Philippines: Marcos sharpens focus on tax management, economic growth to cut debt

MANILA, Philippines — President Ferdinand Marcos Jr. on Monday expressed his administration’s preference for better tax management and “spending efficiency” rather than imposing several new taxes to fix the government’s pandemic-battered balance sheet, a plan that could translate to a slow recovery in revenues and sluggish easing of public debt.

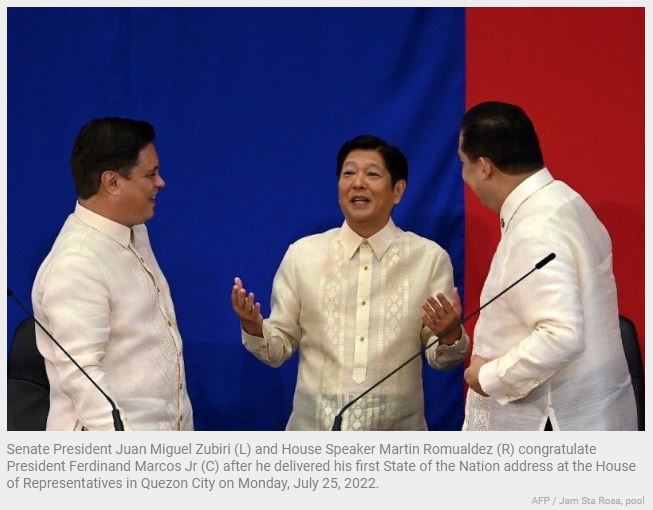

In his first State of the Nation Address, Marcos did not provide new details of his much-awaited fiscal strategy besides what had already been disclosed by his economic team earlier this month, which only included a plan to tax digital sales and single-use plastic. On his government’s plan to impose value-added tax on digital services, Marcos explained that the measure is estimated to generate P11.7 billion in revenues in 2023 alone.

Instead of collecting new taxes or raising existing ones, Marcos said his administration would just “simplify” tax payments procedures and “realign” spending priorities to “attain short-term macro-fiscal stability.”

To generate some savings, Marcos asked Congress to pass a legislation that would “rightsize” the bloated government bureaucracy, a move seen to free up some P14.8 billion per year. To instill “fiscal discipline”, he also pushed for a measure that would institutionalize a cash-based budgeting system, which the Duterte administration had adopted during its term.

At the same time, Marcos said he would pursue measures to “determine possible undervaluation and trade misinvoicing of imported goods” to ensure the government is collecting the right duties from inbound shipments.

“Our tax system will be adjusted in order to catch up with the rapid developments of the digital economy,” Marcos said.

Enough?

The decision to rely on spending controls and tighter tax management defied calls from several economists, and the previous Duterte administration itself, to impose new taxes to boost state revenues, which is expected to take a hit in the next three years due to additional personal income tax cuts under a Duterte-era tax reform law.

Finance Secretary Benjamin Diokno earlier argued that tax efforts are expected to improve between 0.3-0.4% every year with better tax management. However, some observers said this might not be enough to significantly improve the state’s fiscal health, considering the Marcos administration’s plan to sustain high spending on infrastructure.

Based on revised government targets, the budget deficit is not expected to shrink to 3% of GDP until the end of Marcos’ term in 2028. This means that during Marcos’ six-year term, the government would likely sustain its borrowing spree to plug the fiscal gap, resulting in a slow easing of liabilities. Public debt, as a share of the economy, is targeted to slightly decline to 60% by 2025 from the current level of 63.5%, which is already above manageable levels.

For Domini Velasquez, chief economist at China Banking Corp., while the SONA was comprehensive, particulars on how such programs will be funded are still thin.

“The President’s SONA was comprehensive in its plan, touching on almost all sectors, but we still think it is lacking in detail on how to finance this ambitious program,” Velasquez said in a message to Philstar.com.

“Reiteration of increasing tax revenues through digitalization and improvements in tax administration remains unconvincing,” she added.

Separately, Anthony Lawrence Borja, political science professor at De La Salle University, believes Marcos was likely saving his political capital by giving “broad” statements on his fiscal plan.

“His statements on spending efficiency and fiscal management are broad enough to provide some space for a possible tax hike. This suggests that he is still testing the waters, focusing instead on things that the government can spend on in line with acknowledged limitations, and opportunities emanating from public-private partnerships,” Borja said in an interview.

“Taxation is always bad publicity and the SONA is and will always be, publicity. That said, I think he chose not to quickly exhaust his political capital at this stage by deploying his jargon-based statements on fiscal management,” he added.

Source: https://www.philstar.com/business/2022/07/25/2197907/marcos-sharpens-focus-tax-management-economic-growth-cut-debt

English

English