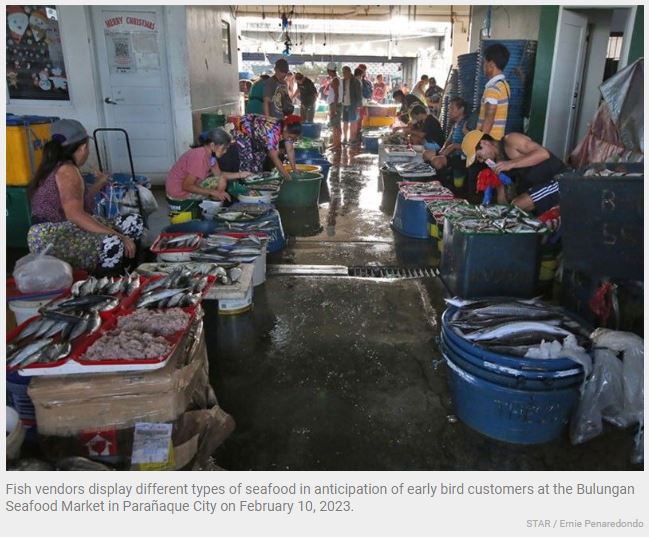

Fish inflation also accelerated as the implementation of the closed fishing season and cold weather conditions limited the supply of fish.

“The January 2023 inflation data points to the need for sustained efforts to combat price pressures, particularly non-monetary government measures to mitigate the impact of persistent supply-side constraints,” the central bank said.

Most economists see further upside in inflation in the coming months that would prompt the BSP‘s Monetary Board to deliver higher rate hikes starting this Thursday to anchor inflation expectations and safeguard the inflation target over the policy horizon.

To tame inflation and stabilize the peso, the central bank raised key policy rates by 350 basis points last year, bringing the benchmark interest rate to a 14-year high of 5.5 percent, from an all-time low of two percent.

Source: https://www.philstar.com/business/2023/02/12/2244268/rate-adjustments-needed-tame-inflation-says-bsp

English

English