Malaysia: In for another great quarterly GDP

PETALING JAYA: Malaysia is expected to announce another smashing economic growth rate for the third quarter of 2022 (3Q22) amid very strong economic data and early signs of growth weakness ahead.

Initial expectations was for domestic growth to hit a soft patch in the second half of the year, but 3Q22 looks set remain strong boosted by trade figures hitting the highest value in September and the Industrial Production Index for August growing at the fastest pace in 15 months.

This comes despite the sharp rise in interest rates by major developed central banks to control inflation and engineer a soft landing appear to be making slow gains as consumption has held up with demand for Malaysian exports remaining strong especially into Asean and greater China.

Some economists, however, think the slowdown in gross domestic product (GDP) growth would be “delayed” and instead, kick in from 4Q22 onwards.

Speaking with StarBiz, Bank Islam Malaysia Bhd chief economist Firdaos Rosli said that 3Q22 will “for sure” see the strongest GDP growth this year. In 2Q22 and 1Q22, the GDP had expanded year-on-year (y-o-y) by 8.9% and 5% respectively.

“We project 3Q22 growth will come in at 10.7% y-o-y, whereas the subsequent 4Q22’s performance will likely linger around 2.1% primarily due to the dissipating base effects while the unemployment rate remains flat, thus limiting private consumption growth.

“Our updated 2022 projection falls at the low end of the government’s revised estimate at 6.5%,” he said.

Firdaos’ comment follows AmBank Research’s recent report highlighting preliminary projection of 9.5% to 10.2% growth in 3Q22.

“The latest Purchasing Managers’ Index (PMI) data plus the strong exports data are still indicative of growth in the third quarter of the year,” the research house said in a note.

Nevertheless, AmBank Bank also noted that the PMI data for September suggested the loss of momentum in customer demand.

“This resulted in a moderation in new orders in September, ending a five-month sequence of expansion,” it said in a note.

The PMI fell to 49.1 in September, as compared to 50.3 in August. It turned out to be, thus far, the lowest reading in 2022.

“And there were further signs that the rebound in growth in Malaysia’s economy seen earlier in the year could be losing steam as challenging conditions across the global manufacturing sector limit demand and production at Malaysian firms as well,” stated AmBank Research.

Amid the external headwinds, MIDF Research opined that there would be a stronger external trade contribution to Malaysia’s GDP growth in 3Q22.

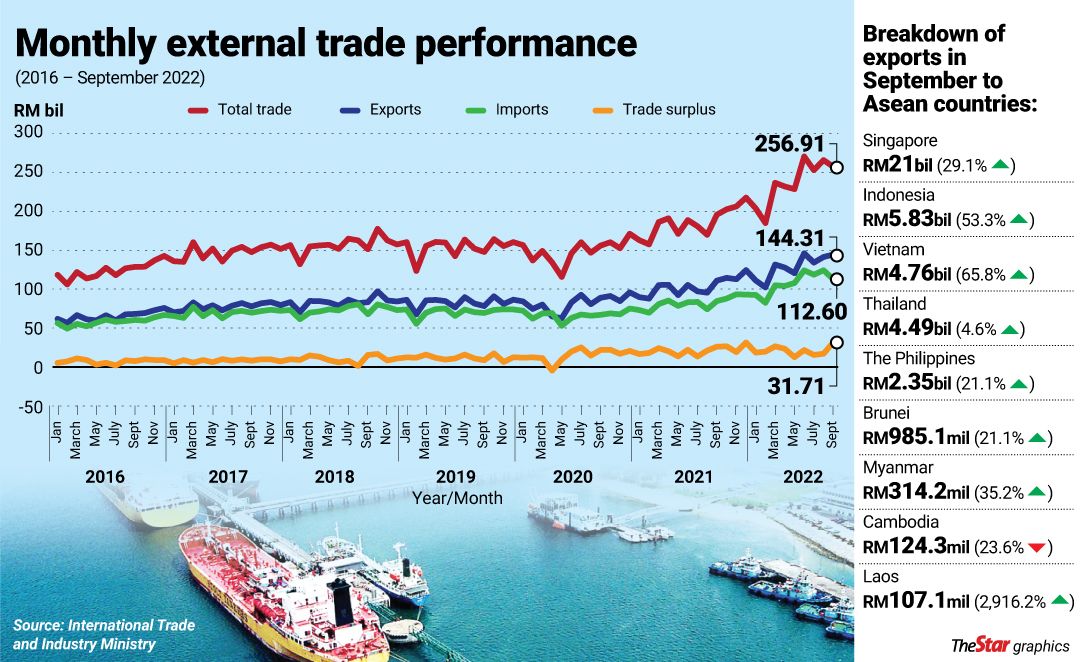

International Trade and Industry Ministry’s trade numbers yesterday showed Malaysia’s exports rose by 30.1% y-o-y to RM144.31bil in September, although a Reuters poll had expected a growth of 31.2%.

