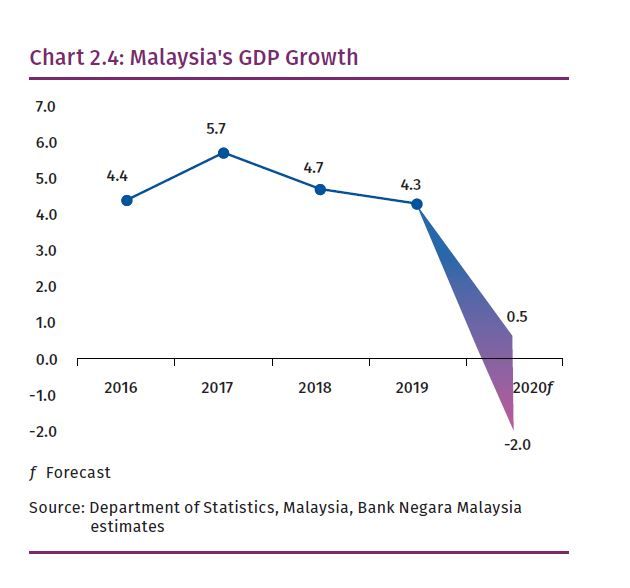

Malaysia: GDP between -2.0% and 0.5% in 2020

KUALA LUMPUR: The Malaysian economy is expected to see a contraction -2.0% at its worst and growth of 0.5% at its best in 2020, compared to 4.3% in 2019, against a highly challenging global economic outlook.

Bank Negara Malaysia (BNM) in its 2019 Economic Monetary Review on Friday said the domestic economy will be impacted by the necessary global and domestic actions taken to contain the outbreak.

“Of significance, tourism-related sectors are expected to be affected by broad-based travel restrictions and travel risk aversion, while production disruptions in the global supply chain will weigh on the manufacturing sector and exports,” the central bank noted.

“The implementation and subsequent extension of the Movement Control Order (MCO), while critical, will dampen economic activity following the suspension of operations by non-essential service providers and lower operating capacity of manufacturing firms,” it added.

Beyond the MCO period, reduced social and recreational activities until the pandemic is fully controlled globally and domestically will continue to dampen consumption and investment activity.

Apart from the pandemic, Bank Negara said the domestic economy will also be affected by the sharp decline and volatile shifts in crude oil prices and continued supply disruption in the commodities sector.

Given the significant headwinds to growth arising from COVID-19, the Government and BNM have introduced large countercyclical policy measures to mitigate the economic impact of the pandemic.

Two economic stimulus packages amounting to RM250bil were introduced to provide immediate relief to affected households and businesses.

These packages also include loan guarantees and an automatic 6-month moratorium on loan repayments for individuals and small and medium enterprises (SMEs).

The economic stimulus measures were complemented by two consecutive Overnight Policy Rate (OPR) reductions early this year and measures to provide additional liquidity in the banking system.

Bank Negara said private consumption is expected to be dampened by weak labour market conditions, mobility restrictions and subdued sentiments.

“Domestic growth prospects are expected to improve towards the end of the year, in line with the projected recovery in global demand and amid continued support from policy measures,” it said, adding that recovering external demand will lift growth in the export-oriented sectors.

Consumer sentiments are also expected to gradually improve following the easing of travel restrictions and resumption of tourism activities as risks from the pandemic subside.

Public sector spending will be underpinned by the continuation of large-scale transport-related projects by public corporations and the implementation of more small-scale projects worth RM4bil by the Federal Government.

“Overall risks to the domestic growth outlook are tilted to the downside, mainly due to the risk of a prolonged and wider spread of Covid-19 and its effects on the global and domestic economy,” the central bank said.

Bank Negara said headline inflation is forecasted to average within the range of -1.5 to 0.5% in 2020 (2019: 0.7%), mainly reflecting significantly lower global oil and commodity prices.

Without the direct downward impact from lower global oil prices, underlying inflation, as measured by core inflation, is projected to remain positive, averaging between 0.8 to 1.3%.

This reflects subdued demand pressures, expectations for a negative output gap this year, as well as weak labour market conditions.

The central bank said monetary policy in 2020 will focus on providing support to domestic economic growth in an environment of subdued price pressures.

The OPR was reduced in January and March 2020 by a total of 50 basis points to 2.50% to provide a more accommodative monetary environment to support economic growth amid price stability.

The Statutory Reserve Requirement (SRR) ratio was also reduced further by 100 basis points in March 2020 along with the granting of flexibility to Principal Dealers to recognise Malaysian Government Securities (MGS) and Malaysian Government Investment Issues (MGII) for SRR compliance, releasing an additional liquidity of RM30bil into the banking system.

In addition, Bank Negara undertook measures to ensure continued financial intermediation including providing additional funds for SMEs, amounting to a total allocation of RM13.1bil under the BNM’s Fund for SMEs and improving features of the funds.

Click here for other reports:

Bank Negara: Economic and Monetary Review 2019 highlights

Bank Negara raises dividend payout to RM3.5bil, adds RM5.4bil to risk reserve

Bank Negara: Financial Stability Review 2H 2019 highlights

Bank Negara: Banks equipped to handle risks from household debt

Source: https://www.thestar.com.my/business/business-news/2020/04/03/bank-negara-malaysias-gdp-projected-to-be-between–20-and-05-in-2020

English

English