Malaysia: Covid-19 surge weighs on Q2

PETALING JAYA: The pace of economic recovery in the second quarter (Q2) will shape how Malaysia’s gross domestic product (GDP) will fare in the second half of the year as the number of Covid-19 cases spike, according to economists.

The number of cases recently surpassed the 3,000-mark and this may put a dampener on the country’s economic growth projection for the year if they are not contained.

Prior to the surge in the number of cases, there were strong expectations that the economy would steam ahead in the second quarter.Bank Negara has projected a GDP growth of between 6% and 7.5% for this year after the economy contracted 5.6% in 2020.

With restrictions being relatively more accommodative to business activity after the lifting of the movement control order (MCO) 2.0, RAM Rating Services senior economist Woon Khai Jhek (pic below) said the pace of economic recovery would likely pick up in the second quarter.

Nonetheless, given the recent resurgence in Covid-19 cases, the downside risk it would pose to Q2 GDP performance remains significant.“Should Malaysia succeed in controlling the caseload in Q2, economic output is likely to recover sharply in the second half of the year, bringing the economy closer to the pre-pandemic levels.

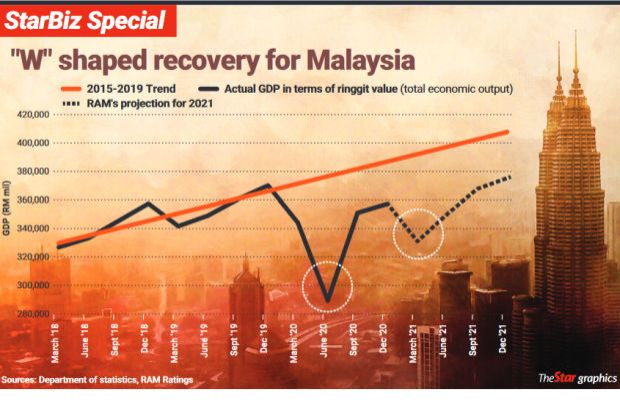

“While RAM projects year-on-year GDP growth to return to pre-Covid levels in the second half (about 4.5%), GDP in absolute ringgit value is unlikely to recover to pre-pandemic potential in 2021, ” he told StarBiz.

Malaysia’s economy appears to be exhibiting a W-shape recovery, where overall economic output underwent a “double-dip” economic loss, first in Q2 of 2020 and the second time in Q1 of 2021 due to MCO 2.0.

Woon said the general manufacturing and retail sales activity during MCO 2.0 in February 2021 has outperformed what was achieved during MCO 1.0 in April 2020 and the conditional MCO in November 2020.

“The activity level in February also exceeds RAM’s initial expectations. If this trend persists, it could provide a lift to our 5% GDP forecast for 2021. Nonetheless, ‘non-essential’ manufacturing and retail sales remain weak in January and February 2021, ” he noted.

Bank Islam Malaysia Bhd chief economist Mohd Afzanizam Abdul Rashid (pic below) said the economy would take a while to normalise, noting that the GDP is highly likely to be positive this year.The key issue, he said, is how soon the spare capacity could be absorbed and put to use. This simply means how soon a person can secure a job and how the businesses would be able to get back on their feet.

“The recovery is going to be uneven. Some parts of the economy would do well such as the manufacturing industries. But services related sectors such as tourism, aviation, food and beverages and retail may take some time to see a strong rebound following the adherence of the standard operating procedure (SOP) and the closure of international borders. Limitation on interstate travelling will also affect the industries, ” Afzanizam noted.

Signalling a bullish view, Sunway University professor of economics Yeah Kim Leng said despite the high daily new Covid-19 cases, the economy is on track to emerge from the pandemic-induced recession if not in the first quarter, then in the second quarter.

The pandemic threat has somewhat dampened the more bullish or optimistic growth expectations anticipated before the resurgence of Covid-19 cases.

On whether the GDP growth forecast of between 6% and 7.5% was achievable, Yeah (pic below) said to reach the higher end of the growth forecast range, household spending and business activities would have to normalise at a quicker pace in the second half of this year.

“Constraints and uncertainties still loom as evident by inadequate global vaccine supply and unequal access, uneven vaccination rates across countries, and pandemic resurgence in many countries, notably India.

“The latest developments suggest that the hoped-for quick suppression of the pandemic and a faster return to normalcy in daily lives and opening of borders for travel remain challenging for most countries including Malaysia.

“However, underpinned by the sustained recovery in China and the United States, the more positive global recovery outlook will provide the ballast to Malaysia’s diversified exports riding on the commodity price booms and global semiconductor industry upswing, ” Yeah pointed out.

According to Juwai IQI Global chief economist Shan Saeed, (pic below)Bank Negara’s projection for this year is too optimistic taking into account the exogenous factors and financial market fragilities in the economic system.

“Malaysia is open for business but not many economies are ready for business with other countries. The country can start trading with countries once they are open for business and banks are ready for financial transactions in order to support the country’s trade.“It would take a while for many economies to open up and come back into the growth mode. For Malaysia, with the Chinese economy opening up, it is a good sign in the long run as trading resumes for many businesses to move forward, ” he said.

Shan said the reopening of the borders likely by the third quarter of this year, coupled with the introduction of vaccine passports and vaccination rate of 60% to 80%, would help the economy to bounce back.

“The Malaysian economy has the resilience to take the pressure of the external environment. We stand buoyant on the macro economic outlook for the country due to its domestic aggregate demand, healthy exports and increased investments, ” Shan said.

Meanwhile, AmBank Group chief economist Anthony Dass (pic below) said there are some downside risks to economic growth.

“Uncertainty on the rising number of Covid cases, effectiveness of the vaccines and management of the pandemic can pose some headwinds.

“It remains unclear what will happen after the state of emergency ends on Aug 1 and when some of the stimulus measures end before the upturn. On the whole, our base case GDP growth is around 6% to 7% this year with the downside at 5.5% for 2021, ” he said.

However, there is also a potential upside, supported by the government’s stimulus measures totalling RM340bil via fiscal, monetary and non-monetary measures to prop up the economy.

The stimulus measures have helped business activities gain momentum.

“Global trade has picked up and will support the economy which is open. Besides, firm commodity prices will provide an added uplift to growth.

”Labour market, reflected by the unemployment rate, is at 4.9% in January 2021, from its May 2020 peak of 5.3%, although it has been on an uptrend from 4.6% in September.

“Measures including wage subsidies and loan moratorium have helped contain some of the Covid-19 scarring impact, ” Dass said

Source: https://www.thestar.com.my/business/business-news/2021/05/03/covid-19-surge-weighs-on-q2

English

English