Malaysia: New normal has limited impact on property

PETALING JAYA: The “new normal, ” brought upon by the Covid-19 pandemic, has had minimal effects on property-buying sentiment, according to a survey by CGS-CIMB.

Citing the survey, the research house said 41% of respondents had unchanged interest in property investment following the Covid-19 outbreak. It added that 39% had decreased interest, while 20% had increased interest.

“By buyer profile, we found that post-Covid19, property-buying interest decreased for a majority of property upgraders, remained unchanged for a majority of first-time buyers, and increased interest for property investors.

“The ‘new normal’ work practice, such as work-from-home and more flexible hours arrangements, has a limited effect on property buying sentiments.

“From our survey, we gathered that 56% of respondents are property investors, 24% are property upgraders and 20% are first-time homebuyers.

Prior to the Covid-19 outbreak, CGS-CIMB said only 44% of respondents had plans to purchase a property in 2020.

“They are mainly from the 30-to-39 years old age group; those with a gross monthly income of RM5,000 to RM9,999; and first-time home buyers.

“A majority of those who were not planning to buy a house in 2020 are in the 21-to-29 years old and above 50 years old age groups; those with a monthly gross income bracket of below RM5,000 and above RM20,000; and property investors.”

Meanwhile, of the respondents who had planned to buy a house in 2020, only 35.5% (who are mainly first-time buyers) are still planning to get a property in 2020 post the movement control order (MCO).

“This showed that the underlying real demand for property post-MCO is mainly coming from first-time homebuyers.

“Meanwhile, 32.7% of those who had planned to purchase a property in 2020 are postponing their purchases to 2021, and 31.8% (mainly property investors) have changed their minds about buying a house.”

In spite of continued buying interest, CGS-CIMB said property prices still remain unaffordable. “Most respondents view the current property prices as unaffordable, with a majority having a property-purchase budget of RM250,000 to RM499,999.

“This finding is in line with Bank Negara’s view that Malaysia house prices remain seriously unaffordable, despite the lower average transacted house price in 2019 (-2.5% year-on-year for the median residential housing price), as reported in the central bank’s Financial Stability Review for the second half of 2019.”

For the first half of 2020, CGS-CIMB said residential properties transaction volume, properties priced below RM500,000, made up around 84% of the total transaction volume. “We believe that the more affordable properties (below RM500,000) will likely be in demand and we have observed that most developers are rolling out cheaper units to entice buyers.”

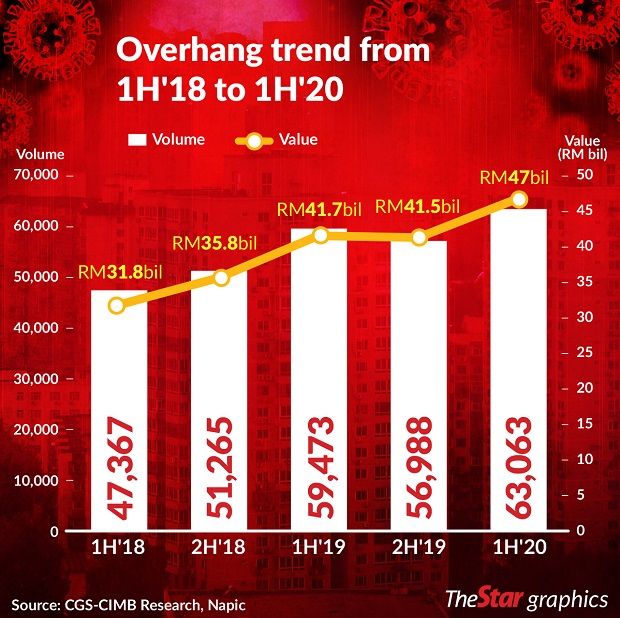

Additionally, CGS-CIMB noted that property overhang levels are on the rise.

“According to the National Property Information Centre, the total property overhang saw an improvement in 2019 with a 8% year-on-year decrease, which could be mainly driven by the Home Ownership Campaign 2019 and fewer new launches by developers.

“Nonetheless, the first half 2020 total completed unsold property (by units) increased 10.7% compared with the second half of 2019 due to the Covid-19 outbreak and disruptions from the MCO.”

Source: https://www.thestar.com.my/business/business-news/2020/11/06/new-normal-has-limited-impact-on-property

English

English