Cambodia’s economy to expand at a faster pace, says AMRO

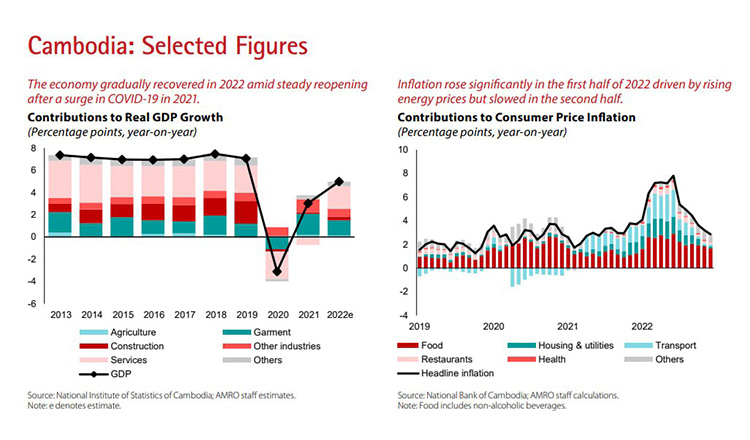

Driven by the strong external demand and a resumption in domestic activity, Cambodia’s real GDP growth is estimated to have accelerated to 5 percent in 2022 from 3 percent in 2021. The manufacturing sector was robust, supported by the expansion of both garment and non-garment exports

The Cambodian economy is projected to expand at a faster pace in 2023, with a robust performance from services, according to the ASEAN+3 Regional Economic Outlook (AREO) 2023.

The services sector is expected to benefit from a robust return of tourism, reflecting the re-opening of China, it said.

While answering a question from Khmer Times during a virtual press conference yesterday, Anthony Tan, Deputy Group Head and Senior Economist, AMRO, said: “This year, we are expecting Cambodia to grow by 5.9 percent… slightly faster pace from the estimated growth rate of 5 percent last year.

Talking about the expected performance of different sectors, he said: “If you look at the sectoral drivers of growth, the services sector is projected to recover strongly, benefiting from the expected return of Chinese tourists. If you look at the 2019 data, this is free. Pandemic. Chinese tourists are the largest source of inbound tourists to Cambodia, accounting for about one-third share. That means that there’s a substantial amount of tourist arrivals, boosting the economy and creating more jobs.

“If you look at the latest monthly statistics, we do know that the total tourist arrivals in Cambodia already recovered to 50 percent of the pre-pandemic levels and are therefore on track to reaching the pre-Covid period,” he said.

On the sectors that would face setbacks due to the global recession trends, he said: “In terms of the sectors that will be facing some headwinds, I must say that because of this subdued external demand we do expect the manufacturing sector in Cambodia, mainly garments to face some headwinds.”

He also mentioned some sectors to perform well this year.

“There are some bright spots because we know that Cambodia is doing a lot of diversification in exports. There are some segments in the manufacturing sector, particularly electrical and vehicle parts, optical cables, and solar panels. These are the sectors that would help support growth in the manufacturing sector at a time where the garment exports are mostly tailored to the US and Europe,” Tan said.

The report said Cambodia’s economy continued to recover in 2022. Driven by the strong external demand and a resumption in domestic activity, real GDP growth is estimated to have accelerated to 5 percent in 2022 from 3 percent in 2021. The manufacturing sector was robust, supported by the expansion of both garment and non-garment exports, it said.

“Tourism grew rapidly from a low base but remained far below pre-pandemic levels. For 2023, the economy is projected to expand at a faster pace, with services sectors expected to benefit from a robust return on tourism, reflecting the re-opening of China. However, the rebound in services could be partially mitigated by a weaker outlook for manufacturing,” the report said.

It pointed out that the headline inflation spiked to 5.3 percent in 2022 from 2.9 percent in 2021, reflecting soaring global energy and food prices. Inflation pressures were particularly acute during the first half of 2022, with inflation peaking at 7.8 percent in June.

Inflation has since trended downward and is projected to further ease in 2023.

Regarding the current account deficit, it is expected to narrow but remain high for 2022. “Despite a strong export performance, the trade deficit remained large at an estimated trade deficit of 34.8 percent of GDP, given increased spending on petroleum imports due to elevated global oil prices, and that imports of gold remained substantial. With tourism receipts and remittances recovering, the current account deficit is estimated to have narrowed to around 31 percent of GDP, down from the historical high of 46 percent of GDP seen in 2021. Despite steady foreign investment inflows, Cambodia is estimated to have recorded an overall balance of payments deficit in 2022, resulting in a reduction in international reserves. Nonetheless, external buffers remained a sizable $17.8 billion as of end-2022, equivalent to 8.4 months of imports of goods (excluding gold) and services,” the report indicated.

