Malaysia – RAM survey: Business confidence improving, but more can be done

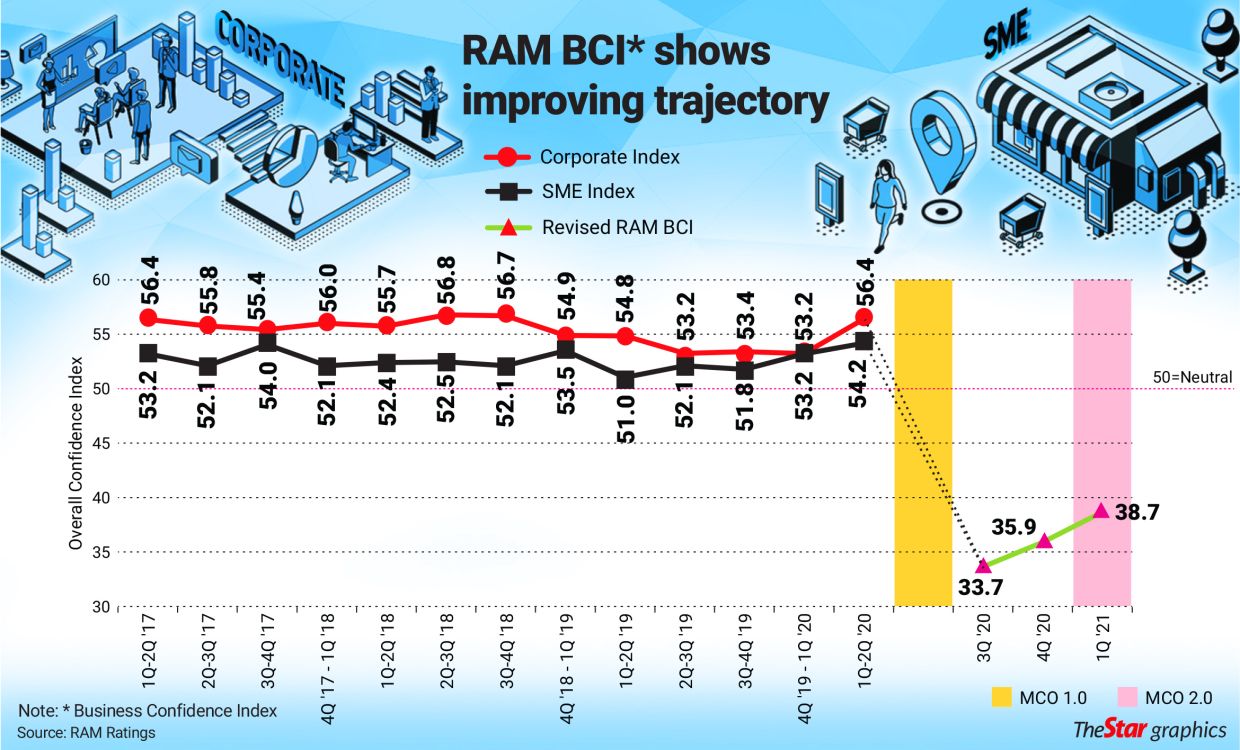

PETALING JAYA: The results of RAM’s Business Confidence Index (BCI) survey for the first quarter (Q1) of 2021, which was concluded in mid-March, reveal that businesses remain pessimistic through the next three months.

Having polled 229 firms across Malaysia, about 93% of which are small and medium enterprises (SMEs) and micro enterprises, the overall BCI reached 38.7.

This represented an improvement over the index readings of the preceding two quarters, but still significantly below the threshold of 50 – the delineation point for an “optimistic” interpretation.

For context, the Q1 survey was conducted shortly after the lifting of movement control order (MCO) 2.0 on March 5 in the key economic areas of Selangor, Penang, Johor and Kuala Lumpur.

About 83% of the firms polled cited weak economic conditions as their main concern, with around half of them expecting their revenue and profit to keep declining in the next quarter.

Notably, 58% of the firms pointed to a worse performance after MCO 2.0 relative to the earlier recovery MCO (RMCO) phase.

Given their bleak outlook, RAM Rating Services senior economist Woon Khai Jhek (pic below) told StarBiz it is not surprising that most of them are not ready to hire or expand their capacity.

Clearly, nationwide MCOs with blanket restrictions are detrimental to many SMEs, he noted.

This he said is especially true for the services sector that is most sensitive to social restrictions – an outcome also verified by the survey results.

While the MCO 2.0 was less restrictive than MCO 1.0 last year, the lack of clarity on standard operating procedures (SOPs) has hurt businesses. Close to 60% of those surveyed cited this as an impediment to their operations, which in turn affected business confidence.While lockdowns may help stem the tide of infections, Woon said policymakers should clearly communicate guidelines and SOPs to minimise unnecessary disruptions.

“The decision to lift MCO 2.0 in favour of looser restrictions under the CMCO/RMCO is welcomed by all businesses. We have polled respondents on what a hypothetical MCO extension would have meant to their businesses.“Almost 90% said they would be negatively affected by a further extension. Of these, 35% claimed they would not survive it. The inability to survive another MCO is even more pronounced among micro enterprises (42%). Of those that cited they could still hold out through another MCO extension, the average maximum period of survival only spans some four months.

“Response by firm size, meanwhile, indicates that the bigger they are, the longer they would be able to survive a lockdown in line with their cash reserves, ” Woon added.

RAM’s recent study of corporates in Malaysia indicated that the median entity had about 3.5 months’ cash reserves as at end-3Q 2020.

To gauge SMEs’ feedback on the various government stimulus packages, the rating agency had asked respondents how helpful these have been, specifically on the RM15bil Permai stimulus package unveiled in January 2021.While SMEs and enterprises expressed appreciation for the assistance, many (47%) in the survey did not qualify for such aid. This is partly attributable to the highly targeted nature of the Permai scheme.

Of the 53% that qualified, only 13% found Permai helpful, the rest did not, for reasons unknown to RAM.

From anecdotal evidence, some constraints may be attributed to the short duration of financial aid, the stringent criteria, the requirement for extensive documentation, and the arduous application process.

According to Woon, it is clear that apart from the hardest hit aviation, hospitality and tourism sectors, many firms in the non-manufacturing and services sectors still need some form of support to remain viable.

The overall RAM BCI index readings for business services and retail are relatively low at a respective 38.9 and 40.0, compared with 43.0 for the manufacturing sector.

It is therefore timely that the government launched the RM20bil Pemerkasa scheme on March 17.

A total of 83% of the firms surveyed indicated that they would welcome yet another round of stimulus.

It is also heartening to highlight that 12% of the surveyed firms try to manage on their own resources instead of over relying on government handouts. This hints at a strong survival instinct that bodes well for entrepreneurship.

Woon said: “Following from the insights gained from our latest survey, we urge the government to continue engaging SMEs and micro enterprises from the non-manufacturing and services sectors, to facilitate quick disbursement of the Pemerkasa stimulus and find ways to support and empower SMEs in sustaining their businesses.

He concluded that the country is still treading on fairly fragile ground despite the ongoing vaccination programme and nascent economic recovery.

Policymakers, he noted should keep engaging SMEs and micro enterprises across the services and non-manufacturing sectors to provide the necessary assistance as businesses rebuild and revitalise operations.

This would ensure that SMEs and micro enterprises – the backbone of Malaysia’s economy – remain vibrant and emerge stronger than before from the pandemic, he added.

Source: https://www.thestar.com.my/business/business-news/2021/04/05/ram-survey-business-confidence-improving-but-more-can-be-done

English

English