Indonesia – Outlook: Happy news for some sectors in 2019

Although 2019 is expected to see a repeat of the previous year’s challenges, some sectors have a rosier outlook than others.

The Jakarta Post looks at the prospects of the 2019 economy to see the potentials amid challenges posed by the global environment. Compiled by Marchio Irfan Gorbiano, Norman Harsono, Rachmadea Aisyah, Riska Rahman, Riza Roidila Mufti, Stefanno Reinard Sulaiman and Winny Tang, this is part two of the outlook:

Investment

Investment Coordinating Board (BKPM) head Thomas Lembong responded with a smile when reporters asked him in December whether he was optimistic about the investment climate in 2019.

His smile may linger on his face as Indonesia received several pieces of good news toward the end of 2018 that could boost investment in 2019, notably that of the government’s acquisition of the Grasberg gold and copper mine in Papua from Freeport McMoRan.

The government also received news of a potential $1 billion investment by Pegatron Corp., a Chinese company that assembles iPhones, to build a manufacturing plant in Riau Islands, in addition to a Rp 12 trillion ($824.9 million) investment plan by Korean automaker Hyundai to build an Indonesian factory with a capacity of producing 250,000 cars annually.

University Indonesia’s Institute for Economic and Social Research (LPEM UI) has forecast a better investment climate in 2019, especially after the presidential and legislative elections in April, in addition to Indonesia’s expected improvement in capturing investment potential from companies escaping the United States-Chinese trade war and relocating their production plants out of China.

Energy

Energy policies in 2019 will likely have a similar goal as in 2018, which is to ensure the most affordable fuel and electricity, which mostly comes from dirty energy, throughout the country.

Therefore, fossil fuel will continue to drive Indonesia’s energy sector this year and is likely to get special treatment from the government, either in terms of incentives or policies.

In March 2018, President Joko “Jokowi” Widodo ordered the Energy and Mineral Resources Ministry to ensure the affordability of fuel and electricity prices until the end of 2019.

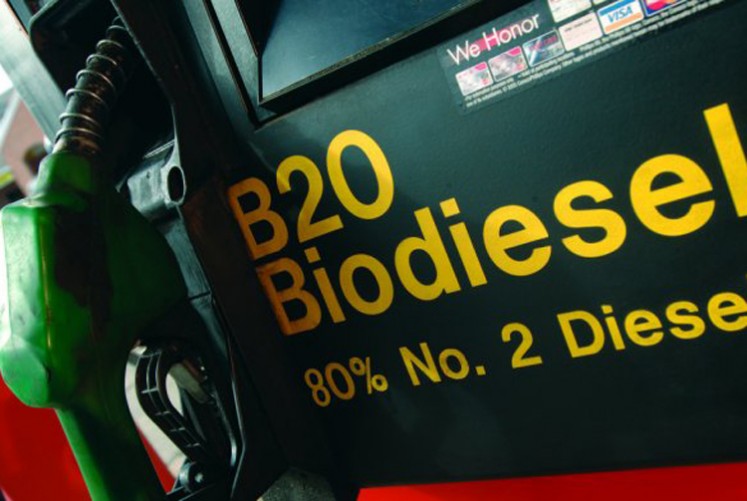

However, a small move by the government to phase out fossil fuel by increasing the blending rate of biofuel to diesel fuel from 20 percent, which was enforced in September 2018, to 30 percent by 2020 may have significance in 2019.

A 20-percent blended biodiesel ( B20 ) gas station. (Courtesy of/The Indonesian Palm Oil Producers Association (Gapki) )

The biodiesel policy is likely to be the only major development in renewable energy as sector experts and players recently predicted that 2019’s political year would slow down efforts to have cleaner energy, including investment in it.

Tourism

The government is maintaining its target of 20 million foreign arrivals and 275 million domestic tourists in 2019, despite acknowledging that it was unlikely to reach the 2018 target of 17 million foreign arrivals as a result of natural disasters that hit the country.

In an effort to achieve the 2019 target, Tourism Minister Arief Yahya said the government had prepared three extraordinary programs — boosting cross-border tourism, especially at potential entry points like Riau Islands; establishing tourism hubs in neighboring countries such as Thailand, Singapore and Malaysia; and opening a low-cost terminal (LCCT) at Soekarno-Hatta International Airport.

The government also aims to boost meetings, incentives, conferences and exhibitions (MICE) tourism, which is perceived to attract high-spending tourists, as well as the millennial tourism market.

