Malaysia: Economists predict further rate cut ahead

PETALING JAYA: Malaysia’s benchmark interest rate is currently the lowest on record, but economists think there is a fair chance that it could drop even further.

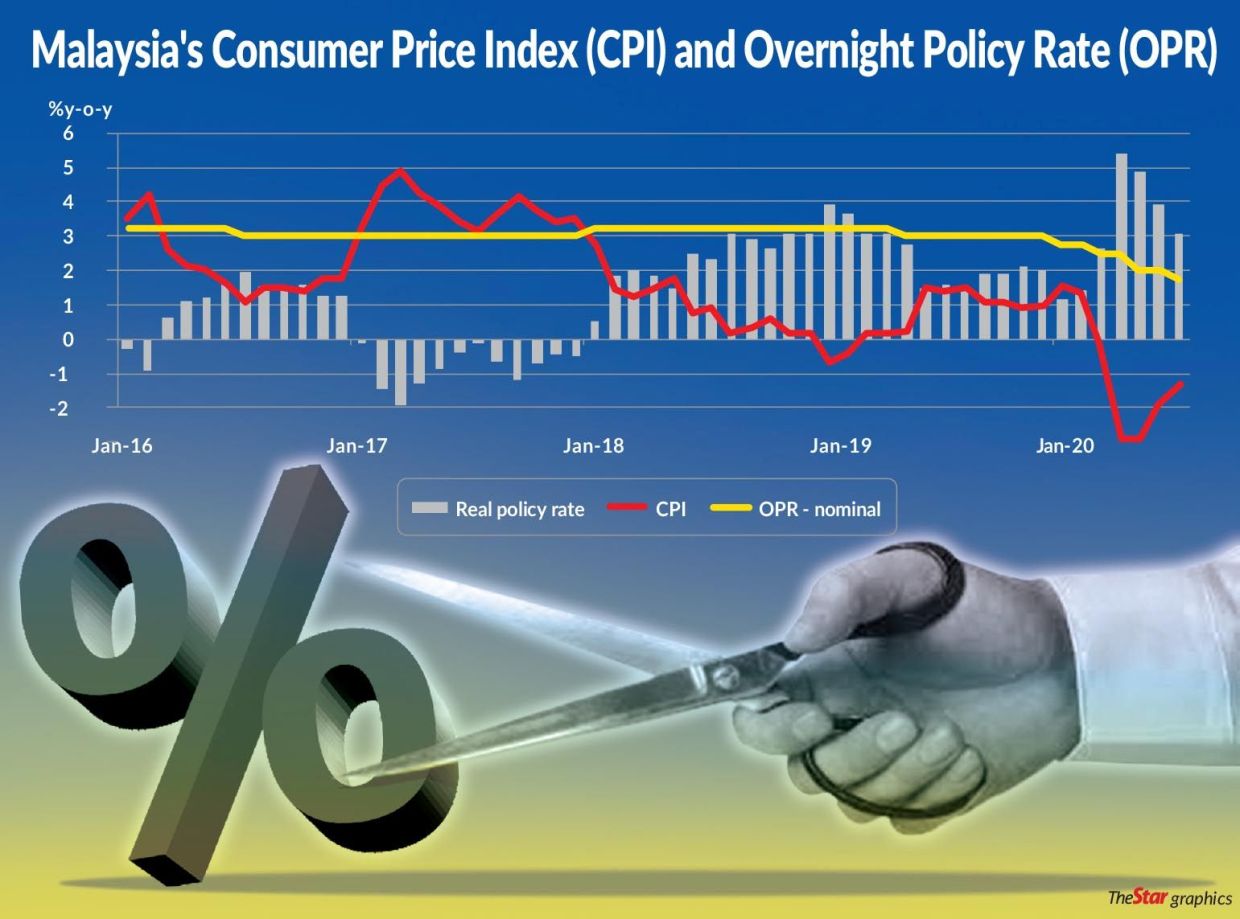

Bank Negara could be prompted to cut the overnight policy rate (OPR) due to concerns that a deep negative output gap may persist in the Malaysian economy, according to CGS-CIMB Research.

This is following a sharp gross domestic product (GDP) contraction of 17.1% year-on-year in the second quarter of 2020, worse than market predictions.

With the country experiencing a technical deflation for the fifth consecutive month as of July, this provides ample room for the central bank to ease its monetary policy to spur borrowings and economic growth.

TA Research foresees the Consumer Price Index, which measures the headline inflation, to continue falling in August by 1.2% year-on-year, following a 1.3% decline in July.

This is on the assumption of cheaper retail pump prices.

In a note, AmBank Group chief economist Anthony Dass (pic below) said there is a 70% possibility for the OPR to hit 1.25% in September compared to the current 1.75% – an all-time-low since the central bank adopted the OPR framework in 2004.

For context, the central bank’s Monetary Policy Committee will be meeting for the fifth time this year on Sept 10 to decide on whether the OPR will be revised. In all the previous four meetings of the year, the MPC has cut the OPR by a cumulative 125 basis points (bps) from 3% last year.

“With the ringgit at a strong level, it provides ample room for another 25 bps OPR cut in September from the current 1.75%.

“We have now factored in a 70% chance of a 50bps OPR cut in September, ” Dass said in a note yesterday.

RAM Ratings, CGS-CIMB Research and TA Research have also said yesterday that they expect a 25bps cut in the benchmark interest rate next month.

However, JF Apex Research is of the opinion that the current OPR level will be maintained for the rest of the year as economic activities gradually recover, with reopening of business activities as well as implementation of fiscal stimulus packages to spur private spending.

Similarly, Socio-Economic Research Centre executive director Lee Heng Guie (pic below) does not think that a further rate cut is warranted, although he concurs that the country’s muted inflationary pressures would allow Bank Negara to continue with its accommodative monetary condition.

Speaking with StarBiz, Lee said the central bank could consider to pause the easing cycle as it reserves the arsenal for future shocks.

“Bank Negara had already front-loaded the rate cut as the 17.1% y-o-y slump in real GDP in 2Q20 was within its expectations. Recent factual high frequency data and anecdotal evidence have lent credence that the worst economic contraction has hit the trough in May and is poised for a gradual recovery in the months and quarters ahead.

“There is an evident trade-off as low interest rates are good for macroeconomic stability in the short-run, but a prolonged period of low interest rate could harm long-run financial and macroeconomic stability, ” he said.

Lee added that central banks have to take a medium-and longer-term perspective, looking beyond the economic recovery to avoid a prolonged period of low interest rate-induced distortions.

“The central bank should raise or normalise interest rates as soon as macroeconomic conditions allow.

“The long hesitation move could push policymakers into a trap, that is the longer interest rates remain low, the higher the probability that they will continue to remain low, ” he said.

According to Lee, a prolonged period of low interest rate and cheap borrowing costs tend to amplify more risk-taking activities, induce speculative buying into non-earnings and fundamentals backed riskier assets and fuel asset bubbles.

It could also expose businesses and households to take on more debt beyond their financial capacity and delay the necessary adjustment in their balance sheets, including deleveraging.

Source: https://www.thestar.com.my/business/business-news/2020/08/20/economists-predict-further-rate-cut-ahead

English

English