Malaysia: Increasing tax income crucial in revised Budget 2023

PETALING JAYA: While pre-Budget news reports have been on managing federal government spending, growing revenue should be a priority in the revised Budget 2023.

Government revenue is expected to dip to 15% of gross domestic product (GDP) in 2023, after temporarily increasing in 2022 to 16.7% of GDP, as crude oil prices moderate to the US$80 (RM350) a barrel levels.

The World Bank has noted Putrajaya’s current narrow fiscal space is due to structural expenditure remaining high, thus growing revenue should be a key issue more so as the country continues to under collect personal and consumption taxes in comparison to its peers.

The government’s fiscal consolidation projects government revenue to decline from 15% of GDP in 2023 to an average of 14.7% in the medium-term. Economists believe tax measures are an option to consider for the revised budget.

“The government can still lift its revenues from alternative sources, such as the expiry of Covid-19-era tax exemptions, a tax on sustainability, greater tax compliance, as well as addressing leakages in procurement processes. “The government’s drive to further raise revenues may still mean that ‘surprise’ taxes are possible. We could see a return of the prosperity tax in some form or another as the new administration is not tied to the previous government’s promises,” CGS-CIMB Research’s economist Nazmi Idrus warned in a report yesterday.

The research house added that wealth-related taxes, such as inheritance tax, tax on dividends, or capital gains tax are other options. An economist contacted stated some measures Putrajaya can look into is to enhance tax administration efficiency and minimise tax evasion and avoidance as well as simplify tax rules and procedures to reduce the size of the informal sector and enlarging the tax base.

“Another option on the table is to continue the ‘prosperity tax’ for sectors experiencing exponential profits as is raising individual tax rates above a certain threshold so that the super rich pay higher taxes,” he said.

The World Bank meanwhile noted consideration should be given to streamlining reliefs and broadening the tax base of personal income tax and by enhancing the consumption tax framework.

The initial Budget 2023 announced last October had proposed an expansionary fiscal bias with a total allocation of RM373.3bil (RM385.3bil in 2022) which accounted for 20.5% of GDP.

The allocation for operational expenditure (OE) was 73.1% of the total or RM272.3bil, and RM95bil (RM71.8bil) or 25.5% for development expenditure (DE).

The lower OE year-on-year (y-o-y) under Budget 2023 is premised on reduced allocation for subsidies and social assistance, projected to total RM42bil, with the gradual implementation of targeted subsidy mechanism.

Subsidies and social assistance amounted to RM80bil in 2022 with 45% of the amount spent on fuel subsidies.

For the revised budget that will be tabled in Parliament on Feb 24, CGS-CIMB is projecting OE to in fact grow by 1.7% y-o-y due to natural adjustments to emoluments and pensions while the rise in inflation and the erosion of consumer spending power may force the government to implement larger support measures despite estimated possible budget savings of RM5bil if the targeted fuel subsidy is fully implemented.

The Finance Ministry’s Fiscal Outlook report 2023 forecast pension liabilities will expand going forward as the country becomes an ageing nation.

With elections due in six states and just some seven months away from Budget 2024, CGS-CIMB Research noted the short length of time may entice the current government to hold back any controversial or unpopular measures, possibly resulting in a ‘mild’ budget for the year instead.

Centre for Market Education CEO Carmelo Ferlito believes there is no need for an expansionary budget, which can further misdirect allocation of resources, thus creating temporary and unstable employment and inflation pressures.

“Instead, we need bold measures (much beyond the scope of the budget) to rebuild a pro-investment ecosystem. I am actually in favour of a tax reform which reduces income tax and reintroduce the goods and services tax (GST). Furthermore, enforcement should be strengthen and special schemes for small and microbusinesses should be introduced” he said.

Ferlito added the budget is a limited tool, mostly regarding resources allocation and with a certain fiscal space while the actual reforms the Malaysian economy needs go beyond the budget and should be the subject of a broad discussion in Parliament.

He suggested measures such as liberalisation of the labour market, reducing red-tape for foreign investors and improving banking regulation to provide a boost to the economy.

A higher revenue level would also provide more buffer to the federal government to deal with the RM1.5 trillion debt and off-budget liabilities.