Imports in September grew 33% y-o-y to RM112.6bil allowing the country to record a trade surplus of RM31.7bil in the month.

For the 3Q22, exports increased by 38.3% y-o-y to RM419.65bil and imports expanded by 46.5% y-o-y to RM355.32bil. This was the highest quarterly value for exports and imports while trade surplus for quarter grew by 5.6% y-o-y to RM64.33bil.

While Bank Islam’s Firdaos and AmBank Research have a positive GDP projections for 3Q22, economist Geoffrey Williams expects the Malaysian to slow down in the 3Q22 and even warned that an economic contraction is possible in the 4Q22.

“The consensus 5% to 6% growth for full-year 2022 is consistent with average annual growth in the third and fourth quarters of between 3.5% to 4% compared to the same periods last year, which is a slowdown.

“Alternatively, the consensus’ lower forecast of 5% is also consistent with zero quarter-on-quarter growth in the third or fourth quarters or a y-o-y contraction of 1.4% in 4Q22,” he said.

Williams, who is an economics professor at Malaysia University of Science and Technology (MUST), pointed out that the massive 8.9% growth in 2Q22 was due to “extra money” from the withdrawals allowed by the Employees Provident Fund as well as from the economic recovery.

“This has pushed the slowdown and possible contraction to 3Q22 and 4Q22 and also into 2023. This is consistent with the scenario given by the government.

“As the government is telling us, 2023 will be worse and we will see the start of that before the end of 2022,” he said.

With economists generally expecting Malaysia to head into a tougher economic environment in the final few months of this year, a major question arises.

Would Bank Negara postpone any hike in the overnight policy rate (OPR), even though major central banks have continued to increase their rates?

This year, the central bank raised the OPR by a cumulative 75 basis points (bps) over three meetings.

Firdaos expects Bank Negara to “most likely proceed” with another 25 bps hike at its Monetary Policy Committee meeting in November to take the OPR closer to its pre-pandemic level.

“Looking at the present circumstances, we posit that Bank Negara will proceed with policy normalisation with a 25 bps hike at each meeting towards a terminal rate of 3.5%. OPR will be cut accordingly in the event of higher-than-expected external headwinds in 2023,” he said.

Williams, on the other hand, said that it is “not inevitable” that Bank Negara will increase the OPR further next month.

“Although Bank Negara does not have a specific target, the OPR is normally in the range 2.5% to 3% historically.

Since we are in that range now and there is less chance of a change.

“Bank Negara is independent. So the decision depends on economic conditions, which are quite sound, not political considerations due to the election,” he added.

The aggressive rate hikes by the Federal Reserve has led to capital flight to dollar assets and at the expense of the ringgit hitting a fresh low of RM4.723 in intraday trade yesterday. Market watchers expect the high inflation in the American economy will push the Fed to hike its fed fund rate by another 75bps early next month.

Amid the expectation of a slower growth moving into 2023, Bank Islam’s Firdaos said supply-side reforms are needed to push Malaysia’s economic potential to a higher level.

“Issues such as fiscal sustainability, labour, tariff elimination and trade facilitation, investments and competition policy are key to Malaysia’s reform agenda.

“As we head to the polls soon, we hope the incoming government will amass the required political capital to follow through with the reform momentum during the next political cycle,” he said.

MUST’s Williams also concurs that reforms are needed to improve the supply-side capacity of the economy.

He pointed out that the underlying potential growth rate in Malaysia is lower due to the impact of the lockdowns and hence, previous long-term economic plans must be revised.

“Specific reforms have to address incomes and equality through a Universal Basic Income model, pension reform is essential through a Universal Basic Pension because 96% of people do not have adequate pensions cover.

“Addressing under-employment through labour market liberalisation is also important.

“Tax reform to create a more efficient overall tax environment is essential and reform of National Higher Education Fund Corporation (PTPTN) is important because it is close to the limit of its resources and may pose a systemic risk if it is ignored,” he said.

Source: https://www.thestar.com.my/business/business-news/2022/10/20/in-for-another-great-quarterly-gdp

English

English