Lower income, rising debt expected as Indonesia unveils extra stimulus

The government’s big-check fiscal stimulus to bolster purchasing power and tourism- and trade-related industries amid the coronavirus (COVID-19) outbreak will reduce state revenue and raise debt levels, economists say. They have called for productive spending to support the economy.

Center of Reform on Economics (CORE) Indonesia research director Piter Abdullah said the planned stimulus packages would “no doubt” increase debt levels and widen the budget deficit, and he called on the government to manage the budget efficiently while providing the much-needed stimulus.

“The government needs to be smart about the stimulus to ensure the fiscal deficit remains below 3 percent,” Piter told The Jakarta Post by phone interview on Wednesday.

The government is working to finalize eight measures that will be incorporated in a second stimulus package aimed at easing rules for exports and imports, as supply chains continue to be disrupted by the spread of the coronavirus. The measure follows the unveiling of a Rp 10.3 trillion (US$725 million) stimulus package last week to support consumer spending and tourism.

“The stimulus packages, while needed, will no doubt widen the budget deficit and must be communicated well to the public,” said Piter, adding that the budget deficit was reasonable amid the current circumstances.

Apart from the stimulus package, Finance Minister Sri Mulyani Indrawati has announced the government will front-load its spending on social welfare and rural development to boost household expenditure.

A large portion of this year’s social spending will be disbursed in the first quarter of this year. The programs include the Family Hope Program (PKH), School Operational Assistance (BOS) for elementary and high schools and the noncash food program, as well as village funds for rural development.

The government collected Rp 103.7 trillion in January, down 4.6 percent from the same month last year. Meanwhile, government spending reached Rp 139.8 trillion, down 9.1 percent compared with the same period last year. It resulted in a budget deficit of Rp 36.1 trillion, 0.21 percent of gross domestic product (GDP) in January.

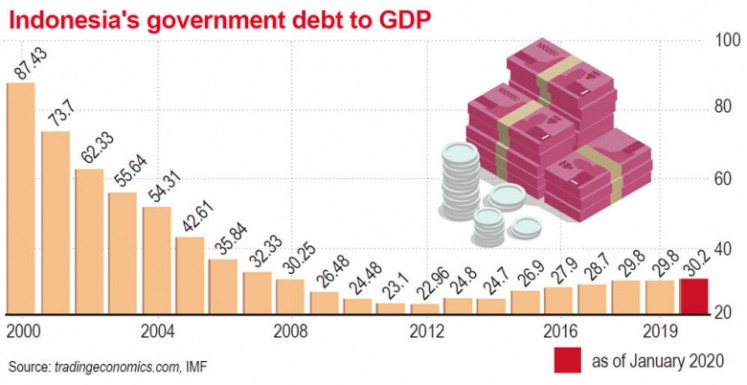

The country recorded debt of Rp 4.82 quadrillion in January, a 30.21 percent debt-to-GDP ratio. The last time Indonesia recorded debt-to-GDP ratio of above 30 percent was during the 2008 financial crisis at 30.25 percent.

“Adding more debt is the only way to counter the negative coronavirus effects amid pressure on revenue performance,” Piter added.

Separately, Fitch Ratings director of sovereign ratings Thomas Rookmaaker said the coronavirus outbreak could cause a short-term deterioration in revenue collection through its effects on economic activity.

“The self-imposed fiscal deficit ceiling of 3 percent of GDP will limit the government’s capacity to materially relax fiscal policy,” Rookmaaker told the Post by email interview.

Rookmaaker said that any deterioration in fiscal metrics as a result of the novel coronavirus would likely be short-lived. “We forecast a fiscal deficit of 2.2 percent of GDP in 2020 and expect the debt-to-GDP ratio to rise only marginally in the next few years.”

Indonesia’s economy is likely to be affected by the novel coronavirus outbreak mainly through lower commodity export prices and weaker tourism revenues, said Rookmaaker.

“The outbreak could also affect consumer sentiment and the services sector more broadly if the coronavirus were to spread within Indonesia itself,” he added.

Government debt-to-GDP ratio. (JP/IMF, Finance Ministry)

Government debt-to-GDP ratio. (JP/IMF, Finance Ministry)

It was confirmed that four Indonesians had tested positive for COVID-19 on Friday. Across the world, more than 106,000 people have been infected and more than 3,600 people had died from the disease as of Sunday.

In January, the government sold $2 billion of dollar-denominated notes and raised another 1 billion euro ($1.11 billion) selling bonds in Europe to finance its budget deficit in 2020. Meanwhile on Wednesday, the government raised Rp 17.5 trillion from seven series of government bonds.

Meanwhile, Bank Indonesia deputy governor Destry Damayanti told the Post that the debt level remained relatively conservative under the international threshold of 60 percent.

“There are a lot of developed countries including the United States and Japan that have recorded debt-to-GDP ratios above 100 percent,” Destry said on Friday. “Indonesia’s debt level remains manageable but the more important thing is how the government spends the state budget.”

“The current circumstances must have [adversely] affected tax collection but it is being used [productively],” she added.

Source: https://www.thejakartapost.com/news/2020/03/09/lower-income-rising-debt-expected-as-indonesia-unveils-extra-stimulus.html

English

English