Some RM46.1bil of the OE in the October budget was allocated for debt service charges (DSC) in tandem with higher financing needs for DE and the Covid-19 Fund.

About 98.4% of the money was for coupon payments on domestic debt and the remaining on offshore loans.

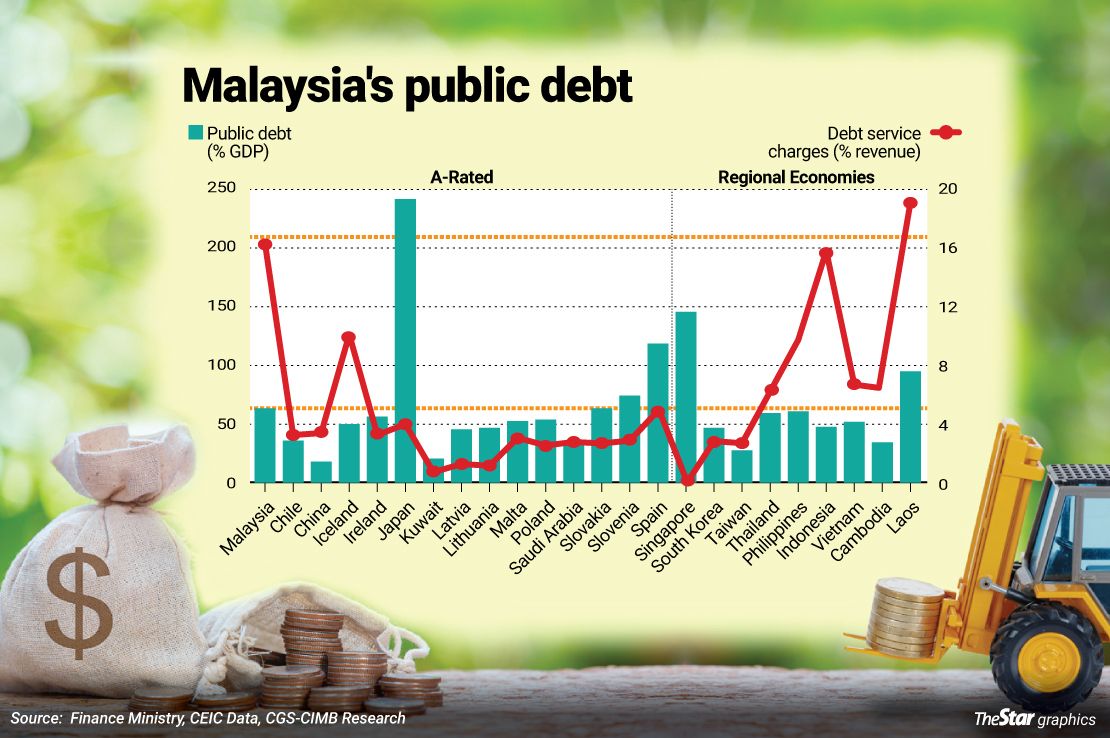

The DSC ratio to revenue is estimated at 16.9%, slightly above the 15% threshold in accordance with international best practices. CGS-CIMB Research believes DSC are likely to fall to 16.5% this year and remain above the Ministry of Finance’s internal guideline of 15% of revenue in 2023. Ferlito thinks it will be difficult for the DSC to go down with interest rates on the rise.

While tax matters are an option for the government to raise revenue, CGS-CIMB Research base-case scenario for the revised budget predicts no new major taxes, but ‘surprise’ taxes are possible.

“The government could look at various ways to lift revenues, such as in the areas of sustainability. Other possible new taxes could be wealth related. Malaysia still has not imposed any taxes on capital gains from investments in shares, nor it has any taxes on dividends. Similarly, transfer of inheritance is not taxable. These taxes may address the issues of inequality and the redistribution of wealth, consistent with the current government’s political agenda,” it stated.

The research house however warned these measures may have negative consequences, such as crowding out effect in the local stock market as investors pull out, or erosion in investments as more private sector funds are shifted to public sector spending.

Source: https://www.thestar.com.my/business/business-news/2023/02/17/increasing-tax-income-crucial-in-revised-budget-2023

English

English