Malaysia: Ringgit heads for a strong finish

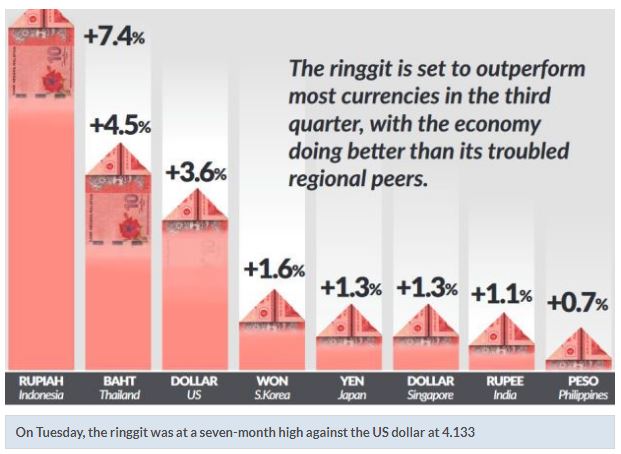

PETALING JAYA: The ringgit is heading for a strong close against most major currencies at the end of the third quarter, with the local economy showing resilience amidst the pandemic that is continuing to wreak havoc on many countries.

On Tuesday, the ringgit was at a seven-month high against the US dollar at 4.133

The ringgit’s quick recovery from its Covid-19 blues in March was boosted by the US dollar’s steep decline, which is being undermined by the Federal Reserve’s ultra-loose monetary policy.

The US Dollar Index, which measures the greenback’s performance against a basket of major currencies, has tumbled nearly 10 % from a recent peak in March.

“The weak dollar was due to expectations that the US economy is weakening, ” Alliance Bank’s chief economist Manokaran Mottain told StarBiz.

On the ringgit, he reckoned that the currency would test RM4.10 per dollar in the near term, due to Budget 2021, as well as further strengthening in crude palm oil (CPO) and Brent crude oil prices.

“The pressure points will be how the government is going to manage its fiscal deficits and the tabling of Budget 2021, which we expect will be an expansionary budget, ” Manokaran said.

The strength of the ringgit, he said, was also helped by the glove manufacturers that have been bringing money back into the country.

CPO prices have been on the uptrend and recently went above RM2,800 per tonne, while Brent crude oil is trading at above US$42 per barrel.

The ringgit’s strength would be a boon to importers, but it could be a negative for exporters who could see a decline in earnings.

Glove makers, electric and electronic (E&E) manufacturers as well as furniture players, all exporters, could be affected by a stronger ringgit.

Rakuten Trade Research vice-president Vincent Lau, however, expects that the impact would be minimal on exporters, especially the glove players who have been experiencing a historical high in their selling prices.

“Many E&E manufacturers have already hedged their position for the next six months and the glove players are seeing their orders and average selling prices for their products increasing sharply, ” he said.

The outlook for the ringgit is positive, Lau said.

“We expect the ringgit to strengthen further, especially if Brent crude oil continues to improve, but it’s not likely to dip below RM4 per dollar, ” he said.

Meanwhile, Bank Islam chief economist Mohd Afzanizam Abdul Rashid reckoned that the interest rate differentials between Malaysia and advanced economies have driven the ringgit higher.

“The overnight policy rate (OPR) is clearly higher than the benchmark rates in the advanced countries.

“So, from the carry trade point of view, the ringgit could rise. At the moment, the OPR stands at 1.75% while the US Federal Fund Rate remains at 0.25%.

“That’s a 150-basis-point difference between the OPR and the Fed Fund Rate, ” he said.

In addition, he said the country’s ability to contain the Covid-19 spread was a plus point as the economic recovery process can happen almost immediately, allowing for a sustained increase in the gross domestic product.

“However, the economic uncertainty remains elevated and therefore, the US dollar-ringgit rate is expected to remain volatile.

“We are still projecting that the ringgit could end the year at RM4.25. Events like a trade war between the US and China, the US presidential election, the UK Brexit and lower crude oil prices are likely to exert volatility in the foreign-exhange markets, ” Afzanizam said.

Asked if the ringgit could further strengthen from its current level, he said the ringgit against the US dollar was currently undervalued.

He pointed out that the average value of the ringgit per unit of US dollar stood at about RM3.62 since the currency peg was removed in July 2005.

Source: https://www.thestar.com.my/business/business-news/2020/09/17/ringgit-heads-for-a-strong-finish

English

English