Malaysia: No cash no problem

KUALA LUMPUR: More Malaysians are migrating to e-wallet cashless transactions but one big beneficiary in digital payments and becoming a cashless society is the stamping out of corruption.

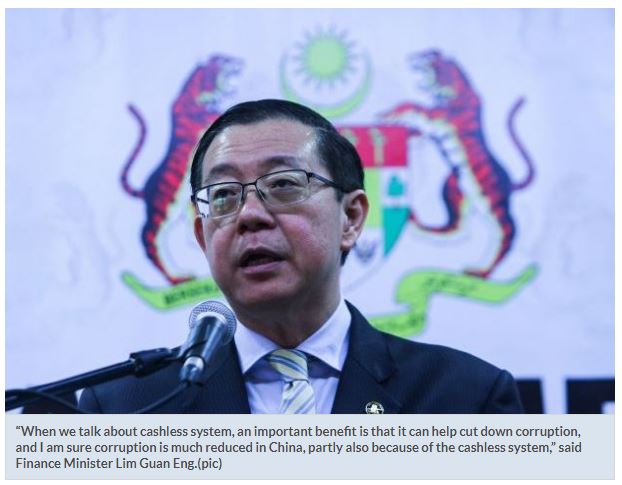

“When we talk about cashless system, an important benefit is that it can help cut down corruption, and I am sure corruption is much reduced in China, partly also because of the cashless system,” said Finance Minister Lim Guan Eng.

Bank Negara data indicated that cash circulating in the economy has dropped slightly to 7.4% of the gross domestic product (GDP) in 2018 compared with 7.7% and 7.9% of GDP in 2017 and 2016 respectively due to the wider application of mobile and online payment in the country.

By 2023, the number of mobile Internet users is expected to reach 21.8 million people in the country.

To become a largely cashless economy, Lim noted that the country needed to have 2% or below of cash in circulation based on the International Monetary Fund’s staff calculation.

Lim was speaking at the opening of the WeChat Pay technology exhibition here yesterday.

The reliance on cash is still high in Malaysia as about RM106bil worth of cash was circulating in the economy as of 2018.

In most societies, corruption is one of the biggest contributing factors to large income gaps and the problem of illicit payments was the lack of traceability.

“Cash has always been the preferred method of bribery since it leaves no paper trail to the person or organisation,” an analyst pointed out. He said the norm is that black money is laundered via the purchase of a business, real estate or expensive asset.

“When this happens, (black money being converted into another asset), corruption can go undetected. The real end to corruption is only when each transaction can be tracked,” said the analyst.

Malaysia has gone up one place to 61 out of 180 countries in Transparency International’s (TI) Corruption Perception Index 2018.

The country, however, maintained a score of 47 points in the corruption index like last year. In 2017, it ranked 62 out of 180 countries, scoring 47 points out of 100.

With the digital wallet, all incoming and outgoing funds, can be traced and thus reducing the risk of fraud.

Lim noted that the adoption rate of e-wallets is “still low” but tech companies are banking on Malaysia’s growth potential.

There are more than 40 e-wallet players in the country including Maybank Anytime Everyone e-wallet, Fave, Boost, AliPay, GrabPay, TouchNgo, and WeChat Pay Malaysia.

“The migration towards cashless has been enabled by the high penetration rate of financial services and widespread availability of Internet access,”

Citing a report by Nielsen in January, Lim said 67% of consumers surveyed in the country have used e-payments adding that debit cards and online banking were the most preferred non-cash channels.

Bank Negara has a target of an average of 200 e-payment transactions per person by 2020 from 44 currently and reducing cheques by more than half to 100 million per year from 207 million.

Among the measures to achieve this aim are providing the right price signals to encourage the switch from paper-based payments to e-payments, and facilitating wider outreach of e-payments infrastructure such as point-of-sale terminals and mobile phone banking.

The move into a cashless society began with reforms made by Bank Negara on Jan 15, 2015. The overhaul of the payment industry was estimated to affect a revenue of RM5.1bil, which is the estimated amount that banks would earn from the provision of credit and debit cards based from 2015 to 2020.

The reforms are expected to result in cost savings for the financial institutions which be channelled into developing infrastructure for the reforms in the payment system.

People from Germany, Australia, New Zealand and the UK conduct a substantial part of their transactions via cards.

A spokesperson for GHL Systems Bhd said the usage of e-payments would lead to the reduction of cash-handling, and ensure that transactions are delivered through secure, transparent and convenient digital channels.

WeChat Pay Malaysia chief executive officer Jason Siew believed that its cutting edge from other mobile payment solutions is the non-payment features it offers. It plans to add two more features this year.

“Payment is just a piece of a puzzle. Another new service that will be available in mamak restaurants around Klang Valley is the online food ordering this year,” he added.

For WeChat, Malaysia is the first market outside of China where it has recently expanded its payment services.

Moving forward, the company plans to introduce a service which uses a camera to detect a vehicle number plate number to activate a petrol pump.

Source: https://www.thestar.com.my/business/business-news/2019/03/27/no-cash-no-problem/#tCDhHBpfRbxpiMO2.99

English

English