It said financial conditions remained easy last year with sufficient liquidity and strong credit growth. “Liquidity is ample as the National Bank of Cambodia (NBC) maintained several measures to ease conditions in the financial system, particularly keeping reserve requirement at a low 7 percent. Credit growth has remained resilient and although a loan restructuring program was phased out as scheduled in June 2022, nonperforming loan ratios have remained manageable. With capital adequacy ratios well above regulatory requirements and banks’ increased provisions, balance sheets are expected to stay healthy even with the end of loan restructuring program,” it pointed out.

The report indicated that the fiscal deficit narrowed in 2022 due to higher revenue and the rollback of the pandemic stimulus. Revenue was buoyant in 2022 by the resumption of economic activity. With most of the population already vaccinated and Covid-19 infection rates low, healthcare spending declined, while spending on other key measures remained stable or increased slightly. The net result was a stimulus package 1.4 percent of GDP smaller than it was 2021. The gradual withdrawal of fiscal stimulus and higher revenue collection enabled the fiscal deficit to fall to 5.4 percent of GDP from 8.5 percent in 2021.

It said the public debt is estimated to have risen only slightly to 35.9 percent of GDP at end-2022 from 35.0 percent at end-2021, as Cambodia drew down its fiscal reserves to finance its deficit.

However, it also pointed out some external and domestic risks for the year.

“The economy’s growth trajectory toward a robust recovery faces several external and domestic risks. Headwinds from slowing global demand amid monetary tightening of most central banks could further dampen Cambodia’s manufacturing exports. A tail risk with a potentially large impact would be the emergence of more virulent Covid-19 variants, which could lead to the return of tight containment measures and delay the expected recovery of international tourism. Despite the recent trend of easing inflation pressures in Cambodia, a resurgence remains a risk, particularly if oil prices soar again due to geopolitical tensions and supply constraints,” it observed.

The report also indicated that Cambodia’s large current account deficits are a potential source of external vulnerability. Most of Cambodia’s external liabilities are funded from FDI inflows and concessional loans from multilateral and donor agencies, which are relatively stable. However, capital inflows from external private debt and banks’ nonresident deposits,

which are more short-term in nature, and have become substantial in the past five years.

“If a shock were to reverse these short-term flows, the external position could come under pressure. Prolonged rapid credit growth amid already high private debt may result in a deterioration in loan quality. The country’s rapid credit growth and the credit-to-GDP ratio of 177 percent have given rise to concerns of financial distress. Risks may have shifted away from banks toward shadow banking activities with the emergence of property developers providing their own long-term financing with lax loan screening and minimal supervision. Such shadow banking activities are more vulnerable to shocks, such as from a fall in property prices,” it noted.

Meanwhile, regarding the prospects of the region, AMRO Chief Economist, Hoe Ee Khor said: “The ASEAN+3 region is expected to remain resilient notwithstanding the strong headwinds of weaker external demand and tighter global financial conditions. The boost in tourism and intraregional trade from the rebound in China’s economy will help mitigate softer external demand from the United States and Europe.”

Domestic demand is expected to remain robust, with household spending to be sustained by rising income and lower inflation. AMRO anticipates inflation to moderate from 6.5 percent last year to 4.7 percent in 2023, before normalizing to 3.0 percent next year.

“With growth on firmer footing, policymakers in the region have shifted focus to containing inflation which remains elevated and restoring policy buffers.

Yet downside risks abound. The region’s growth prospects could be dampened by a spike in energy prices caused by an escalation of the Ukraine crisis, or weaker-than-expected recovery in China, or a sharp slowdown in the United States. Continued US monetary policy tightening amid mounting financial stability concerns could also heighten financial market volatility and spark contagion fears,” the report said.

“Drawing from the lessons learned from the Asian Financial Crisis, ASEAN+3 financial systems are now more resilient and well-regulated,” said Dr. Khor. “However, we are living in precarious times. Policymakers need to remain vigilant and continue to rebuild policy buffers. They also need to remain flexible to extend additional support to the economy, if necessary.”

AMRO also called on ASEAN+3 economies to work more closely together to expedite the region’s journey toward net zero.

“The sooner scalable, reliable, and affordable low-carbon alternatives become available for ASEAN+3, the less painful and costly the transition away from fossil fuels will be,” said AMRO Group Head Ling Hui Tan, one of the key authors of the report.

Source: https://www.khmertimeskh.com/501269532/cambodias-economy-to-expand-at-a-faster-pace-says-amro/

English

English