‘Cambodian economy on the way to recovery’

Cambodia’s economy is expected to steadily recover in 2022 mainly due to the continued expansion of garment and non-garment manufacturing, the ASEAN+3 Macroeconomic Research Office (AMRO) said in its quarterly update yesterday.

It said high vaccination rates facilitated the resumption of businesses, especially in the services sector.

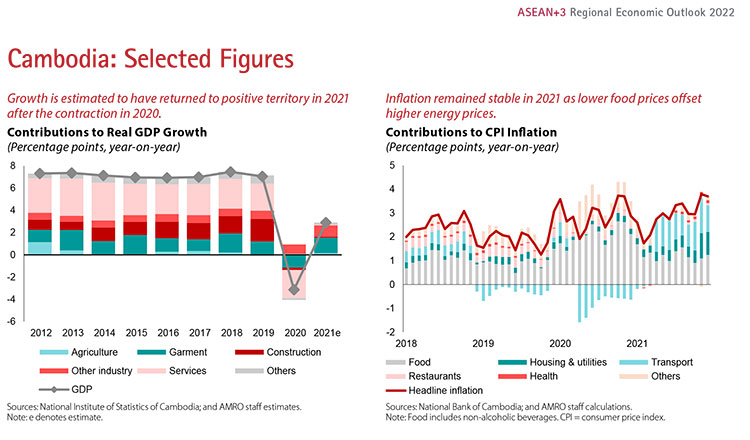

“Strong performance in the agriculture and manufacturing sectors partially mitigated the adverse impact of the pandemic and helped drive GDP growth to an estimated 2.9 percent year-on-year in 2021 from a contraction of 3.1 percent year-on-year in 2020,” the report said.

However, despite the relatively open borders of the Kingdom, tourism recovery is projected to proceed at a slower pace, it said.

Tourism recovery hinges largely on the global pandemic situation and the resumption of international and regional tourism, the report pointed out. Inflation, which remained stable at 2.9 percent year-on-year in 2021, is projected to rise in 2022 from higher oil prices, although prices of pork, fish, and seafood are anticipated to decline with a projected increase in domestic supply.

“Strong exports in 2021 were led by agriculture, garments and non-garment manufactured products, as Cambodia benefitted from strong external demand, particularly from the United States. Meanwhile, imports bounced back across most major items after the contraction in 2020,” the report pointed out.

However, it said the current account deficit is estimated to have widened in 2021 to about 40 percent of GDP (20 percent if excluding gold) due to low remittances and adverse impact on tourism.

It pointed out that the current account deficit is expected to have been partially offset by steady foreign investment inflows. “Thus, Cambodia is estimated to have recorded an overall balance of payments deficit in 2021, resulting in a reduction in international reserves. Nonetheless, external buffers remain sizeable at $20.3 billion, equivalent to 7.9 months of imports of goods and services as of December-end 2021,” AMRO said.

With monetary policy continuing to be accommodative, the liquidity remained ample in 2021. Credit growth recovered across a broad range of sectors in 2021, rising above 20 percent since May 2021, despite the rise in Covid-19 community cases. NPLs remained low at 2.4 percent, while the reopening of the economy has resulted in the steady decline of restructured loans.

“The National Bank of Cambodia (NBC) provided timely and welcome guidance to banks on assessing the creditworthiness of an increasing provisioning for restructured loans,” it said.

The report pointed out that the fiscal policy continued to be expansionary in 2021, with the fiscal deficit rising to 9.2 percent of GDP from 5.3 percent of GDP in 2020. In response to the community outbreak of infections in 2021, the government almost doubled its Covid-19 intervention package to $1,291 million, with the bulk allocated to Covid-19 treatment and prevention, while also increasing the budget for cash transfers to the poor.

The public debt is also estimated to have risen slightly to 34.6 percent of GDP at end-2021 from 33.8 percent at end 2020, as Cambodia drew down its fiscal reserves to finance the deficit.

It also cautioned that the risks of a large outbreak from new virus variants remain, which could derail the economic recovery.

“Slow and uneven recovery, coupled with economic scarring may adversely affect businesses and households, leading to rising NPLs. Economic damage brought about by the prolonged pandemic may lead to permanent job losses and business closures, potentially resulting in a deterioration in the quality of outstanding loans.”

According to the projection of AMRO, NPLs could rise by 1 percentage point from current levels if regulatory forbearance is withdrawn. However, a larger-than-anticipated shock could push NPLs higher, dampening the prospects for economic recovery.

Moreover, narrowing fiscal space may limit the government’s capacity to provide support in case of another surge in infections, it cautioned.

“With government savings drawn down by $1.7 billion to help finance the stimulus budget in 2020-21, government savings that can be tapped for discretionary spending have gone down by almost a third compared to their pre-pandemic level,” it noted.

“This steady decline in fiscal savings could limit the government’s capacity to provide counter-cyclical support in the future, particularly given the persistent risk of further waves of infections from new virus variants. The reduction in fiscal revenues relative to pre-pandemic trends has also made it more challenging to rebuild fiscal buffers,” the report added.

Source: https://www.khmertimeskh.com/501107131/cambodian-economy-on-the-way-to-recovery/

English

English