Malaysia: Brace for weaker growth

PETALING JAYA: The Malaysian economy could take a turn for the worse, economists warned as some anticipate growth to drop below the 4%-mark in the fourth quarter (Q4)of 2019.

In such a case, this would be the weakest quarterly economic performance since the Pakatan Harapan government took office in May 2018.

CGS-CIMB Research, which expected a 4% growth, described it as the slowest pace since 2009. Poor performance of the agriculture and mining sectors in the last three months of 2019 pointed towards a weaker gross domestic product (GDP) growth in Q4, amid continuing soft domestic and external demand.

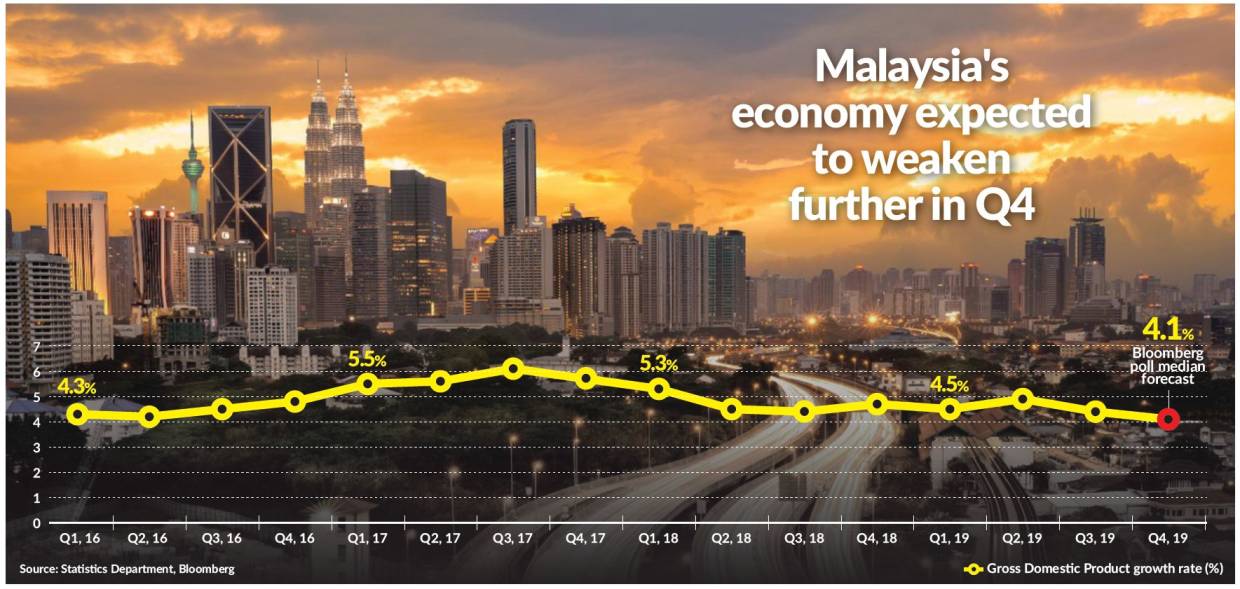

Ahead of the GDP figures to be released today, a Bloomberg poll of 21 economists showed a median growth forecast of 4.1% for the October to December 2019 period, with individual forecasts ranging between 3.4% and 4.3%.

In comparison, the economy expanded by 4.4% year-on-year in the third quarter (Q3) of 2019. The domestic economy has been growing below the 5% level in every quarter since the second quarter of 2018, in the range of 4.4% to 4.9%. The growth has been dragged down by the growing global macroeconomic challenges such as the US-China trade tensions, weakening business sentiment and commodity price volatility.According to Maybank IB Research, the economy could likely expand by only 3.8% in Q4, considering the mixed supply-side or output-based indicators in the quarter.This was despite the pick-up witnessed in the services sector and the rebound in construction.

“Mining production index fell further (Q4: -3.4%; Q3: -4.7%) suggesting continued drop in mining GDP. Output of crude palm oil, palm kernel and crude palm kernel oil tumbled (Q4: -17.2%; Q3: 8.5%) indicating agriculture GDP shrank in Q4 after three quarters of growth.“Manufacturing production index recorded its slowest quarterly gain of 2019 last quarter (Q4: 2.8%; Q3: 3.4%), which should translate into deceleration in manufacturing GDP growth, ” Maybank IB Research said in a note yesterday.

The research house, however, also pointed out that the growth of the Index of services picked up slightly (Q4: 6.4%; Q3: 6.2%) to highlight slight improvement in services GDP growth.In addition, construction works done rebounded (Q4: 1.3%; Q3: -0.6%) to signal turnaround in construction GDP.

“Demand-side indicators such as retail trade index, capital goods imports and trade surplus point to slowdown in domestic demand and net external demand, ” stated Maybank IB Research.

Based on its forecast of 3.8% for Q4, the research firm expected the full-year 2019 growth to average at 4.4%, which is below the government’s official guidance of 4.7%.

Meanwhile, AmBank Research said that its preliminary estimates suggested that the Q4 GDP growth is likely to hover around 4.3% to 4.5%, considering that Industrial Production expanded at an average of 1.3% in Q4, as compared to 1.5% in Q3.

“This translates to a full-year GDP growth of between 4.5% and 4.6% in 2019, ” it said.

CGS-CIMB Research, which said that commodities cast a pall over Q4 GDP growth, expected the trend to extend into the first quarter of this year.

It also toned down its expectations of a cyclical recovery in the electrical and electronics and machinery segments, due to China being at the epicentre of the novel coronavirus outbreak.

The research house cautioned the market to brace for further economic weakness as weakness in the commodities radiates into other segments of the economy in the wake of the outbreak.

“While there is considerable uncertainty about the economic impact from the outbreak, we estimate that 0.5 percentage point could be shaved off Malaysia’s GDP growth in the first quarter due to the direct impact of restricted travel on tourism, transport and consumer spending, as well as weaker export demand for commodities and manufactured goods from China’s slowing economic expansion.

“To cushion the negative external spillovers and avert the downward slide in GDP growth, the Finance Ministry is in discussions with the Economic Affairs Ministry, Tourism Ministry and the International Trade and Industry Ministry to craft a stimulus package, which we think could be in the ballpark of the RM8.1bil spent during SARS outbreak in 2003, equivalent to 0.5% of GDP in today’s terms, ” it said.

CGS-CIMB Research expected the policy mix to be strengthened by a further dose of monetary easing.

It believed Bank Negara would reduce the overnight policy rate by a further 25 basis points to 2.50% in the first half of 2020.

Source: https://www.thestar.com.my/business/business-news/2020/02/12/malaysian-economy-could-take-a-turn-for-the-worse-economists-warn

English

English