Myanmar: Govt Extends Deadline for Taxes on Unassessed Income

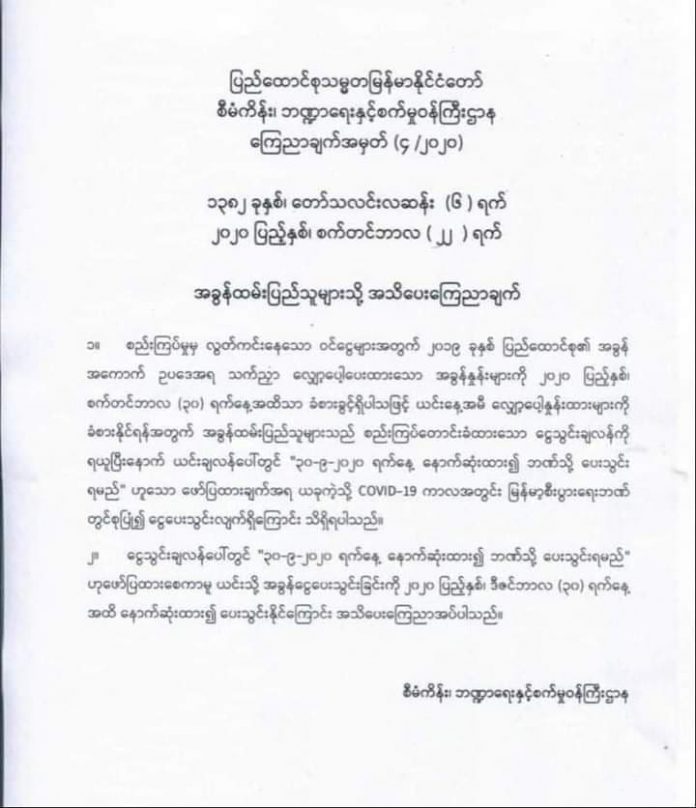

The Ministry of Planning and Finance issued an order on September 22 extending the deadline for tax payment on the unassessed income for the 2019-2020 fiscal year until December 30.

The previous deadline was September 30, which is the end of the 2019-2020 fiscal year. However, the Myanmar Economic Bank, which receives tax payment, was crowded with the taxpayers increasing the risk of being infected by the COVID-19.

The country, experiencing the second wave of the COVID-19, has put the stay-at-home order to curb the rapidly rising number of reported cases.

Under the 2019-2020 Union Tax Law, the government levy three percent for unassessed income up to K100 million, five percent for K100-300 million, 10 percent for K300-1,000 billion, 15 percent for K1-3 billion, and 30 percent for above K3 billion.

The taxation on unassessed income or undisclosed sources of income, under the 2020-2021 Union Tax Law passed in August, is six percent for K1-100 million, 10 percent for K101-300 million, 20 percent for K301-3,000 million, and 30 percent for more than K3 billion.

Written by Ko Myo

Source: https://mmbiztoday.com/govt-extends-deadline-for-taxes-on-unassessed-income/

English

English