Malaysia: Price pressures to moderate further

PETALING JAYA: Economists are expecting headline inflation in Malaysia to continue moderating further in 2023, aligned with the softening trend of rising prices globally, following the tailing off in oil prices compared with 2022.

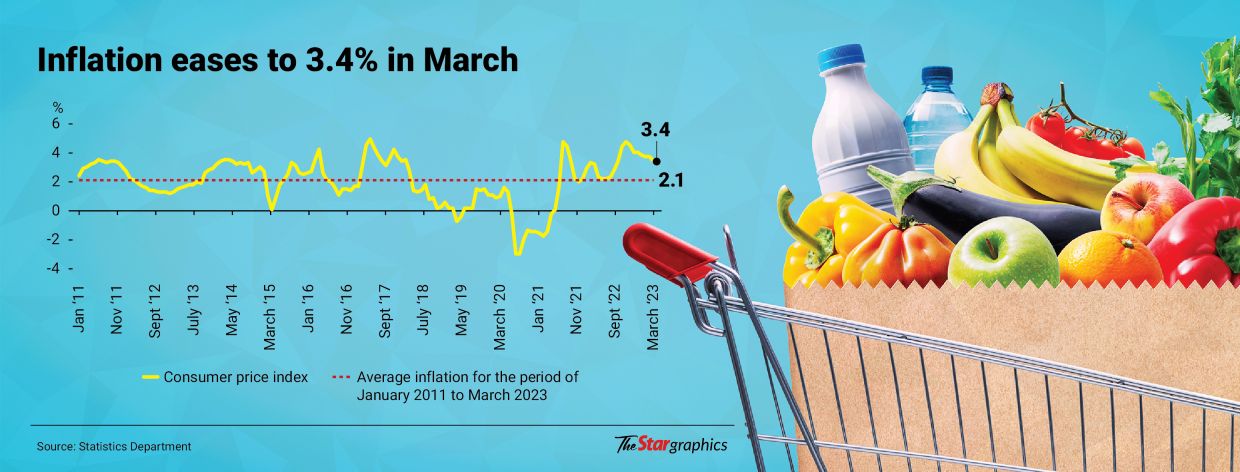

This is in light of the latest consumer price index (CPI) figures released by the Statistics Department yesterday, which showed inflation to be lower month-on-month (m-o-m) for March, having moderated to 3.4% from 3.7% posted in February.

However, inflation is still considerably higher on a year-on-year (y-o-y) basis if compared to the same corresponding month in 2022, when headline inflation was at 2.2%.

The CPI also showed the index point recorded for last month was at 129.9, against 125.6 in March 2022.

Reflecting on the latest inflation figures, Malaysia University of Science and Technology (MUST) economics professor and dean Geoffrey Williams said the weakening inflation trend is expected and will likely continue throughout the year, especially as the effects of lower oil prices begin to kick in.

He told StarBiz, “Oil price inflation will be negative for the rest of the year compared to last year because oil prices peaked in March 2022 and have been falling ever since. This effect will help inflation to moderate on an annual basis.”

While maintaining that price levels will remain high as there has not been much downward pressure, he opined that the rate of increase in prices will slow down to around 2.5% by the second half of this year.

Under the current circumstances, Williams suggested that the government allow the normalisation process to take its course, as inflation is moderating elsewhere globally and Malaysia will also experience likewise.

This was also evidenced by the fact that inflation in Europe has also moderated to 6.9% in March from 8.5% in February, while the United States also saw the rate of increase in prices drop from 6% in February to 5% in March.

Meanwhile, chairman of the Centre for Public Policy Studies at the Asian Strategy and Leadership Institute and economist Tan Sri Ramon Navaratnam believes that to combat inflation effectively over the long term, the country would need a more fundamental economic reform and restructuring.

This would involve increasing competition, as well as supporting the current government’s fight in battling corruption and monopolies, he added.

He also said short-term ad hoc measures that tinker with the financial system will not result in long-term success against inflation, and that major changes are necessary.

Statistics Department chief statistician Datuk Seri Mohd Uzir Mahidin attributed the slower increase in headline inflation for March to the decline in the price of the RON97 fuel, which significantly lowered transport inflation to 2.4% from February’s 3.7%.

He noted this was in tandem with the downward trend of the Brent crude oil price, which was hovering close to US$78.50 (RM348.34) per barrel last month as compared with the US$115.60 (RM512.98) range in the same period of last year.

Nevertheless, Mohd Uzir pointed out, “Inflation for food and non-alcoholic beverages (F&NAB), as well as for restaurants and hotels (R&H) remained high at 6.9% and 7.2%, respectively, even though they were lower than February’s level.”

Commenting on the stubbornly high prices of food products, Williams pinned the effect on the combination of supply-side problems, lack of competition and the passing on of costs from producers to consumers.

“This is especially true for food away from home and also grocery shops. This is the same pattern we have seen for many months with F&B, restaurants and transport pushing up the index while everything else is relatively flat.

“These three sectors are connected by their capacity to pass through the costs to consumers who are not switching spending quickly enough to cheaper options,” he said.

Concurring with the supply-side issue, Navaratnam said a large portion of Malaysian farmers are facing a lack of access to land, while having to deal with low incomes and a dearth of capital investments to technology.

The Statistics Department acknowledged the notable impact of the three sectors of F&NAB; transport; as well as R&H on the country’s inflation rate and cost of living, as they make up 47% of the total weight for CPI count, with the F&NAB segment leading the way at 29.5%.

Furthermore, inflation for F&NAB saw an increase of 6.9% in March, only fractionally lower than the 7% recorded for February.

Out of 230 items for food and beverage (F&B), 201 items – or 87.4% – recorded price increases as compared to March 2022, said Mohd Uzir.

As such, judging from the latest statistics, eating at home is still less costly than dining out at restaurants, but only marginally so.

The Statistics Department reported that inflation for the food at home component moderated to 5.6% in March as compared to February’s 5.8%.

However, prices of various types of meat, including chicken, beef, pork, lamb and duck, continued to see price increases at a rate of 9.2% in March against the 9% of the preceding month.

On a brighter note, most vegetables saw retreating prices month-on-month in March, with the department estimating they were less costly by 2.7% compared to February.

The Statistics Department said better weather conditions and improved local production were the reasons for the decline in most vegetable prices.

Of particular interest is that inflation for the lower-income group – RM3,000 monthly and below – had risen 3.6% y-o-y in March, primarily due to the hikes in the price of food items such as meat, milk and eggs, as well as the carbohydrate staple groups of rice, bread and other cereals.

MUST’s Williams pointed out that raising interest rates at present will not affect inflation for 24 months, and hence interest rate hikes are no longer the solution to inflation.

Echoing Navaratnam’s view, he said “The effect of previous hikes will begin to impact later this year.

“To help with the cost of living, the government should focus on incomes, not prices and should push harder on supply-side reforms, ending monopolies and promoting competition.”

Source: https://www.thestar.com.my/business/business-news/2023/04/21/price-pressures-to-moderate-further

English

English