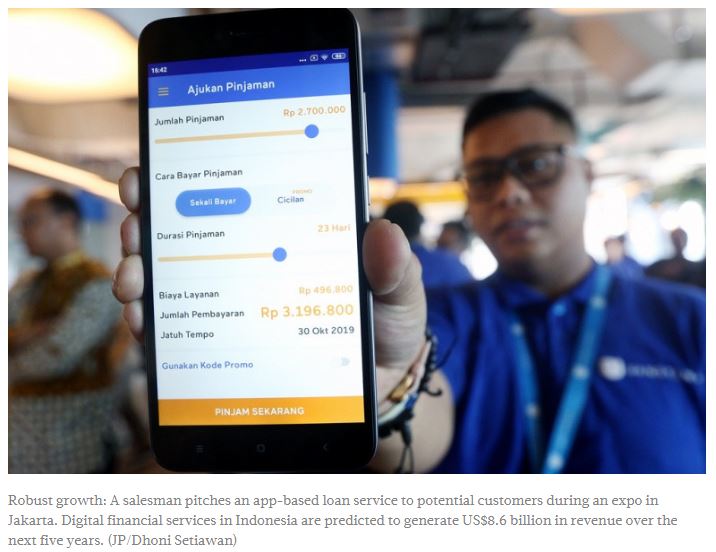

Indonesia: Fintech lenders struggle to get back money, bad loan ratio reaches 7.9%

Indonesian peer-to-peer (P2P) fintech firms have reported an increase in bad loans to 7.99 percent in July as many borrowers have lost their sources of income due to the COVID-19 crisis, the Indonesian Fintech Lenders Association (AFPI) has stated.

The proportion of defaulted loan after 90 days has continuously worsened since March, when it stood at 4.22 percent. That figure already marked a significant increase from 2.62 percent in March last year, according to data from the Financial Services Authority (OJK).

Adrian Gunadi, the chairman of the AFPI, said he had expected the rise in the industry’s nonperforming loan (NPL) ratio as a result of the economic impact of the pandemic on borrowers’ income.

“The declining payment quality is not only happening in the fintech lending industry but also in other financial services, like banking and multifinance. This is in line with the coronavirus pandemic’s impact,” Adrian was quoted as saying in a news release on Wednesday.

P2P lenders disbursed loans totaling Rp 116.97 trillion (US$7.86 billion) as of July 2020, more than double the Rp 49.79 trillion issued over the corresponding period last year, OJK data show.

Bank loan disbursement grew by 1.53 percent yoy in July, OJK data show.

“The fintech lending industry is facing challenges due to the COVID-19 pandemic. It is both the association’s and its members’ obligation to maintain the industry’s growth, so that its role in increasing access to financing for underbanked people will keep growing,” said Tumbur.

Source: https://www.thejakartapost.com/news/2020/09/23/fintech-lenders-struggle-to-get-back-money-bad-loan-ratio-reaches-7-9.html

English

English