Five countries will lead fintech in Southeast Asia

Five countries stand out in the development of financial technologies in Southeast Asia. In the context of the growing focus on financial inclusion, fintech lending services will provide a determining vector, predicts the international financial holding Robocash Group.

Southeast Asia has the fastest growing Internet penetration in the world estimated at 58% in 2018 (2017 — 53%). Google and Temasek predicted the number of local Internet users to reach 480 mln people in a year and the Internet economy to increase to US$200 billion by 2025 (2017 — $50 bln). In return, it makes the region significantly promising for business in the digital field.

However, the potential is untapped that is proved by the still low financial inclusion (about 38% of adults had no account in SEA in 2017). Robocash Group, which is now providing financial services for the underserved by banks in three countries in SEA, expects that in the context of the Bali Fintech Agenda accepted in October 2018, alternative lending will determine the further progress in fintech across the region. The following countries will stand out on this background: Singapore, Indonesia, the Philippines, Vietnam, and Thailand.

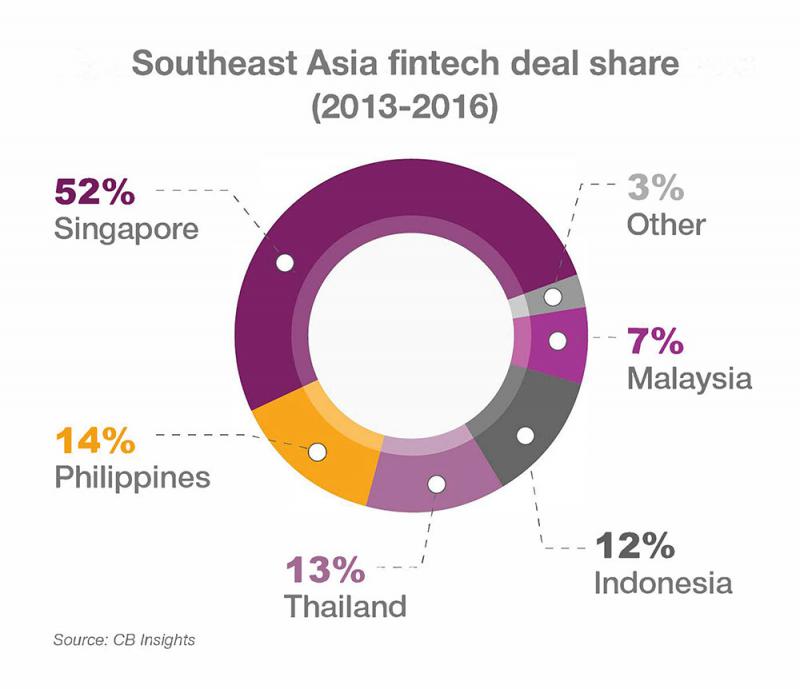

The apparent leader in SEA is Singapore with the highest fintech adoption: 56% of the population was digitally active in 2017. In 2017, Singapore saw US$229.10 million raised in financial technologies after holding 52% of all fintech deals across the region in the period of 2013-2016.

With the support from the government and banks, Indonesia with its largest population in the region is actively catching up. The low rate of financial inclusion (49% of the population had a bank account in 2017) facilitated an increase in alternative lending. According to estimations, 31% of the Indonesian fintechs are p2p platforms. Moreover, the Financial Services Authority of Indonesia (OJK) reported about more than US$1.131 bln loans issued as of October 2018.

Compared to Indonesia, the Philippines has a higher number of people underserved by banks (65.5%). However, the country is adapting quickly and efficiently to the new digital reality. EY stated that local fintech companies raised US$78 million in funding in 2017 that is a 13 times increase year-on-year. About 30% of fintech firms in the Philippines represent alternative finance.

In Vietnam, only 31% of the adult population had bank accounts in 2017. Alternative lending has become widespread on this background: almost 100 platforms have started in the last few years. Yet, the country is actively gaining traction in fintech supported by the fast increasing Internet penetration, mobile connectivity (84% of the Vietnamese had smartphones in 2017) and the government strategy to increase the volume of cashless transactions up to 90% by 2020. Solidance forecasts that the Vietnamese fintech market will grow from $4.4 bln in 2017 to $7.8 bln in 2020.

Thailand, which shows fast progress of the socio-economic development and relatively high financial inclusion (82% of the population had an account in 2017), is nevertheless lagging behind the neighbours. Alternative lending that might be relevant for the population living in rural areas (2016 — 48%) is low spread. Developing according to the economic strategy “Thailand 4.0” (2016), Thailand is focused on high-tech industries and innovations but expands the lending market carefully. As a result, it affects foreign capital too. In 2017, the country saw US$12M raised that was 40% decrease year-on-year.

Commenting on the potential of the SEA region, Sergey Sedov, Chief Executive Officer of Robocash Group said, “Apparently, there is a scope of several factors facilitating the further growth of fintech lending both for private customers and SMEs. They are the demand for accessible finance, business interest, high Internet penetration and mobile connectivity, the increasing adoption of cashless payments, and the support from the state authorities. We have been present in Southeast Asia since 2017. In a year and a half, there were many significant improvements, which have increased the attractiveness of the region from financial and digital view. We expect to see further changes to make SEA one of the fintech world leaders in 2-3 years”.

Source: https://www.openpr.com/news/1601723/Five-countries-will-lead-fintech-in-Southeast-Asia.html

English

English