Infrastructure

Coordinating Economic Minister Darmin Nasution said the government had set a target of completing 79 national strategic projects (PSN) out of a total of 223 before the end of the 2019 third quarter.

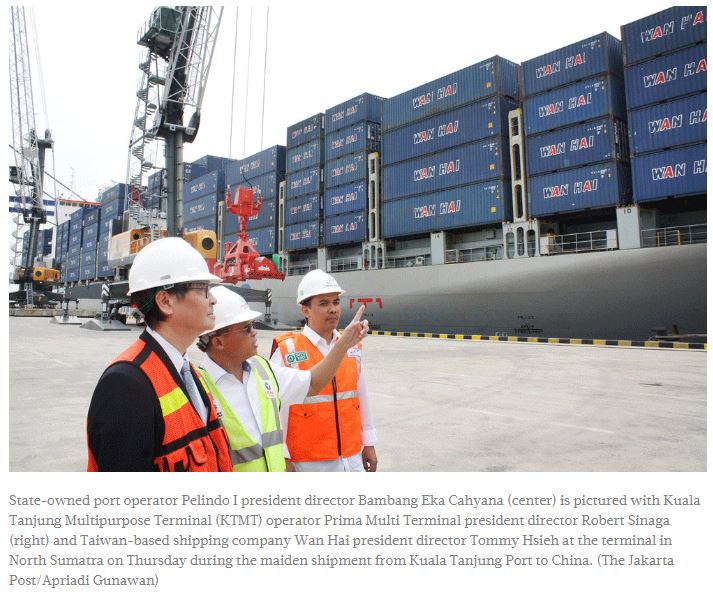

President Jokowi recently said several major projects, such as the Kuala Tanjung Port in North Sumatra and Makassar New Port in South Sulawesi, were scheduled for completion early 2019. A number of toll roads, including Batang-Semarang and Salatiga-Surakarta in Central Java, Banyuwangi [East Java]-Merak [West Java] were scheduled for completion at the end of 2018.

Transportation

The Transportation Ministry is expected to implement a new regulation on online transportation services in May 2019. The new regulation features minimum service standards (SPM) in security, safety, amenity, affordability and orderliness of vehicles. The ministry is also working on another regulation on online motorcycle taxis that is expected to be introduced in 2019.

An MRT train passes over JL Sisingamanganraja, South Jakarta, during a trial run on Tuesday. The MRT is expected to begin operation in March 2019, with an estimated fare of Rp 700 (5 US cents) to Rp 850 per kilometer. (The Jakarta Post/Seto Wardhana)

The ministry also expects several transportation infrastructure projects to be completed in the near future, including the MRT in Greater Jakarta and several airports that are expected to significantly boost tourism.

Digital economy

The local digital economy is projected to grow significantly in 2019, riding on a momentum of bombastic growth projections, investor confidence and government support.

A Google-Temasek report released in November estimated that the size of Indonesia’s digital economy could triple from US$27 billion this year to $100 billion by 2025 – equal to annual growth of about $10.4 billion.

The report also predicts that growth will be led by e-commerce, online travel, ride-hailing services and online media, likely to be followed by financial technology (fintech).

A McKinsey & Company report released in December predicts that Indonesia’s e-commerce sector alone may grow at least sevenfold from $8 billion last year to $55 billion by 2022.

Meanwhile, a recent Bain & Company survey found that 49 percent of investors believed that Indonesia would be the second-hottest digital economy market in Southeast Asia in 2019, trailing just after Singapore.

Similarly, the Google-Temasek report found that Indonesian startups secured the second-highest average investment ($5 million) in the region this year, after Singapore’s average of $6 million.

Communications and Information Minister Rudiantara was bullish in his view of Indonesia’s digital economy, saying he expected to see Indonesia’s fifth unicorn and first decacorn (company valued at more than $10 billion) by the end of next year.

However, technical challenges remain for the digital economy, such as cybersecurity and electronic payment systems, which are the top concerns among businesses, according to a recent Dell Technologies survey and the Google-Temasek report.

Another pressing concern is a shortage of skilled digital talents, who may expect salary increases of up to 50 percent if they move jobs next year, according to a Robert Walters survey.

To address the shortage, digital literacy programs were initiated this year by private and public sector figures such as Minister Rudiantara, who pledged to train 20,000 local digital talents in 2019, and Alibaba founder Jack Ma, who pledged to train 1,000 local developers every year for the next 10 years.

Source: https://www.thejakartapost.com/news/2019/01/01/outlook-happy-news-for-some-sectors-in-2019.html

English

English