Myanmar: Time for a second wave of reforms

Myanmar’s initial phase of economic liberalisation led to an impressive growth takeoff and poverty reduction. But now, a second wave of reforms is needed to continue the strong momentum, according to the latest International Monetary Fund (IMF) report for Myanmar.

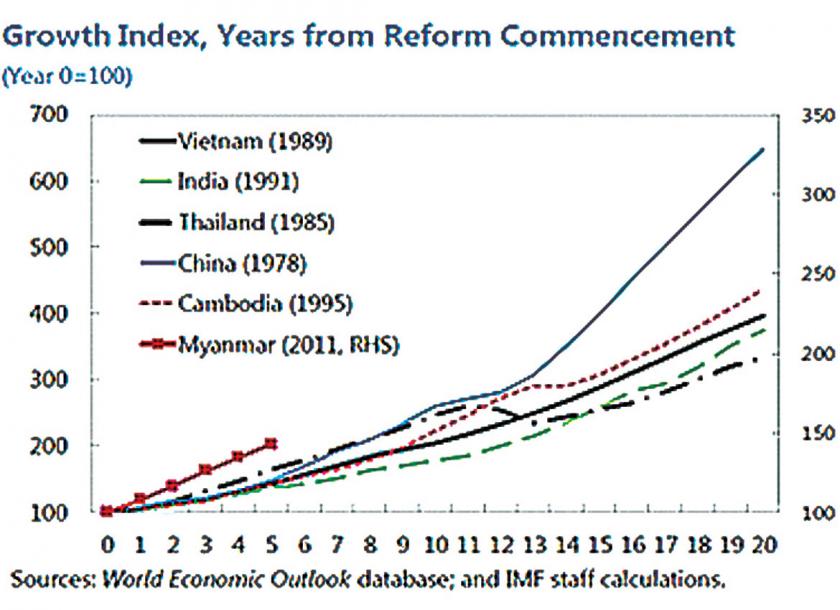

The IMF Article IV report released March 28 found that the growth take-off has been even stronger than in Myanmar’s fast-growing neighbours and was led by a surge in foreign direct investments (FDI), with investors attracted by Myanmar’s status as one of Asia’s last frontier markets.

The World Bank’s latest estimates show a sharp decline in the poverty rate, from 48.2 percent in 2004-05 to 42.4 pc in 2009-10 and 32.1 pc in 2015, although nearly 40 pc of the population remains under the near-poverty line. The rate of poverty reduction is comparable to early-liberalisation success stories in the region.

Rebounding economy

The global recovery has supported a rebound in exports and continued strong FDI inflows. The near-term growth trajectory is weaker than previously expected, due to the subdued pick up in domestic investment and uncertainties related to the Rakhine state crisis, particularly for tourism. However, growth is expected to rebound to 6.7 pc in 2017-18, mainly supported by a recovering agricultural sector, exports, and higher public spending.

Rice and garment exports are growing at above 40pc year over year in 2017-18 while natural gas exports are expected to get a boost as contracted prices reset with lag. In addition, Myanmar is poised to benefit from trade service flows associated with oil and gas pipelines from Southern Rakhine state to Kunming, China.

Progress in tax administration reforms are expected to support higher fiscal spending and economic growth. Dissipating lower food price effects are expected to cause inflation to increase temporarily before declining back to around 5pc in the medium term.

Medium-term outlook favorable

Over the medium term, growth is expected gradually to pick up towards the estimated potential rate of about 7-7.5pc, reflecting continued FDI inflows and higher public investment spending and efficiency.

In line with development needs, the current account balance is expected to remain in deficit, with the improvement in commodity prices and exports more than offset by growth in FDI and infrastructure related imports.

Risks to growth

The humanitarian crisis in Northern Rakhine state has created uncertainties regarding external development finance and investor sentiment. The highly targeted US sanctions are not expected to affect the broader economy, but any broadening of sanctions would add to downside risks.

While direct economic impact has been largely localised, the social costs and full impact of the crisis are yet unfolding. Peace and a favorable external environment would help Myanmar realize its strong growth potential.

Long-standing weaknesses in the banking sector have surfaced as banks adjust to new regulations, raising the risk of a sharp reversal of previously-strong credit growth. The upcoming change in the fiscal year, from October 1, will challenge limited public-sector capacity and may introduce greater risks on revenue and budget under execution.

Other risks stem from external sources, including commodity prices, potentially volatile global financial markets. Flood effects were relatively moderate in 2016-17, but natural disasters remain an ever-present risk.

Second wave of reforms

An overarching medium-term growth strategy and a second wave of reforms are needed to set economic direction, and support investment and job creation.

The Myanmar Sustainable Development Plan (MSDP) launched in February is commendable and could provide such a framework. While further work is needed to specify reform sequencing and integration with the medium term fiscal framework, the MSDP is a good first step towards setting reform direction, and building an inclusive development agenda.

Structural reforms should focus on priority areas with strong payoffs such as agriculture, infrastructure, financial sector and further opening up of the economy to foreign trade and investment, building on the new Companies Act and Investment Law.

The consolidation of macroeconomic stability is a precondition to reap the benefits of a second wave of reforms. Key macro policy recommendations could be summarised as follows:

• Fiscal policy needs to target achieving the Sustainable Development Goals (SDGs) by raising social and infrastructure spending, while remaining anchored on debt sustainability and lowering central bank financing of the deficit.

• Fiscal resources for achieving the SDGs and greater infrastructure can be increased through continued domestic revenue mobilization, expenditure rebalancing, and improvements in Public Financial Management.

• Concessionary external financing can expand fiscal resources, while reducing the historical reliance on monetary financing and bolstering foreign exchange reserves.

• New prudential regulations need to be implemented with a view to ensuring financial stability and deepening, while forming contingency plans to address systemic banking risks and strengthening the resolution framework.

• The central bank is called for formally adopting a new market-determined mechanism for setting the exchange rate, and continue to allow exchange rate flexibility to help cushion against exogenous shocks.

The IMF will continue to assist Myanmar in undertaking these and many other reforms. The Fund maintains a productive dialogue with the authorities on policy issues and has provided substantial technical assistance and training to Myanmar. The Fund is encouraged by Myanmar’s commitments to reforms and looks towards continued cooperation with the authorities.

Yasuhisa Ojima has been the IMF resident representative for Myanmar since September 1, 2015.

Source: https://www.mmtimes.com/news/myanmar-time-second-wave-reforms.html

English

English